What Is a Fund of Funds?

A fund of funds is exactly as it sounds -- it is a fund that invests in other mutual funds or hedge funds. The basic idea is that a fund of funds can offer greater diversification and access to high-minimum funds, albeit with an additional layer of fees.

Fund of funds examples

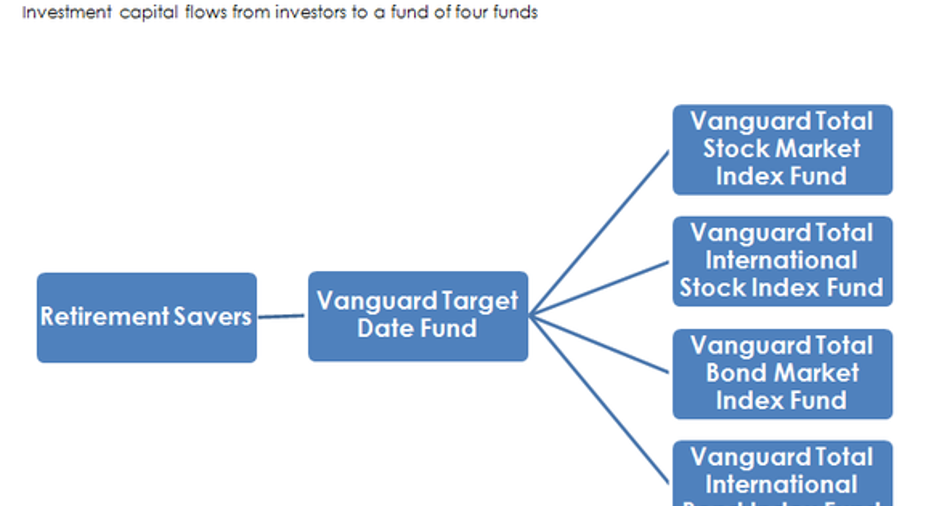

One of the most common examples of a fund of funds is a target date mutual fund. Target date funds allocate investors' capital based on their expected retirement date. For example, Vanguard's target date mutual funds pool investors' money and invest it into four other Vanguard funds.

Fund of funds are also common in hedge funds, which typically have high minimum investments that often top $1 million or more. By investing in a fund of hedge funds, an investor who might not ordinarily be able to scrounge up enough to meet the minimum investment for a hedge fund can invest in a fund of hedge funds and get access to an investment vehicle that might have traditionally been out of reach.

Fund of funds were famously brought into the spotlight by a $1 million bet between legendary investor Warren Buffett and hedge fund manager Protege Partners. Warren Buffett bet that an S&P 500Index fund would beat the performance of five funds of funds picked by Protege over a 10-year period, after fees. So far, it looks like Buffett's charity will win the friendly wager.

Criticisms of funds of funds

One of the biggest criticisms of funds of funds is that they make investing more expensive by adding another layer of annual management and performance fees. A fund of funds might charge investors annual management fees of 0.5% to 1% each year to invest its clients' capital in funds that charge another 1% annual management fee. Over time, the additional fee burden makes it difficult for funds of funds to generate good returns for their investors.

Similarly, just as it is difficult to pick market-beating stocks, studies show it is just as tough to select market-beating fund managers. Selecting star fund managers from a pool of thousands of fund managers is no easy task, as historical performance is no guarantee of future results.

Finally, because a fund of funds may invest in hundreds of funds, it may become so diversified that beating the market is impossible. A fund of 20 funds that each holds 50 stocks could own 1,000 investments, assuming no overlap in the underlying funds' positions. With that kind of diversification, the fund of funds' investors would likely be better off owning a low-fee index fund that offers vast diversification at a substantially reduced price.

Despite the industry's criticisms, funds of funds and fund allocation are big businesses. One of the most successful allocators, Blackstone'sHedge Fund Solutions unit, recently reported having more than $68 billion of client assets that it invests in other managers' funds.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us atknowledgecenter@fool.com. Thanks -- and Fool on!

The article What Is a Fund of Funds? originally appeared on Fool.com.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.