Wells Fargo's Massive Fraud Made This Woman Filthy Rich

By defrauding customers, one Wells Fargo executive earned a $125 million payday. Image source: iStock/Thinkstock.

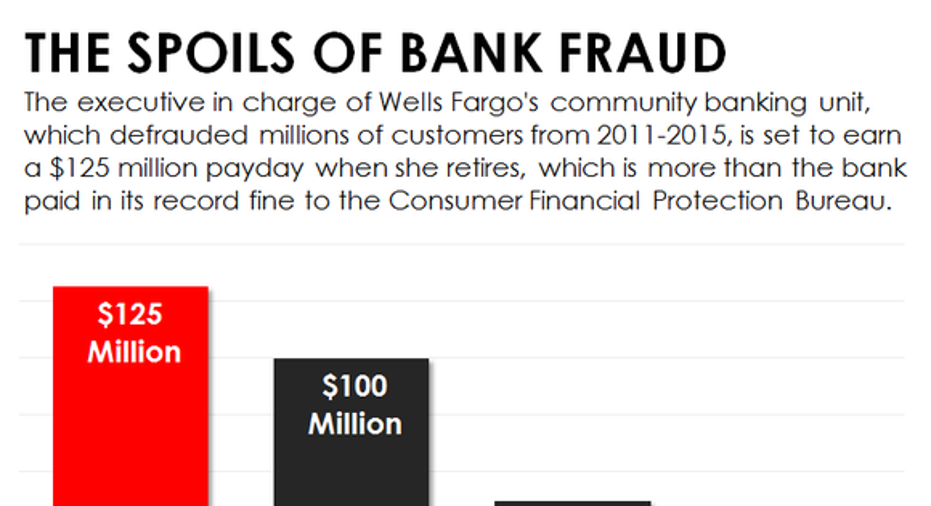

Just in case you weren't outraged enough at the fact that thousands of employees at Wells Fargo (NYSE: WFC) fraudulently opened millions of accounts for customers without their consent, then I have a chart for you.

It reveals the one person who, more than anyone else, appears to have personally benefited from Wells Fargo's massive fraud.

I'm referring to Carrie Tolstedt, the executive who oversaw Wells Fargo's community banking division for much of the past decade. That includes the years from 2011 to 2015, when more than 5% of the employees under her watch engaged in a wide-ranging, systematic scheme to boost revenue by taking advantage of millions of unwitting customers.

Wells Fargo reported two months ago that Tolstedt had decided to retire at the end of this year, though she stepped down from her role overseeing the bank's branch network on July 31.

"A trusted colleague and dear friend, Carrie Tolstedt has been one of our most valuable Wells Fargo leaders, a standard-bearer of our culture, a champion for our customers, and a role model for responsible, principled and inclusive leadership," said Chairman and CEO John Stumpf at the time.

As a parting gift, Tolstedt will earn a purported $125 million payday, the lion's share of which stems from the exercise of stock awards that she received from the bank along the way. The bank's latest proxy filing shows that the 27-year Wells Fargo veteran owns in one way, shape, or form more than 2.5 million shares of stock.

That's a lot of money. But just how much it is becomes even clearer when you compare it to the amount of money that Wells Fargo paid in fines to regulatory agencies for its transgressions:

Data source: Consumer Financial Protection Bureau. Chart by author.

As you can see, no person or agency benefited more from Wells Fargo's fraud than Tolstedt.

The Consumer Financial Protection Bureau, the upstart regulatory agency that ostensibly led the investigation, got a $100 million fine from Wells Fargo. But even though that was the biggest fine assessed by the CFPB in its five years of operation, it's still materially less than Tolstedt is set to walk away with.

And there's simply no comparison between how much Tolstedt will get relative to the other government bodies that joined with the CFPB to sanction Wells Fargo. The Office of the Comptroller of the Currency got only $35 million, while the city and county of Los Angeles, which was the first to sue the bank, received $50 million in civil penalties.

This goes to show that even the best-performing banks in the country seem to have lost their bearings over the past few decades in terms of what is and what isn't appropriate conduct.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

John Maxfield owns shares of Wells Fargo. The Motley Fool owns shares of and recommends Wells Fargo. The Motley Fool has the following options: short October 2016 $50 calls on Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.