How Trump avoids recession, wins reelection: Billionaire Jeffrey Gundlach

Billionaire bond fund manager Jeffrey Gundlach doesn’t think the U.S. economy is in imminent danger of recession but says there are some worrying signs for President Trump ahead of the 2020 election.

“If you have a recession, a negative sign in front of GDP, especially nominal GDP, that would just be horrific,” Gundlach, CEO and chief investment officer of the Los Angeles-based DoubleLine Capital, which has $140 billion in assets, told FOX Business. “I think there is just nothing for Trump to run on if the economy is negative.”

The good news for Trump, according to Gundlach, is that the economy has shown some signs of improving after a summer swoon. The U.S. services sector grew in August for the 115th consecutive month. Additionally, job growth remains strong, consumer spending remains healthy and new and existing home sales saw a nice bump in August.

But while leading indicators are still positive, they have fallen from 6.6 a year ago to 1.1 in August. A drop below zero could have big implications for the economy.

“There's some numbers rolling off in the next few months, it will mean there's a good risk of the leading indicators going to zero,” he said. “And the reason why that matters is there hasn't been a recession in decades of economic tracking, there has not been a recession ever without leading indicators first going negative.”

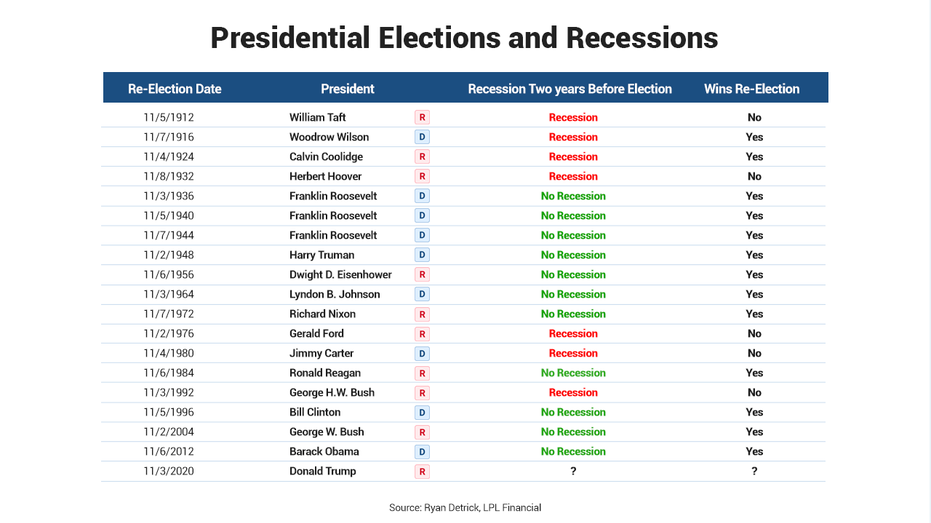

The stakes are high for the president, as a recession, or two consecutive quarters of negative growth, occurring before Election Day could be the death blow that prevents him from winning a second term.

Five of the last seven presidents to oversee a recession in the two years ahead of their reelection bid lost, including the most recent example, President George H.W. Bush’s defeat at the hands of President Bill Clinton.

While keeping the economy stable at best is critical, Gundlach also says the Trump administration could borrow a page from President Barack Obama’s playbook.

“If you cut payroll taxes it absolutely helps the economy because that's money that's all at the middle-class level and it’s all going straight into the paycheck,” Gundlach said. “So that might actually help to put a monkey wrench into these indicators...if the economy is left alone.”

Trump could also eliminate the tariffs on Chinese goods in order to stimulate the economy, Gundlach says.

“What if we just pull all the tariffs in I don’t know March, we just eliminate them,” he said.

“That would probably create a pretty big pent up demand. I mean if you were thinking of buying something that has a tariff on it. Well, maybe you're waiting for the tariff to be removed.”

The Federal Reserve has cut rates in each of its last two meetings, their first-rate cuts in more than a decade. Gundlach thinks the central bank is likely to lower rates one more time before the end of the year.

CLICK HERE TO READ MORE ON FOX BUSINESS

“So it looks like there's these tools in the kit that might help forestall a recession and then get Trump reelected,” Gundlach concludes.