Wells Fargo employees changed customer information on documents: report

Employees at Wells Fargo, which has been riddled with scandals throughout recent months, are said to have adjusted corporate customers’ information on documents without their knowledge or consent, according to a new report.

Workers in the bank’s wholesale unit added or changed personal information including birth dates, Social Security numbers and addresses for people associated with its business clients in 2017 and early 2018, according to The Wall Street Journal, which cited people familiar with the matter. At the time, the unit was pressed with regulatory deadlines, including one related to anti-money laundering controls.

Wells Fargo recently became aware of the incident and discovered that it occurred more than once, the Journal reported. Wells Fargo has reported the problem to the Office of the Comptroller of the Currency, which is investigating the matter.

A spokesperson for Wells Fargo said in a statement that the company could not comment directly on regulatory matters but the incident involved internal documents used for internal purposes and no customers were negatively impacted.

The Wall Street behemoth is still reeling from a slew of recent scandals. Last week, Wells Fargo came under fire after it was revealed that it kept rebates that should have been deposited in a Tennessee public pension fund.

The U.S. Labor Department is also reportedly looking into whether Wells Fargo pressured participants in lower-cost corporate 401(k) accounts to roll their savings into more expensive IRA plans when they retire or leave their jobs, according to reports released last month. Investigators are examining whether the bank encouraged savers to purchase in-house funds that would have increased its own revenue.

Meanwhile, last month, the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency announced that Wells Fargo had agreed to pay a $1 billion fine as part of a settlement after the bank forced an auto loan insurance program onto hundreds of thousands of consumers that did not need it and mischarged consumers for certain mortgage interest rate lock extension products.

Of those who were forcibly sold the auto loan insurance product, thousands had their cars repossessed because they could not afford the extra payments, the bank admitted.

Wells Fargo said the hefty fine, one of the largest levied on any bank unrelated to the financial crisis, will cut about $800 million off of its first-quarter profit.

The troubled bank also agreed to pay a $185 million fine in 2016 after it was revealed that employees were creating fraudulent accounts for customers without their approval.

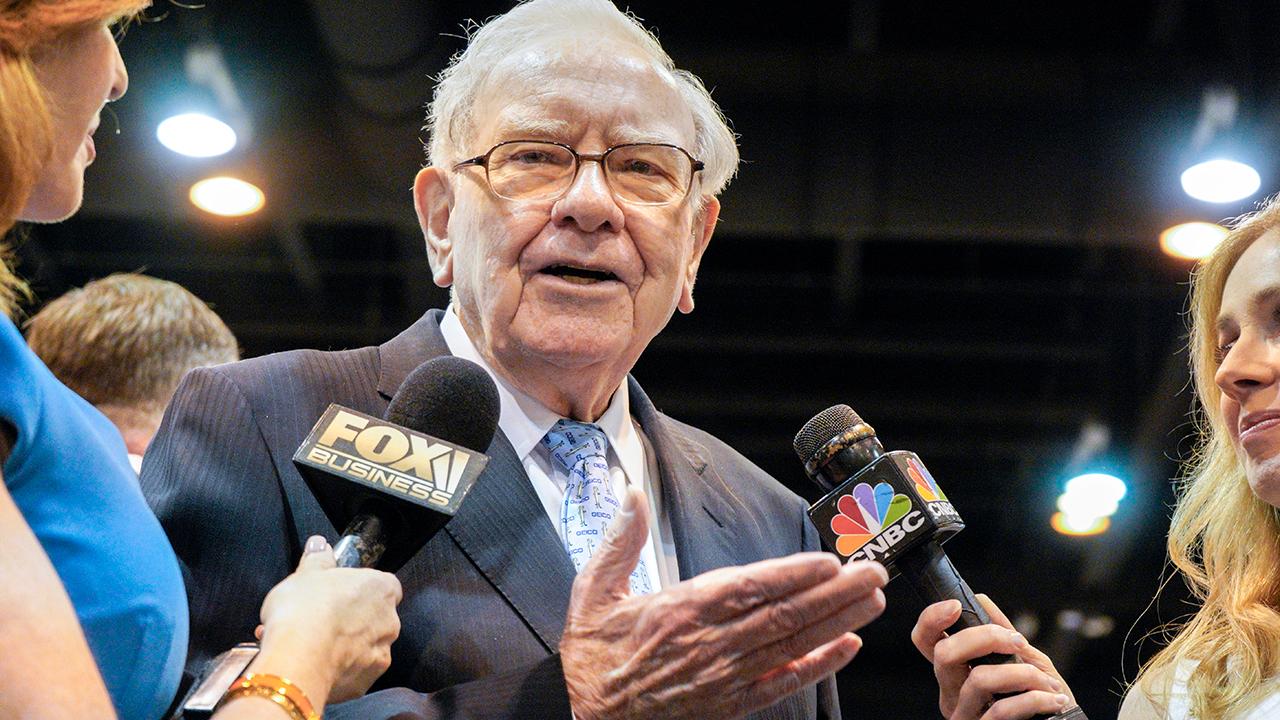

Despite a slew of missteps, legendary investor Warren Buffett told FOX Business’ Liz Claman earlier this month that the bank has a “great future” and that “someone made a terrible mistake” by allowing the creation of sham customer accounts.