Trump, Data Diverge on Whether U.S. is Headed Toward Recession

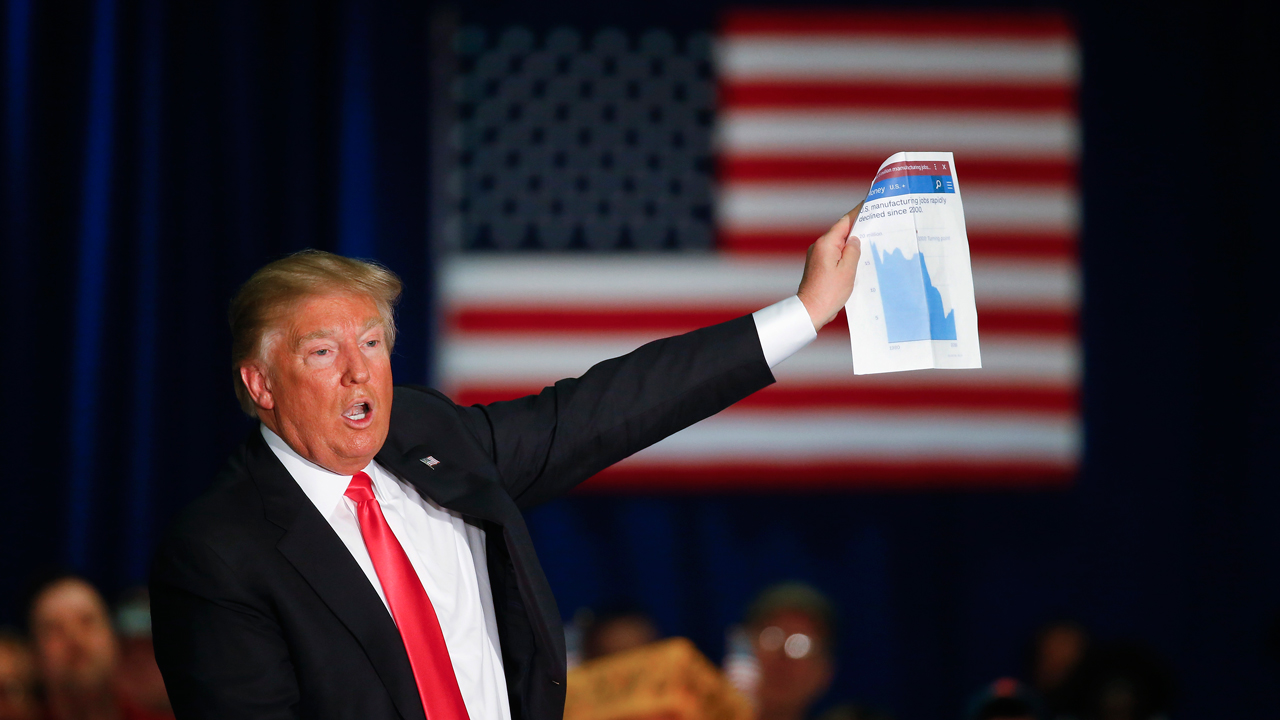

Presidential hopeful and GOP frontrunner Donald Trump has said on the campaign trail he believes America is hurtling straight for another recession.

“We’re going to go into a massive recession,” he said recently on the stump. “But I also say if I’m president, that’s not going to happen because I’m going to straighten things out before that happens.”

The U.S. economy is still on the mend after the worst financial crisis since the Great Depression, which began in 2007, and monetary policy still remains accommodative not just in America, but around the globe.

However, recent data have shown the U.S. economy is not just on the mend, but able to stand on its own two feet. Take Friday’s March jobs report as the latest example. The economy added 215,000 jobs last month, above consensus estimates for the creation of 205,000 jobs. Further, while the unemployment rate ticked up, so did the labor force participation rate, while wage growth accelerated.

Jason Pride, director of investment strategy at Glenmede, said in a note the U.S. economy appears to be turning a corner, citing manufacturing-industry strength, and continued job creation.

“In addition to a robust ADP employment report, March payrolls came in better than consensus. Further, it appears the expansion is broadening to the benefit of low and middle-income workers,” he said.

U.S. manufacturing activity is back on firmer footing after months spent in contraction territory. A closely-watched gauge of manufacturing activity from the Institute for Supply Management on Friday jumped out of contraction, rising to 51.8 from 49.5 the month prior. The ISM new orders index also rose more than expected for the month. That data came on the heels of positive regional manufacturing reports from both New York and Chicago.

In addition to the data, confidence in the stock market has returned after Wall Street took a beating in the first two months of the year. According to Pride, the Dow Jones Industrial Average saw its biggest quarterly comeback in 1Q since 1933, as it joined the S&P 500 in jumping out of correction territory – defined as a 10% decline from a recent high – before the quarter’s end last Thursday.

“Risk-on sentiment prevailed through the second half of the quarter, while others voiced skepticism for the swift rally in equities,” he said.

Gary Kaltbaum, owner and president of Kaltbaum Capital Management, was one of those who has voiced his doubts about the recent rally. In a conversation on the FOX Business Network’s Cavuto Coast-to-Coast Monday, he said the Fed’s continuation of ultra-low interest rates combined with low first-quarter growth expectations spells bad news for the markets.

“I don’t think it’s a reach to think we’re on the precipiece [of another recession],” he said. “One never knows, but easy money, that’s all we have for [all the accommodative policy]. I think there’s a lot of trouble lying ahead.”

He cited lowered expectations for first-quarter earnings, easy-money policies by central banks around the globe, and a lack of lessons learned by investors after the Great Recession.

“We now have more leverage and debt than we had in 2008 because nobody every learns their lessons from the past and that’s where the big worry comes,” he said.

Still, Mark Matson, CEO of Matson Money, said rather than watching the tick-by-tick in the market, investors should be focused on long-term returns.

“In the long run, all market drops, even if they’re 20% or 50%, are all temporary. Everyone knows you should buy things when they’re low, not when they’re high. If the market does go down in the short run, how about this: Buy more,” he said.

He suggested owning not just U.S. equities, but investing in stocks all across the world.

“Equities long term are the greatest wealth creation tool known to mankind, but no one can predict them in the next 20 months,” he said, critical of Trump’s recession claims.