Wall Street Puts Rough 1Q in Rearview Mirror, Looks for Steady 2Q

Wall Street has come a long way from the dark first 10 days of 2016. The two-week period added up to the worst start to a new year ever…and housed volatile action that spooked investors around the world.

On paper, markets at the end of the first quarter looked to be where many analysts would have expected, according to Casey Clark, a member of Glenmede’s investment strategy research team. But peeling back the layers show the messy trail that’s led to April 1.

“The big swings intra-month are really eye-catching,” Clark said. “Just think about where we were to start the year: There were fears about how the dollar’s strength would affect earnings, missteps in Chinese government regulation which really started this whole fear of disrupting markets, and leading economic indicators were coming in slower than expected.”

Indeed, the initial selloff in 2016 was, in a sense, a carryover of the same fears that had plagued markets in the back half of 2015: Fears about China’s slowing growth and how it could impact the U.S., uncertainty over the Federal Reserve after it hiked rates for the first time in nearly a decade in December, and oil prices that plunged to fresh 12-year lows.

The fear pushed all the major averages into correction territory, defined as a 10% drop from a recent high.

Since then, however, Wall Street has staged a significant comeback as equities have jumped more than 12% from February depths. March was the first month to end on a positive note for both the S&P and the Nasdaq, and the major averages booked hefty gains of at least 6.5% for the period. On a year-to-date basis, the broader averages managed to cross back into positive territory. The Dow is up 1.5% while the S&P 500 has gained 0.7%.

Meanwhile, trading volume was the highest quarterly average since the third quarter of 2011, according to data from Dow Jones.

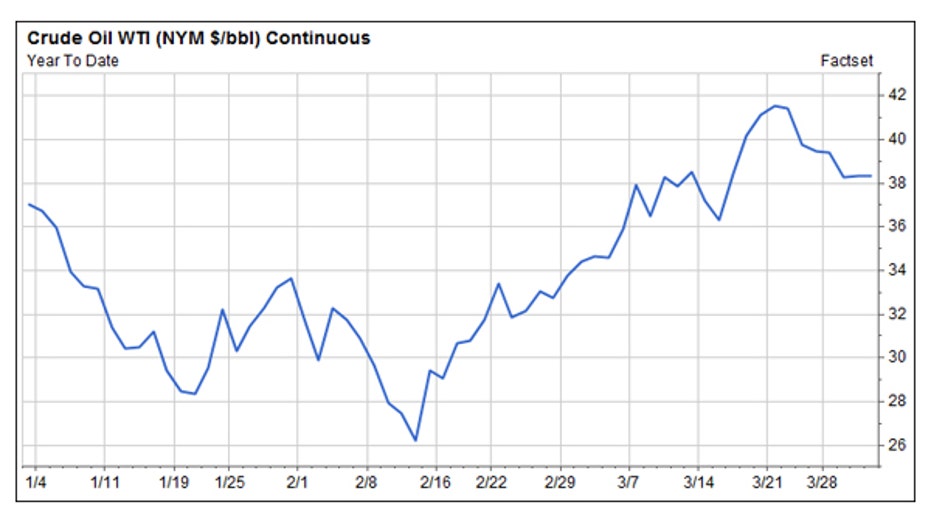

Telecom and utilities were by far the top performing sectors in the first quarter, rising more than 14.5% each, while health care and financials rounded out the bottom, each losing more than 5%. Meanwhile, oil prices snapped a two-month losing streak in March, settling up 13.6% to $38.34 a barrel.

A Recovery to Believe In?

As investors have piled back into risky assets like equities and high-yield corporate bonds, there hasn’t been a significant corresponding selloff of safe-haven assets like gold and U.S. treasury bonds. Since January, gold prices have spiked from around $1,070 to the $1230 range. The yield on the benchmark US 10-year Treasury bond, which moves in the opposite direction of price, slid 42.4 basis points to 1.8% as the Fed’s rate-hike plans were pushed back. That move is the largest decline in yield since the second quarter of 2012, according to Bloomberg data.

Scott Wren, Wells Fargo (NYSE:WFC) Investment Institute managing director and senior global equity strategist, said the market is chock full of professional money rather than so-called mom and pop retail investors.

“I think that retail investors still have doubts. They’re still fearful. And the volatility [early this year] only made it worse. When you see a 10% plus fall that quick, most retail investors are like, ‘I’m not touching this,’” he said.

"Retail money is not waiting for a pullback. They’re just frozen."

If they didn’t get in when the market started moving higher again, traditionally, these kinds of investors would wait for another, but smaller, pullback to put money back to work. But Wren said this time, it’s different.

“Retail money is not waiting for a pullback. They’re just frozen,” he said.

Taking a step back to look at the broader market picture shows that while the bull market, which turned seven just last month, is growing long in the tooth. But Clark said there’s still room for expansion.

“We see moderate risk and we don’t envision an imminent recession,” he said. “We see a greater probability of slow but continued growth.”

He pointed to markets getting back to a “normal” pace as credit spreads continue to tighten, and as fear indicators like the VIX, a gauge of expected volatility, signal less fear in the marketplace relative to January and February levels.

Putting a Wrench in Growth Expectations

Global central banks have played a key role in market movement since the financial crisis. First, helping to stabilize financial markets and institutions, and now telegraphing expectations as the U.S. moves away from accommodative policy measures.

But it’s a double-edged sword for the Federal Reserve. Markets have become accustomed to the easy-money policies which have spurred appetites for risky assets like equities and commodities, and given strength to the U.S. dollar against other world currencies. To move rates in either direction too quickly would be to risk unraveling the market’s trajectory.

Wren said Friday’s March jobs report would be another key for the Federal Reserve as it continues to watch for stabilization in the labor market.

“The Fed feels good the labor market is moving in the right direction, but they’re concerned that wages aren’t going up because they’d like to see more inflation. Wages make up about 70% of the cost to produce any good or service in the U.S…if you want to figure out what inflation is going to do, look at wages,” he said.

The central bank has said economic data is paramount to its decision-making process on rates, in addition to monitoring developments in the global economy.

Clark added that key pieces of manufacturing data, also due out on Friday, could help reinforce the idea that the U.S. is continuing on the path to recovery. Recent regional factory surveys, including those from Philadelphia and New York, have shown improvement over the last month as they jumped out of contraction territory.