US companies might use tax reform profits to invest in automation, experts say

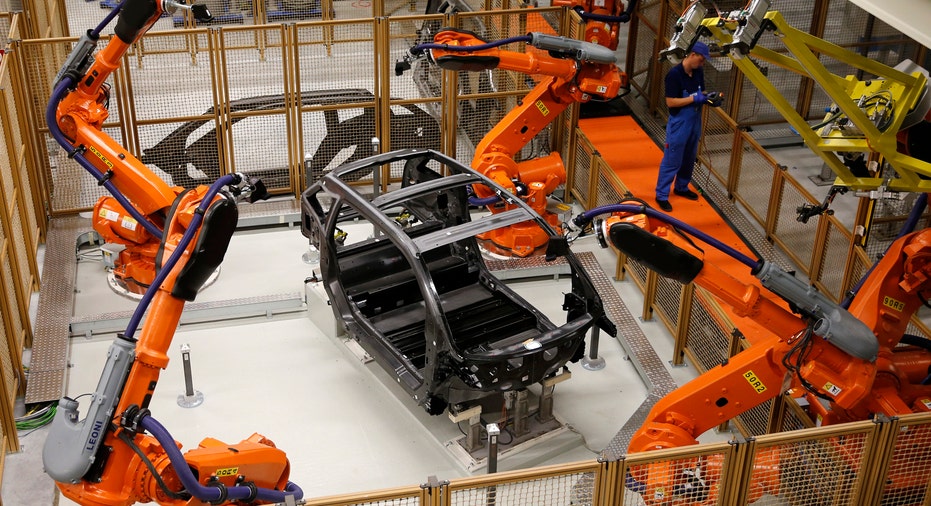

If Republicans successfully pass tax reform, U.S. companies could use the resulting cash windfall to make investments they have been holding out on, including in automation, market experts say.

“We would see a variety of investments get made that CEOs and CFOs have been holding back on,” Matt Litfin, a portfolio manager of the Columbia Acorn fund at Columbia Threadneedle Investments, told FOX Business. “One of the higher … quicker payback investments that companies have been looking at are [in] automation.”

In addition to automation, Litfin expects corporations to invest in accelerated acquisition activity, share buybacks and new manufacturing capabilities.

Eric Marshall, a portfolio manager with Hodges Capital, told FOX Business that investing in technology and automation will be corporate executives’ first move, as they seek to maximize the productivity of their existing employee base. This could come at the expense of hiring new workers.

“It’s going to be disruptive but it can be a positive and a negative,” he said. “Each employee becomes more productive [which means she is] worth more. However, we may need fewer employees.”

As a result, Hodges expects the future labor force will require higher-skilled employees, as automation could weed out a greater proportion of lower-skilled positions.

For the U.S. economy as a whole, automation could lead to a boost in growth because it might encourage companies to bring production back onshore, one of President Donald Trump’s main tax reform objectives.

“You’re balancing labor productivity and labor costs and I think we’ve seen a 30-year trend toward off-shoring and sending jobs overseas, in Asia specifically … A lot of times automation allows companies to bring their manufacturing [back onshore],” he said, adding that while there may be fewer jobs on the factory floor, at least the factory is in the United States.

As the stock market continues to hover near record-highs, Litfin said if the Republican Party fails to deliver on tax reform, that could derail the current momentum. On the other hand, Marshall said Wall Street is still skeptical about whether anything will get done in Washington after getting burned on infrastructure and health care.

“I think that all year we’ve gotten used to the volatility from Capitol Hill,” he said. “I don’t think the market has fully priced in the prospects for tax reform.”

On Friday, National Economic Director Gary Cohn told FOX Business the administration is working every day to craft a bill that will garner enough support from lawmakers to pass both chambers of Congress before the end of the year.

Tax reform cleared a small hurdle on Thursday when the House of Representatives approved the budget resolution for fiscal year 2018. The measure is expected to be put up for a vote in the Senate later this month.

The budget contains the reconciliation mandate for tax reform, which will allow the Republican Party to use the fast-track process when it votes to approve the legislation later this year. It also sets aside money for tax cuts. In a statement released Thursday, Trump applauded the GOP’s efforts, calling it “a pathway to fix our rigged and burdensome tax code.”

On Thursday, a source with knowledge of the matter told FOX Business that the budget resolution is expected to pass both chambers in late October or early November, after which the GOP will introduce the tax reform bill for discussion.