Trump orders federal retirement money invested in Chinese equities to be pulled

The assets at hand number around $4.5 billion in Chinese stocks

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

President Trump is moving to cut investment ties between U.S. federal retirement funds and Chinese equities, FOX Business has learned in a move that is tied to the handling of COVID 19.

In the first letter written Monday, obtained exclusively by FOX Business, national security adviser Robert O’Brien and National Economic Council Chair Larry Kudlow write to U.S. Labor Secretary Eugene Scalia stating that the White House does not want the Thrift Savings Plan, which is a federal employee retirement fund, to have money invested in Chinese equities that numbers about $4 billion in assets.

WH to Sec Scalia (002) by FOX Business on Scribd

It says the Federal Retirement Thrift Investment Board is “Departing from the Board’s established index for the International Stock Investment Fund (I Fund) to track one that maintains Chinese equities is risky and unjustified." The letter directly links China’s handling of COVID-19 as one of several reasons why investment in Chinese companies should not occur.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

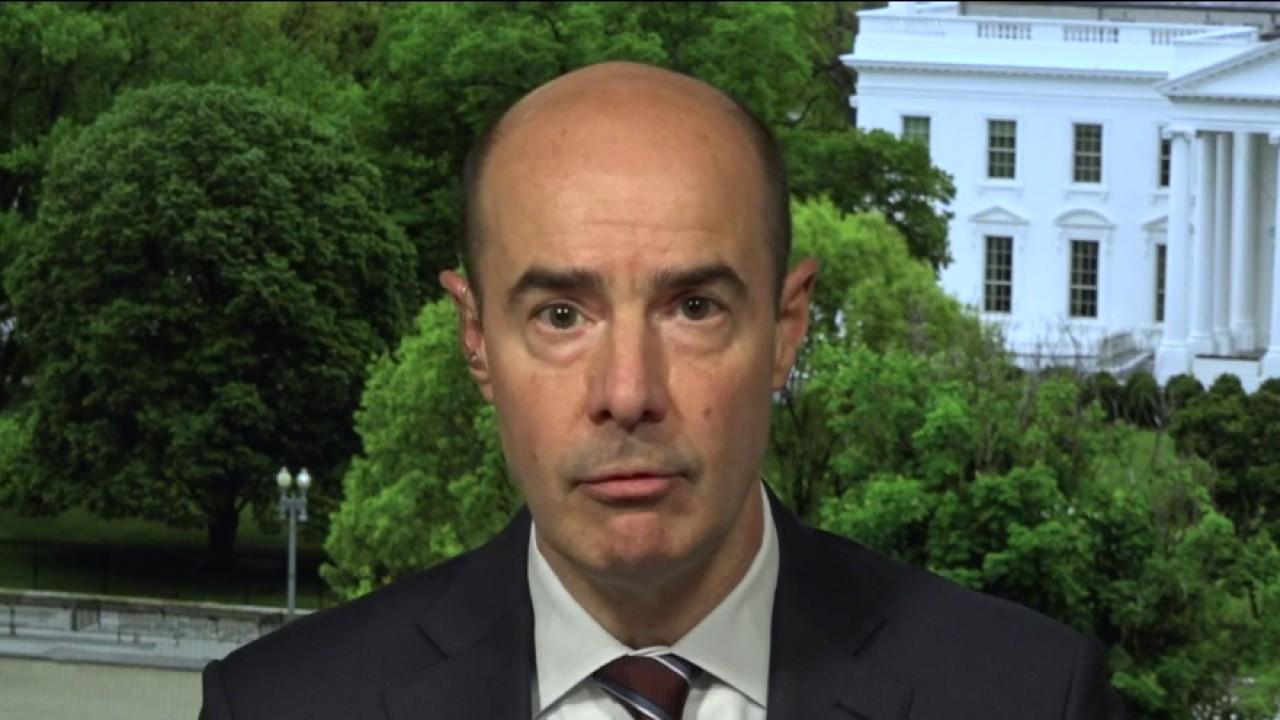

In the second letter, Scalia writes to Michael Kennedy, the chairman of the Federal Retirement Thrift Investment Board, sharing the Kudlow/O’Brien letter noting the two have “grave concerns with the planned investment on grounds of both investment risk and national security.”

Sec Scalia to Chairman Kenn... by FOX Business on Scribd

It concludes by saying that moving the assets out of a certain fund is "at the direction of President Trump."

Scalia wants a response by Wednesday.

WAITING FOR CORONAVIRUS STIMULUS CHECK? DIRECT DEPOSIT INFORMATION IS DUE WEDNESDAY, IRS SAYS

The move is likely to rachet up tensions between the U.S. and China as the terms of their Phase One trade deal come under scrutiny.

The Federal Retirement Thrift Investment Board had no comment on the letter.