Trump impeachment inquiry ‘theatrics’: Billionaire Jeffrey Gundlach - EXCLUSIVE

Billionaire bond fund manager Jeffrey Gundlach says House Speaker Nancy Pelosi's official impeachment inquiry against President Trump is a lot of noise.

“This is more theatrics than anything else,” Gundlach, CEO and chief investment officer of the Los Angeles-based DoubleLine Capital, which has $140 billion in assets, told FOX Business in an exclusive interview.

“I don’t think it’s a real major market issue," he said. "When it comes to politics, the outcome of the 2020 election is far more important than what will be an unsuccessful and probably not even fully realized impeachment sort of action."

The inquiry is designed to probe accusations that Trump tried to convince Ukraine President Volodymyr Zelensky to investigate former Vice President Joe Biden and his son. U.S. stock markets sank on the news on Tuesday. Trump, who denies the allegations involving his potential Democratic rival for the White House, promised to release the transcript of his call Wednesday.

READ THE TRANSCRIPT HERE ON FOX BUSINESS.

Gundlach's view coincides with financial markets' performance around impeachments.

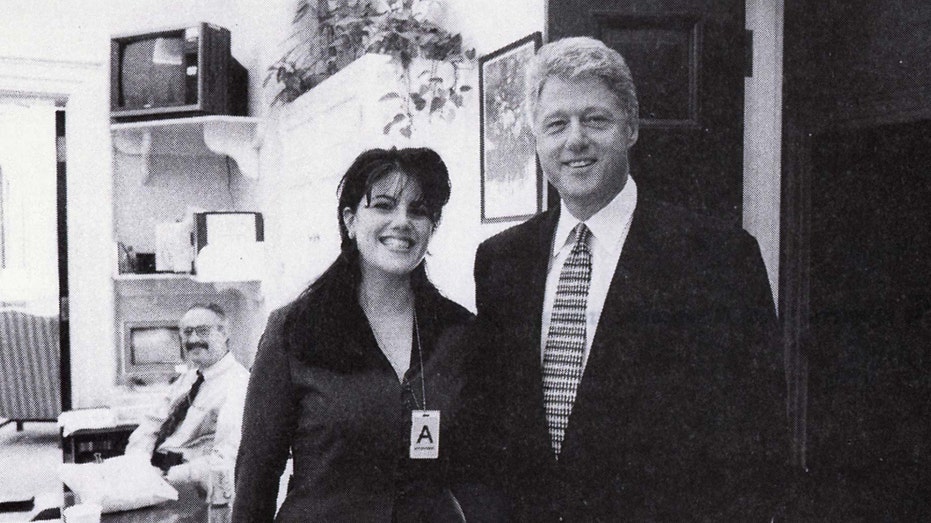

The stock market rallied 31 percent from the time President Bill Clinton's affair with Monica Lewinsky made headlines to the date he was found not guilty of perjury and obstruction in a Senate trial, according to data from Dow Jones Market Data Group.

President Clinton poses with Monica Lewinsky in a Nov. 17, 1995 photo, that was released Sept. 21 by Independent Counsel Kenneth Starr as part of more than 3,000 pages of documents pertaining to the scandal. According to Lewinsky's deposition, she an

Impeachment inquiry aside, Gundlach does think the 2020 nomination for the Democrats is most critical.

“If you look at the betting markets, Warren has by far the greatest chance for the nomination,” he said.

Betting markets show Warren has a 42 percent chance of winning the Democratic nomination, according to electionbettingodds.com. Biden and Vermont Sen. Bernie Sanders round out the top three at 22 percent and 8.5 percent, respectively.

“There’s no way Joe Biden is going to be the nominee, there’s just no way,” Gundlach said. “I’ve been asking people, ‘Do you know anybody that really supports Joe Biden?’ and I haven’t met a single person that says they know anybody that truly supports Joe Biden."

This isn't the first time Gundlach has slammed Biden. In June, he told FOX Business' Neil Cavuto that he thought Biden was a "placeholder type of candidate."

Gundlach says Warren is “definitely the flavor of the month,” but he doesn’t think she can win a general election. He points to her stance on Medicare-for-all and getting rid of private insurance.

Warren has repeatedly refused to answer questions about how she would pay for the program, leading to speculation she would raise taxes on the middle class.

“I don’t think you can go to 160 million Americans and say you’re going to get worse healthcare,” Gundlach said. “That the healthcare you have now is too good, and we need to take from you so that we can improve the lot of people that have inferior healthcare. I don’t think that’s a winning issue.”

Gundlach says Warren scores points with voters because of her stance on a wealth tax. He notes polling has showed some 70 percent of Americans were in favor of a wealth tax, conceding that it’s “really hard to get 70 percent on anything.”

Warren’s plan imposes a 2 percent tax on assets over $50 million and a 3 percent tax on fortunes over $1 billion.

Sanders, another Democratic contender, rolled out a wealth-tax plan on Tuesday that was similar to Warren’s, which Gundlach says is “synonymous with him ending his campaign.”

“It just seems like it’s awful late in the game for him to wake up and just imitate Elizabeth Warren,” he said. “To me, it’s a sign that he knows his campaign is headed in the wrong direction.”

As for which would be worse for the stock market, Gundlach says that would probably be Sanders. “Elizabeth Warren comes across as less ideological, I think, and a little more pragmatic,” he said.

“Bernie is just ideologically a communist," Gundlach added. "He got thrown out of a commune for being too lazy back when he was young."

Still, Gundlach says the stock market would be selling off sharply if it were convinced that Warren was a plausible candidate.

“She keeps talking on and on and on about how corporations are going to pay, they’re going to pay, they’re going to pay for everything, so that sounds really bad for bottom-line earnings for large American corporations,” Gundlach concluded. "But you haven’t seen it yet, so that tells me that there’s no coalesced opinion for what’s going to happen with Warren."