The Newest Challenge in Gambling: Finding Growth

One consistent theme for gaming stocks over the past two decades is that growth hasn't been hard to come by. Ever since Steve Wynn opened the Mirage in Las Vegas in 1989, it seemed like the industry was on a tear to build bigger and better casinos around the world. First Las Vegas and Atlantic City were built out, then Macau and Singapore came online, and now there's an East Coast gaming boom.

But growth for casino operators is becoming harder to come by, and that may signal a major shift for the gaming industry. Maybe it's even time for gaming companies to look past growth to returning cash to shareholders?

Macau's skyline at night. Image source: Getty Images.

The biggest markets in gaming are saturated

For most of the 1990s and 2000s, the world's two most important gaming markets were Las Vegas and Atlantic City. Gaming companies rapidly built new casinos, which drew more customers, which led to more casinos being built, and an upward cycle emerged. But in the last decade, the pattern has been a little different.

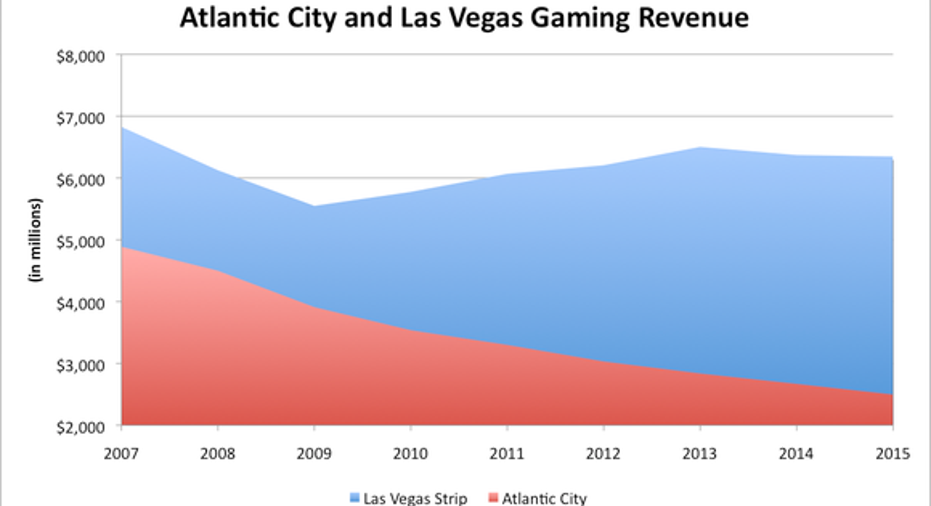

Gaming revenue in Las Vegas and Atlantic City. Data Source: Las Vegas Gaming Commission and New Jersey Division of Gaming Enforcement. Chart by the author.

As the chart above shows, gaming revenue in Las Vegas has stagnated over the past decade, and Atlantic City's numbers have fallen off a cliff. It's no wonder that no major resort has been built in Las Vegas in six years (the Cosmopolitan, which went bankrupt during construction but opened in December 2010, was the last) and Atlantic City can't even keep new casinos operating. Growth has dried up in both markets.

For many years, gaming companies focused their growth dollars on Macau, where Las Vegas Sands (NYSE: LVS), Wynn Resorts (NASDAQ: WYNN), and MGM Resorts (NYSE: MGM) have all opened properties. But Macau has suffered its own hardships over the last three years.

Data source: Macau Gaming Inspection and Coordination Bureau. Chart by the author.

So, three of the biggest markets in gaming are all experiencing challenges, if not downright collapses. What can the gaming companies do to grow?

The search for growth enters dangerous territory

When there aren't any big growth markets, gaming companies have gone looking for opportunity in other locales. MGM Resorts recently completed National Harbor near Washington, D.C., and has a resort under construction in Springfield, Massachusetts. Wynn is building a property in Everett, Massachusetts, just outside of downtown Boston; Las Vegas Sands opened Sands Bethlehem in northeastern Pennsylvania.

The problem with all of these resorts is that they're entering, and further diluting, the barely profitable East Coast gaming market. They're also searching for growth in areas where gambling and high-end resorts aren't really a staple, which could be a big risk, long term. The decline of regional gaming was a big reason Caesars Entertainment's largest subsidiary was forced into bankruptcy, and why Foxwoods, Trump, Revel, and Stations Casinos have either had financial trouble or gone into bankruptcy. Yet it's these same regional markets where it has proved difficult to make money that major casinos are building in.

The old model is gone

Gone are the days where casino companies could just expand up and down the Las Vegas Strip. That was the tactic that made MGM, Mirage, Mandalay Group, and Caesars Entertainment what they were before they consolidated. So if growth opportunities aren't attractive anymore, it may be time to try another strategy.

Rather than bringing new casinos to markets that aren't all that attractive to begin with, gaming companies could transform themselves into cash flow machines for investors. Las Vegas Sands has started paying a dividend and currently yields 5.6%, while Wynn Resorts pays a more modest 2.1% yield. With growth options limited, paying dividends may be the best use of cash in today's casino business. That's a change from what investors have expected in the past, but today's gaming giants may become tomorrow's dividend aristocrats, given the limited opportunities they have for growth.

10 stocks we like better thanWal-MartWhen investing geniuses David and TomGardner have a stock tip, it can pay to listen. After all, the newsletter theyhave run for over a decade, the Motley Fool Stock Advisor, has tripled the market.*

David and Tomjust revealed what they believe are theten best stocksfor investors to buy right now... and Wal-Mart wasn't one of them! That's right -- theythink these 10 stocks are even better buys.

Click hereto learn about these picks!

*StockAdvisor returns as of December 12, 2016The author(s) may have a position in any stocks mentioned.

Travis Hoium owns shares of Wynn Resorts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.