The Biggest Threat to Television Streaming Services

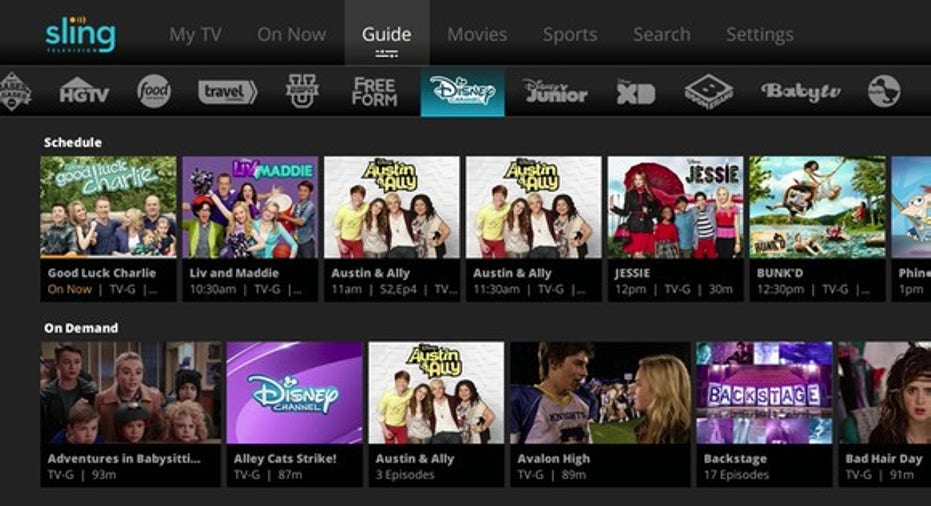

Image source: Sling TV.

Price-conscious consumers keep getting more options when it comes to cutting the cord. No longer are they confined to Netflix (NASDAQ: NFLX), Hulu, or Amazon (NASDAQ: AMZN) Prime. They can even stream live television programming with services like Dish Network's (NASDAQ: DISH) Sling TV or Sony's (NYSE: SNE) PlayStation Vue. Similar services are reportedly in the works from Hulu, YouTube, Amazon, AT&T's (NYSE: T) DirecTV, and others.

Dish has taken to including Sling TV subscribers in its total count of pay-TV subscribers. Its reasoning is that the acquisition cost of these customers is so much lower that the operating profit from Sling TV is similar to its traditional satellite subscribers.

But Sling TV and other over-the-top services are particularly aimed at price-conscious consumers. And price-conscious consumers will do a lot to squeeze value out of every penny they spend. That means they're more likely to turn the service off during months they won't be using it. And that's a big threat to Dish Network, AT&T, and other services that are expecting steady cash flow from their OTT services in the same vein as their pay-TV services.

Churned like butter

Dish is well aware of Sling's susceptibility to churning, but it points to sports programming as the biggest potential driver of churn. "We know that we are subject to some seasonality, in particular because of sports," Sling TV CEO Roger Lynch told analysts during Dish Network's second-quarter earnings call. "I think we'll always see some of that seasonality because it's the nature of this business. I do think over time, as our content offer gets a little broader, it probably helps smooth that out somewhat."

Lynch sees the expansion from a sports-centric bundle featuring ESPN to a more broadly appealing bundle featuring Comedy Central and FX as a way to combat seasonality. Of course, those networks have seasons as well, and watching them live is less important than sports. That's why streaming video on demand services like Netflix and Hulu have become so popular.

Lynch ameliorates the problem by pointing out there's very little cost for Sling TV when a customer turns the service off or back on. And that's true, especially compared to its satellite business -- hence the required two-year contract for satellite service.

Still, the higher potential for churn means Sling TV subscribers belong in a different category than Dish Network's satellite subscribers. AT&T currently breaks out its pay-TV subscribers as DirecTV subs and U-Verse subs. It'll be interesting to see if DirecTV Now subscribers are lumped in with DirecTV subscribers or separated out when the OTT service launches later this year.

Are these subscribers incremental?

The question investors have to ask is, "Are Dish Network, AT&T, Sony, Hulu, YouTube, Amazon and everyone else going to see incremental revenue and profit from launching these over-the-top services?"

In the case of Dish Network and AT&T, they're cannibalizing their own services at much lower average revenue numbers per user. That's true, to a much lesser degree, of Hulu and YouTube as well, but their new services will produce higher revenue per user than their existing services.

Amazon recently started offering monthly subscriptions to Prime, including just access to Prime Instant Video, which is more susceptible to churn as well. Monthly subscribers will pay a slight premium to Prime's annual membership fee every month, but they can cancel anytime.

Sony is just about the only company almost certainly seeing incremental profits from its OTT service.

Dish has lost 339,000 subscribers over the past year, and its 13.59 million subscriber countincludes more than 600,000 Sling TV subscribers.Without Sling, Dish would be down nearly 1 million subscribers in the past year. AT&T, by comparison, has lost 1.1 million U-Verse TV subscribers over the past year, but it has added 884,000 DirecTV subscribers since the end of September.

Traditional pay-TV is certainly seeing a decline in subscribers as more video-streaming options crop up. While Dish and AT&T may be cannibalizing their businesses at a significantly lower revenue per user, if they didn't do it, someone else would. Their hands were forced.

Still, investors shouldn't expect the same steady cash flow from Sling TV or DirecTV Now subscribers. Those services aren't just more susceptible to seasonality, they're also more susceptible to competition since subscribers aren't locked in for the long term. The same applies to the non-traditional TV companies once they get up to scale, so don't get too comfortable with them, either.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early, in-the-know investors! To be one of them, just click here.

Adam Levy owns shares of Amazon.com. The Motley Fool owns shares of and recommends Amazon.com and Netflix. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.