Trump's Timber Tax Raises Concerns Over Cost to Home Builders

President Donald Trump’s administration plans to slap tariffs on imports of Canadian softwood lumber, raising concerns on Wall Street that home builders will face higher costs.

Softwood lumber, which comes from pine, fir and spruce trees, is used in home construction. Taxes on Canadian imports are expected to increase the cost of lumber for home builders, thus weakening profits.

While the broader market rallied Tuesday, shares in the nation’s top home builders retreated. Lennar (NYSE:LEN), Toll Brothers (NYSE:TOL) and D.R. Horton (NYSE:DHI) all declined, with Lennar leading the way with a 1.5% drop. PulteGroup (NYSE:PHM), which reported weaker profit margins for the first quarter, was down 3.6% in afternoon trading.

The tariffs weren’t as punitive as some projections, though. Weyerhaeuser (NYSE:WY), the Seattle-based forestry giant, slipped 2.2%. West Fraser Timber, one of the Canadian companies impacted by the new tariff, rallied 8.2% on the Toronto stock exchange.

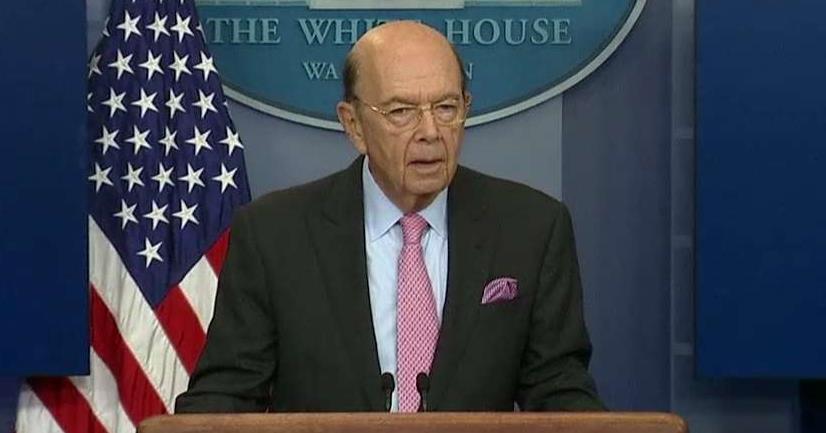

“We do not think that the price of lumber will go up by anything like the 20%, but there may be some small increase in the price of lumber for [home construction],†Commerce Secretary Wilbur Ross said Tuesday during a press briefing in the White House.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| PHM | PULTEGROUP INC. | 139.58 | -2.50 | -1.76% |

| TOL | TOLL BROTHERS INC. | 160.22 | +0.21 | +0.13% |

| LEN | LENNAR CORP. | 116.12 | -5.14 | -4.24% |

| KBH | KB HOME | 64.81 | -0.99 | -1.50% |

He added that home prices won’t be affected by the move.

“The biggest part of most home prices, in any event, is the land value, not the lumber value,†Ross explained. “Lumber is a pretty small percentage of the total cost of the house.â€

The U.S. and Canada have sparred for decades over what American companies have called unfair subsidies from Canadian governments. Ross said provinces in Canada subsidize the rates they charge loggers at an average of 20%. In turn, loggers have been able to sell lumber on the cheap. The practice has undercut U.S. mills, which normally get lumber from trees grown on private land. Canadian loggers argue that the U.S. can’t meet demand from the construction industry on its own.

The U.S. Commerce Department said taxes ranging from 3% to 24.1% will be applied to Canada’s lumber exports to the U.S., which total about $5.6 billion annually, in an effort to level the playing field. The tariffs are based on the amount of Canada’s subsidies.