Trump's Tax Plan Could Cost Bank of America $4.4 Billion

Image source: iStock/Thinkstock.

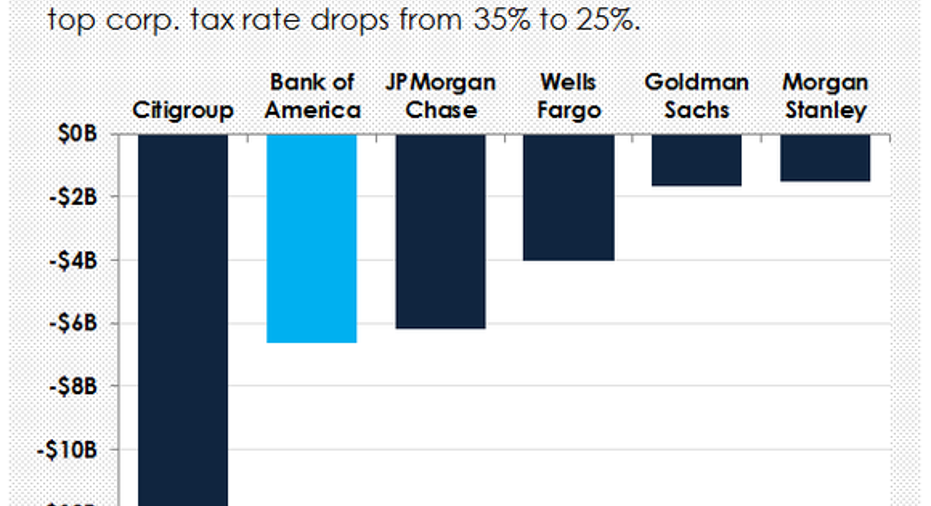

Most of what the incoming Trump administration has proposed in terms of economic and regulatory policies would be a boon for big banks, but there is one policy that cuts both ways: Trump's desire to lower the corporate tax rate. According to one of the nation's leading bank analysts, Keefe, Bruyette & Wood's Brian Kleinhanzl, the move could reduce Bank of America's (NYSE: BAC) tangible book value by $4.4 billion.

Bank of America's deferred tax assets

You'd be excused for wondering how this could be the case. Aren't lower taxes by definition good for companies? And particularly when you're taking about the magnitude of the drop expected under Trump -- a decline in the top corporate tax rate from 35% down to 25%.

Under ordinary circumstances, this is obviously a good thing. The less companies have to pay to the government, the more left over for shareholders. And over the long run, it'll be good for Bank of America as well. However, thanks to a combination of the financial crisis and a specific provision in the tax laws, there's a short-term downside to lower corporate taxes from the North Carolina-based bank's perspective.

The downside can be traced to $33.3 billion worth of deferred tax assets that currently sit on Bank of America's balance sheet (see page 225 of its 2015 10-K here). These relate to losses incurred in the financial crisis that were too large to be absorbed by its income at the time. Under tax law, these can be carried forward in the form of deferred tax assets and used to offset its tax liability in future years.

Deferred tax assets have an expiration date

The catch is that the deferred tax assets must be used within a certain amount of time. The statute of limitations for domestic deferred tax assets is 20 years. It's half that for those that offset foreign income, according to regulatory filings by Bank of America's close competitor Citigroup.

By lowering the tax rate, in turn, these assets become less valuable, as future tax liabilities will accordingly shrink. Even more importantly, it calls into question whether Bank of America will have time to use the entirety of its deferred tax assets before they expire.

The answer to this remains to be seen. After all, we still don't know whether the corporate tax rate will in fact fall, much less when exactly it might do so.But if it were to happen, KBW's Kleinhanzl predicts that it would cause the value of Bank of America's deferred tax assets to drop by $6.6 billion. When you net that against the positive impact of a lower tax rate on certain of Bank of America's liabilities, it means that the bank's tangible book value would decline by $4.4 billion, according to KBW's analysis.

Data source: Keefe, Bruyette & Woods. Chart by author.

Just to reiterate: This is still all theoretical. However, if the tax cut does in fact materialize, and there's reason to think that it will, given that the incoming administration will face a receptive Republican-controlled congress, then it's important for Bank of America's investors to understand the potential one-time shock to the value of their shares.

Fortunately, there's a silver lining to all of this. Namely, after the one-time shock to Bank of America's tangible book value, its earnings per share will actually benefit from lower taxes. KBW estimates that a 10-percentage-point decline in the top corporate tax rate will translate into a 10% boost to the bank's earnings per share in the year following the change.

Despite the potential short-term shock to Bank of America's tangible book value, in other words, this bodes well for the bank's long-term profitability.

10 stocks we like better than Bank of America When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Bank of America wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

John Maxfield owns shares of Bank of America. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.