The Best Preferred Stock Funds

Image source: Getty Images.

Preferred stocks can be some of the best income investments. They pay consistent dividends that are higher than most other stocks, and have higher priority than common shareholders in the event of a bankruptcy. Instead of choosing individual preferred stocks, consider investing in them through an exchange-traded fund (ETF).

What is a preferred stock, and why would you want to invest in one?

In many ways, a preferred stock is similar to a bond. Preferred stocks pay a defined interest rate, either fixed or variable, no matter what the company's profits are or what the economy is doing. For example, a preferred stock with a par value of $25 and a 7% dividend rate would pay $1.75 in dividends each year.

Unlike bonds, preferred stocks trade on major stock exchanges and can have smaller par values -- typically $25. Par value establishes a baseline for what investors pay for a preferred stock, and the modest amount makes preferred stocks significantly more accessible to many investors than bonds, which typically have par values of $1,000. It also provides for a more liquid market for these securities.

When it comes to order of priority, preferred stocks are lower than bonds but higher than common stocks. In the event of a corporate bankruptcy, bondholders have a higher claim to the company's assets than preferred shareholders, who in turn have a higher claim than common shareholders. This is a big reason why preferred stocks tend to pay higher dividends than comparable bonds.

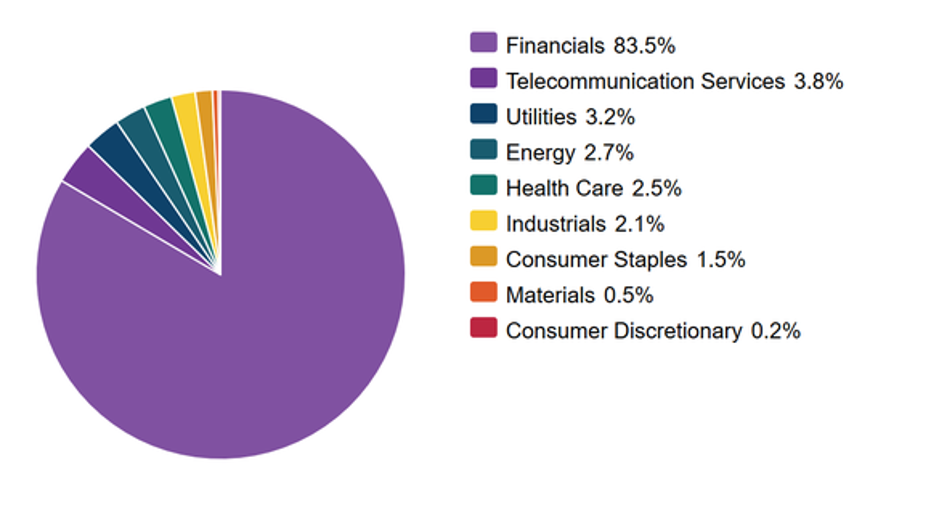

Most preferred stocks are issued by financial institutions such as banks, but it's not uncommon for telecommunications companies, energy and utility companies, and other types of businesses to issue preferred stocks. At the end of the second quarter, this was the sector breakdown of the S&P U.S. Preferred Stock Index:

Image source: S&P Dow Jones Indices.

To sum it up, reasons investors might want preferred stocks include:

- Relatively high dividends

- Safer income than common stocks

- Easy to buy and sell

- Lower minimum investment requirement than bonds

The best way to invest in preferred stocks

Investing in individual preferred stocks can be a challenge. Even if you want to invest in the preferred stock of a certain company, there are often several different series of preferred stock to choose from, each with different potential redemption dates, interest rates, share prices, and other variables. For example, a quick look on Bank of America's website shows 25 different series of preferred stock to choose from.

Instead, I'd rather invest in preferred stocks through an ETF. Here are five solid choices, each with slightly different investment objectives, listed in order from most assets to least.

The first two on the list both have diverse portfolios of preferred stocks, and each tracks a broad preferred stock index, the majority of which pay fixed interest rates. The third invests in preferred stocks with floating or variable interest rates. It pays the lowest dividend yield of the group right now, but this could certainly change once interest rates rise.

The SPDR fund tracks a hybrid index made up of both fixed- and floating-rate preferred stocks, and could be a good compromise if you're not sure which type you prefer. Finally, the VanEck ETF is an interesting one, as it excludes preferred stocks issued by banks and other financial institutions -- the most common issuers of preferred stocks (83.5% of the S&P U.S. Preferred Stock Index is made up of financials). Most of the fund's holdings are issued by telecom companies and energy/utility companies. If you're worried about the banking sector's health, but still want to get into preferred stock investing, this could be a good option for you.

Which is best for you?

It depends what your investment goals and risk tolerance is. If your goal is consistent income with minimal risk, one of the broad, fixed-rate funds is probably best for you. Or, if you're willing to deal with lower dividends now in exchange for possible higher dividends in the future, one of the funds that invests in variable-rate preferred stocks might be best.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Matthew Frankel owns shares of Bank of America (common stock, not preferred). The Motley Fool recommends Bank of America. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.