Warren Buffett really likes these 5 stocks

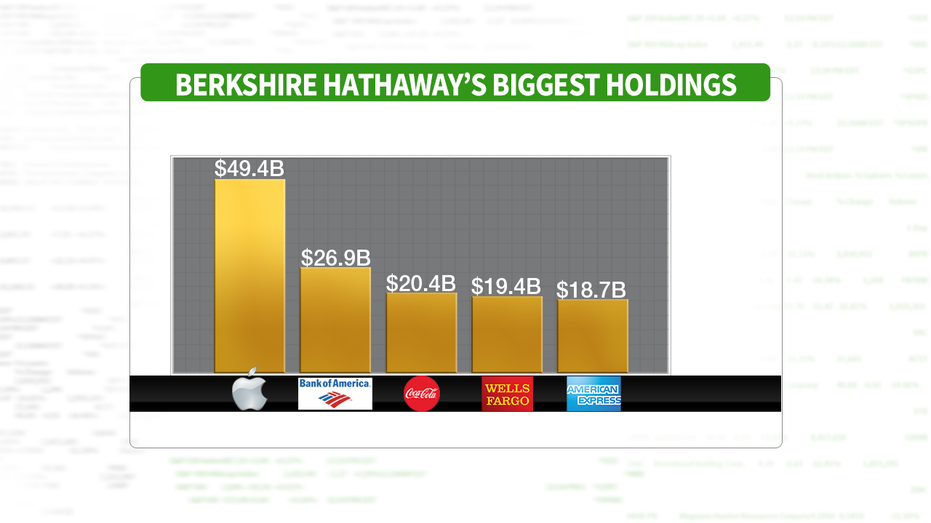

Warren Buffett made a couple of tweaks during the second quarter to Berkshire Hathaway’s $198 billion equity portfolio, but the conglomerate's top holdings remained the same. Apple, Bank of America, Coca-Cola, Wells Fargo and American Express were still Buffett's most-loved stocks.

The legendary investor added to his positions in Amazon, Bank of America, Red Hat Software and U.S. Bancorp while selling a portion of his Charter Communications stake, according to a regulatory filing released Wednesday.

Berkshire, which revealed a 483,300-share stake in Amazon back in May, increased its position in the second quarter by 11 percent to 537,300 shares, worth nearly $950 million.

Another notable change in Berkshire’s portfolio was the addition of more than 31 million Bank of America shares. That raised Berkshire’s stake by 3 percent to over 927 million shares, worth about $26.9 billion.

The Buffett-led conglomerate's lone sale during the quarter was a 5 percent reduction of its Charter Communications stake.

Berkshire did not make any changes to its 26.7 percent stake in Kraft Heinz, which has taken nearly $17 billion in write-downs this year and has seen its stock’s value plunge by more than 40 percent. Berkshire’s position is worth more than $8 billion.

CLICK HERE TO READ MORE ON FOX BUSINESS

Here's a breakdown of Berkshire's largest holdings, by value: