Vanguard narrows ETF gap with BlackRock

Investment advisory firm nets over $25B in first quarter of year

Fed is facing an inflation dilemma that will end in recession: Luke Lloyd

Ernst & Young chief economist Gregory Daco and Strategic Wealth Partners investment strategist Luke Lloyd discuss whether moderating inflation warrants the Fed ending rate hikes on 'Cavuto: Coast to Coast.'

The Vanguard Group pulled in a net $25.7 billion into its exchange-traded funds (ETF) over the first quarter to best its biggest competitor Blackrock in totals since Jan. 1, etf.com reported.

The inflows were powered by $19.1 billion of investments into equity products.

WHAT ETFS ARE GOOD INVESTMENT CHOICES FOR NEW COLLEGE GRADS

Data compiled by etf.com showed Vanguard’s fixed-income ETFs pulled in $6.6 billion during the quarter. The top asset-gathering fund was the Vanguard S&P 500 ETF, which brought in $4.5 billion over the same time.

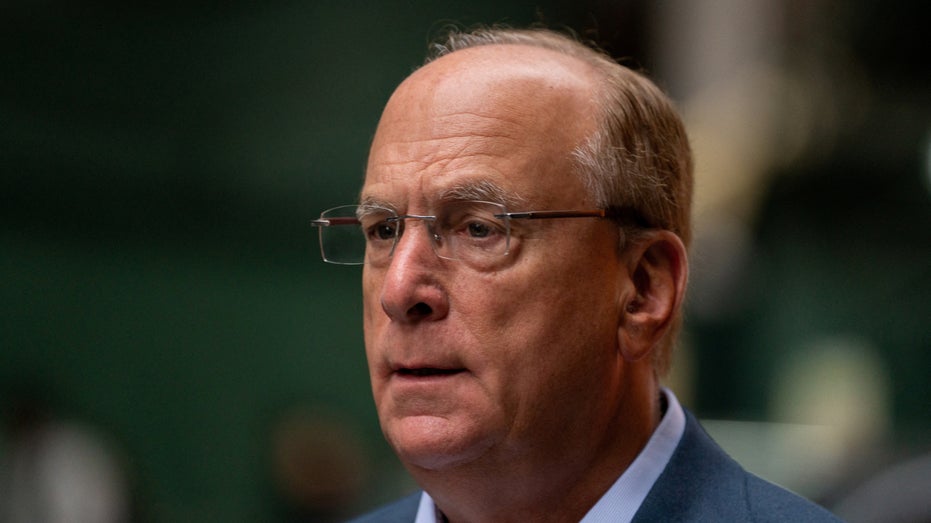

Larry Fink, Chairman and CEO of BlackRock, arrives at the DealBook Summit in New York City, on Nov. 30, 2022. (Reuters/David 'Dee' Delgado)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,056.88 | +2.43 | +0.23% |

Meanwhile, BlackRock’s iShares unit lost $500 million, Vanguard said. Despite the loss in revenue, iShares remains the largest ETF issuer with $2.3 trillion in assets across 384 U.S.-listed products.

Vanguard holds $2 trillion in assets across 82 of its U.S.-domiciled funds.

In the first quarter of 2023, U.S.-listed ETFs fell 18% to $76.9 billion after reaching $91.1 billion over the first quarter of 2022.

CLICK HERE TO GET THE FOX BUSINESS APP

Best performing ETFs in a rising interest rate environment

Pacer ETFs president Sean O'Hara reveals the best ETFs to buy in an inflationary environment on 'The Claman Countdown.'