US recession odds are dwindling, key indicators show

The U.S. economy looks like it could skirt what would be its first recession since the 2008 global financial crisis.

“It looks like the recession has been delayed for now,” Torsten Slok, chief economist at Deutsche Bank Securities, told FOX Business, adding that the steepening of the yield curve is telling us the chances of a recession are “lower than what it was just a few months ago.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The spread between the U.S. 2-year and 10-year yields hit 25 basis points on Thursday, the steepest its been since the middle of July, quieting recession calls that reached a fever pitch after the yield curve inverted in August. Economists began sounding the alarm that a recession could hit the U.S. economy within the next 24 months. Such a development has occurred ahead of each and every U.S. recession of the last 50 years.

Mohamed El-Erian, chief economic adviser for Allianz, attributed the recent steepening of the curve to “continued strength of the labor market" and "de-escalation of trade tensions with China," which he says have helped alleviate recession fears. Unemployment is hovering near record lows and the U.S. and China continue to make progress on hammering out phase one of what could be a historic trade deal.

In the weeks following the curve’s inversion, the probability of a recession spiked to 40 percent, according to the New York Fed. That was down to 29 percent on Thursday.

In a further sign of confidence, the stock market, which is a forward-looking indicator, closed at a record high on Thursday.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

However, Sri Kumar, president of the Santa Monica, California-based Sri-Kumar Global Strategies, told FOX Business just because the yield curve has uninverted doesn’t mean the U.S. economy is out of the woods.

In fact, he says this trend occurred ahead of the last two recessions as the market started to anticipate the Fed was going to cut rates sharply. Policymakers, who have cut rates three times this year, indicated at their October meeting they may "pause" on future moves.

“The yield curve inversion earlier this year was looking for a recession to begin sometime in mid-2020," Kumar said. “And now the steepening is saying that 2021 may be a year when the recovery begins.”

Even if a recession comes down the pike, it is unlikely to be deep. Because of the closeness in proximity to the yield curve’s inversion and uninversion, Kumar says any recession is likely to be shallow and short in duration due to the Fed cutting rates and buying short-term assets at a pace of $60 billion per month, which he likens to a fourth round of quantitative easing, or asset purchase programs designed to provide liquidity by increasing the money supply.

He notes the Fed is providing the economy with “an unlimited amount of cash” and that will boost the stock market and cause the yield curve to steepen.

The Fed expanded its balance sheet from $870 billion to a peak of $4.5 trillion through a series of asset purchase programs in response to the Great Recession, but it has since dipped from those levels. If the Fed completes the recently announced program, which is scheduled to last at least through the second quarter, the Fed’s balance sheet will increase beyond the $4.5 trillion it reached as a result of QE 3.

US-CHINA TRADE WAR'S TIT-FOR-TAT RETALIATION ABATING: GOLDMAN SACHS

Still, even Slok admits the U.S. economy has several overhangs and hasn't yet skirted a recession for sure.

For that to happen, he says we need to see trade war uncertainty eliminated, which would include the Conference Board’s CEO confidence survey rebounding off 10-year lows and the corporate sector increasing capital expenditures. Only then can we “declare victory,” according to Slok.

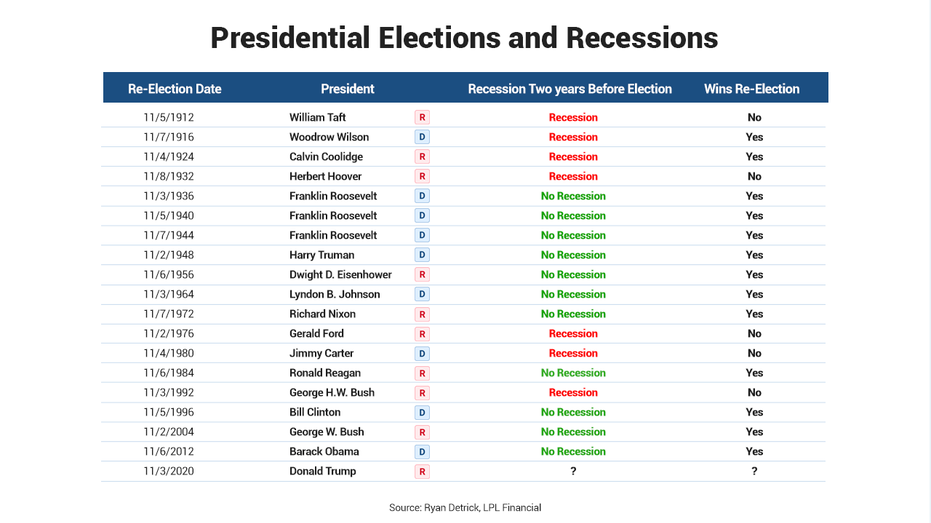

Of course, the stakes are high for President Trump to keep the U.S. economy out of recession as the 2020 election is less than a year away.

Since World War I, the sitting U.S. president has been a perfect 11 for 11 if the economy wasn't in a recession within 24 months ahead of an election. Presidents who oversaw a recession within two years of an election lost five of seven campaigns, including the most recent case – President Bill Clinton’s 1992 election win over George H.W. Bush.

Lucky for Trump, economists surveyed by FactSet have a 2020 consensus GDP forecast of 1.8 percent. A phase one trade deal could go a long way toward helping the economy meet or exceed that outlook.

“For now at least, just having phase one signed, it would certainly be good news for the economic outlook,” Slok concluded.