Uber-Lyft showdown shifts to public markets

The race between Uber Technologies and Lyft to go public next year promises to extend their rivalry for customers to competition for global investors.

Uber this past week confidentially filed its S-1 paperwork with the Securities and Exchange Commission for its planned initial public offering, The Wall Street Journal reported on Friday. Lyft, its smaller ride-hailing competitor, announced just a day prior that it had filed its confidential IPO paperwork as well.

The transition to becoming publicly traded is likely to reshape both companies and the ride-hailing market they pioneered in the U.S., bringing greater pressure from shareholders to be profitable and requiring more transparency. Uber and Lyft both have racked up huge losses as they compete for drivers as well as riders, with Uber’s loss widening to $1.07 billion in the third-quarter, and Lyft losing $254 million.

“Having both companies go public will help the ride-hailing industry become much more rational and disciplined,” Paul Hudson, founder and chief investment officer of Glade Brook Capital Partners LLC and an investor in both companies, said in an interview. “It’s much more difficult to light money on fire as a public company facing the scrutiny of the public markets.”

Mr. Hudson said the ride-hailing companies’ IPO plans also will put more pressure on other tech startups to go public, with employees and private shareholders seeking liquidity that comes with listing in the public markets.

Already 2019 is shaping up as a potentially record-breaking year for market debuts in terms of dollars raised, with companies including messaging company Slack Technologies Inc., data-miner Palantir Technologies Inc., and short-term rental giant Airbnb Inc. all possibly planning IPOs for next year. The pipeline suggests next year could exceed the IPO peak reached in 2000 at the height of the dot-com boom.

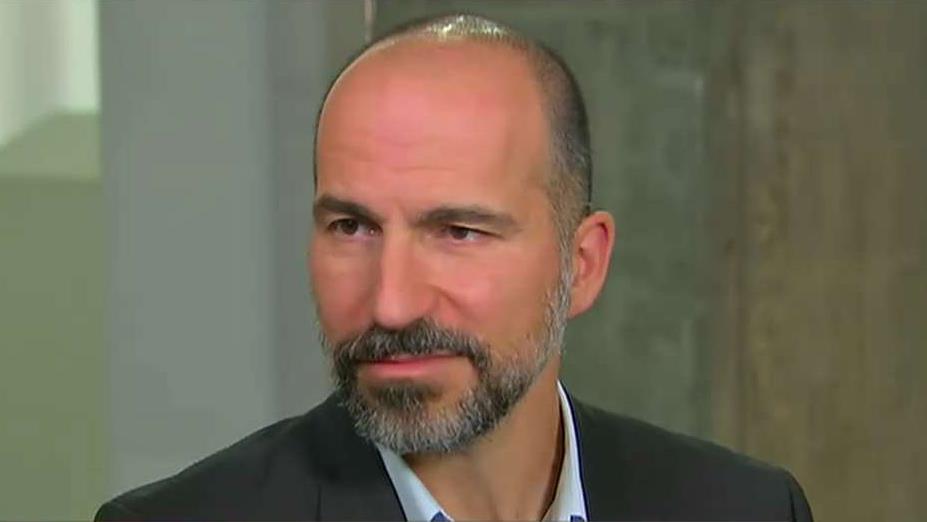

Uber, which has dubbed its IPO plans “Project Liberty,” had been aiming for the second half of next year. But Chief Executive Dara Khosrowshahi wanted to file with the SEC soon to have the option to go public in the first half in case the markets worsen, people familiar with Uber’s decision making said. Filing now doesn’t require Uber and Lyft to go public early in the year, but it gives them time to address comments and questions from the SEC, which often takes several months.

Uber, founded in 2009, is one of the world’s most valuable venture-capital backed private companies, with its most recent valuation at $76 billion. The company’s banking advisers have suggested the ride-hailing firm could go public at a valuation of $120 billion, the Journal has reported. Lyft has raised $5.1 billion to date, compared with about $20 billion for Uber. Both figures include debt financing.

Uber had 69% of the U.S. market, while Lyft had 28% as of October, according to Second Measure, which tracks credit-card spending data. Uber has 20,000 employees world-wide, more than four times that of Lyft.

Growth for Uber, while still rapid, has slowed. Revenue grew 38% to $2.95 billion in the latest quarter, slower than the second-quarter year-over-year jump of 63%.

Uber has indicated it doesn’t expect to get out of the red for at least three years. But Mr. Khosrowshahi has been working to restructure some overseas operations and build up businesses outside its core ride-hailing operation—such as prepared-food-delivery unit UberEats and trucking business Freight—to help bolster Uber’s finances and emphasize the breadth of its business compared with Lyft. As Uber prepares for its IPO, he also has filled several major jobs, hiring the company’s first chief financial officer in more than three years, as well as a chief compliance officer.

Write to Maureen Farrell at maureen.farrell@wsj.com and Greg Bensinger at greg.bensinger@wsj.com