Valentine's Day chocolates set to break hearts after cocoa prices hit record high

Cocoa shortage from crop damage in West Africa raises prices for chocolate makers and consumers

Consumers planning to purchase chocolates for their loved ones this Valentine's Day might find themselves struck with sticker shock, and not just due to inflation.

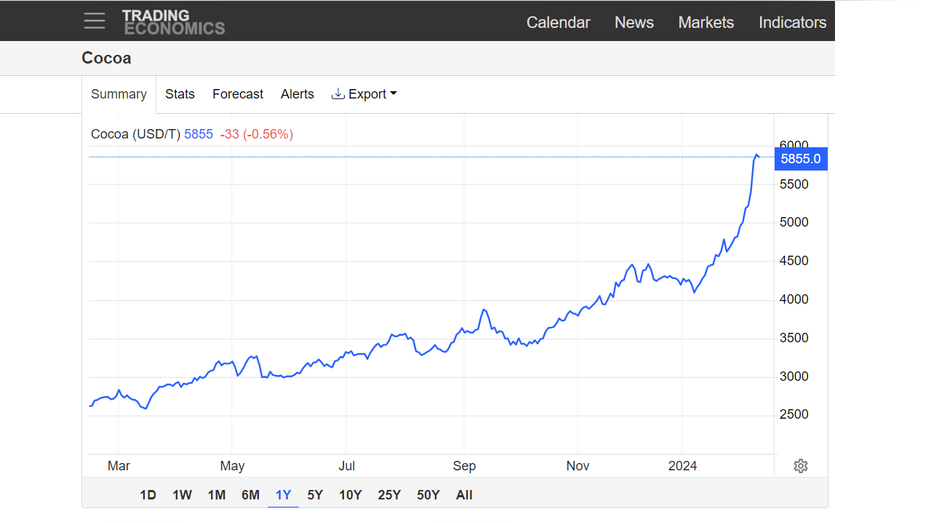

The price of cocoa – which has been on the rise due to crop damage in West Africa – surged to an all-time high last week, and ongoing shortages are putting a squeeze on chocolate manufacturers, who are in turn passing the price hikes on to customers.

World cocoa prices hit a fresh record high for the ninth straight day on Friday, sparking panic that the supply shortages could be prolonged after a double whammy of extreme weather and disease battered cocoa plants in the top-producing West African region.

Chocolates packaged for Valentine's Day on Feb. 2, 2024, in Chicago. Cocoa prices have surged, recently reaching record levels and driving up the cost of chocolate. (Photo Illustration by Scott Olson / Getty Images)

Benchmark ICE London cocoa futures hit a record 4,916 pounds per metric ton on Friday before closing up 2.1% at 4,757 pounds/ton. Prices have more than doubled since the start of last year.

PIZZA HUT OFFERS HOT HONEY BREAKUP PIZZAS AHEAD OF VALENTINE'S DAY: ‘DELIVERING SPICY NEWS’

In New York, benchmark ICE cocoa futures hit a new high of $6,030 a ton on Friday, closing up 1.4% to $5,888/ton, having nearly doubled since the start of last year.

A shortage of supplies is driving up the price of cocoa, which hit a record high last week. (Trading Economics)

A Reuters cocoa poll earlier this month forecast a global deficit of 375,000 tons in the 2023/24 season, more than double that indicated in the previous poll in August, and marking a third successive deficit for the market.

The surge in prices is filtering through to retail shelves, with Hershey expecting to see a further slowdown in demand for its products from cash-conscious customers after its sales volumes slid 6.6% in the fourth quarter.

Hershey Co. said last week it expects high cocoa prices to limit its earnings next year. (Luke Sharrett/Bloomberg via / Getty Images)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HSY | THE HERSHEY CO. | 231.57 | +7.29 | +3.25% |

Hershey Co.

The chocolate giant, shares of which are down some 30% from a May 2023 peak, also said last week that it expects the higher cocoa prices to limit its earnings growth this year.

Volumes at its rival, Cadbury maker Mondelez, also fell last quarter.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MDLZ | MONDELEZ INTERNATIONAL INC. | 60.02 | -0.29 | -0.48% |

Mondelez International, Inc.

"Going back 47 years, almost every major price blip was followed by a massive 20-50% price break, within one to two years. Is this situation different? According to my sources in the cocoa bush of West Africa... YES!" said Jim Roemer, meteorologist and commodity trading adviser at Best Weather Inc.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"At least for now, a squeeze situation may well continue for another month or two," he added.

Reuters contributed to this report.