The November Wall Street Never Saw Coming

Thirty days ago, Wall Street had priced in better odds of Hillary Clinton as president-elect than Donald Trump, bid up Treasury bond yields, and remained skeptical about whether the Federal Reserve would raise interest rates at the tail end of 2016.

What a difference one month makes.

By November 9, market expectations were upended, forcing traders to evaluate what a President Trump means for the market and the economy. So far, Wall Street’s performance shows optimism over expectations for fiscal stimulus programs, higher interest rates, less regulation, and lower taxes. That sentiment helped propel the Dow Jones Industrial Average to its biggest gain since March.

The Dow rallied 667 points in the two weeks following Election Day, hitting the 19000 milestone for the first time ever on November 22. The broad-market index continued its rally, ending the month up 5.4% to 19131. The S&P 500 meanwhile, jumped 3.4% for the period, to 2199, notching its biggest gain since July, while the tech-heavy Nasdaq Composite rallied 2.6% to 5323. The Russell 2000, which benchmarks companies with small market capitalization, surged 11% to its best month in five years as traders believe those stocks will be insulated from the effects of a stronger U.S. dollar.

The financials and industrials sectors saw the biggest gains of the month, soaring 13% and 8% respectively on the heels of the Trump White-House win. Financial stocks, which include the nation’s biggest banks, would benefit from higher rates and a move to scale back post financial-crisis regulations on Wall Street. That sector saw its best month in five years in November. Elsewhere, industrial stocks, which include construction-equipment makers and diversified machinery, would likely be boosted by investment in infrastructure initiatives.

Treasury Yields Deflate

If there was a motto on Wall Street for the month of November, it was buy stocks, sell bonds. Yields on U.S. government debt, which move inversely to prices, jumped as investors remained optimistic about Trump’s policy goals. The yield on the benchmark 10-year U.S. Treasury note saw its biggest monthly gain since 2009 as it neared a multi-year high of 2.5% set in June 2015. The 10-year yield hit 1.37% on July 8, and has since rallied to 2.39%.

The rally comes amid downside risk for bond-market investors as Trump’s initial policy goals include more equity-friendly policies like fiscal stimulus and deregulation, said RiverFront Investment Group chief fixed income officer, Tim Anderson.

“The market appears to believe that these policies would likely generate stronger economic growth, higher inflation, and faster rate hikes from the Fed, all of which are decidedly unfriendly to bond investors,” he said. “The fiscal stimulus measures could lead to higher inflation, especially if increased trade barriers raise the prices of imported goods.”

Bond investors yanked $8.2 billion from bond funds in the week following the presidential election, the biggest weekly outflow since June 2013, according to data from EPFR Global.

Still, equity markets can likely cope with a moderate rise in bond yields – up to about 2.75% on the 10-year, said Goldman Sachs (NYSE:GS) Research chief global equity strategist, Peter Oppenheimer. Meanwhile, investors are pricing in 98% odds of a 0.25% interest rate increase from the Federal Reserve next month.

King Dollar Reigns Supreme

Just as expectations of fiscal stimulus measures and higher interest rates have pushed Treasury yields up, they’ve also helped boost the U.S. dollar. Though the Fed proved to be more dovish about the pace of interest rate increases after its forecast for four hikes in 2016 (it has so far held rates steady this year), the upward pressure on the greenback has not abated.

The dollar index has risen for two-straight months to hover near a 14-year high. Goldman Sachs (NYSE:GS) foreign exchange strategists said though the currency is at the top of the range it traded since last March, the market is pricing in about five rate hikes through 2019, which points to more upside for the greenback.

“The succession of dovish shifts never changed the underlying rationale that the dollar is a currency under appreciation pressure, which shows itself whenever the Fed shifts just a bit hawkish,” they said, pointing to the four days following the Fed’s annual Jackson Hole symposium in the middle of the year that pushed the dollar up more than 1%.

“If mixed Fed speak can push the dollar 1.5% higher, a ‘reset’ should be worth more than the 3.8% rally since before the election,” Goldman’s strategists continued.

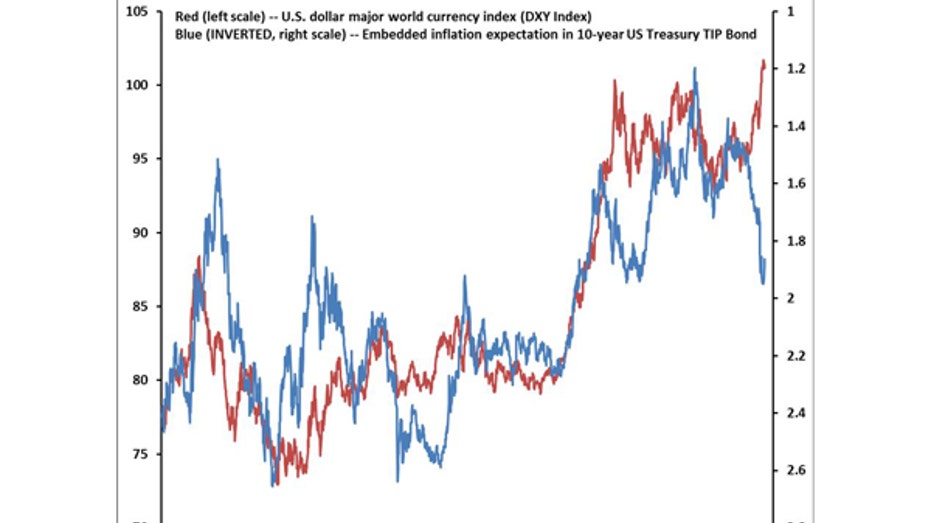

Still, inflation has been historically destructive for the U.S. dollar, argued Wells Capital Management Chief Investment Strategist Jim Paulsen, who pointed to a divergence between the direction of the U.S. dollar and inflation expectations.

He said with wage inflation finally edging up to 2.8%, GDP growth registering above 3% in the third quarter, and the unemployment rate below 5%, it’s not likely inflation expectations will be ratcheted down. Therefore, with the Fed preparing to tighten monetary policy, he expects a “big surprise for consensus” and a dollar decline over the next year.