What's the Maximum Social Security Benefit in 2017?

Inflation ticked higher this year, and as a result, the Social Security Administration is increasing Social Security payments by 0.3% in 2017.The slight increase in Social Security income means that the maximum monthly Social Security benefit at full retirement age next year will be $2,687 per month. However, the chance that someone would get that amount depends on their past earningsand when they claim their Social Security benefits.

Read on to learn how the government decides how much you'll receive in Social Security benefits -- and what you can do to boost your take.

Image source: Getty Images.

How is my Social Security calculated?

It takes most Americans about 10 years of working to accumulate enough Social Security credits (40) to qualify for Social Security benefits. If you qualify for Social Security, then the Social Security Administration will calculate your monthly benefit by adjusting your income -- up to specific limits -- into current dollars. Your highest 35 years of adjusted income are then totaled and divided by 420 (the number of months in 35 years) to arrive at your average indexed monthly earnings (AIME).

Your AIME is then adjusted by multipliers at specific earnings thresholds to determine your maximum monthly Social Security benefit at full retirement age, or FRA.For instance, if you become eligible for Social Security in 2017, then you'd multiply the first $885 in AIME by 90%. Any amount earned between $885 and $5,336 would be multiplied by 32%, and any amount above $5,336 would be multiplied by 15%. The resulting amounts are added together and rounded down to the nearest dime to determine your monthly FRA benefit

Although this calculation is complicated, you don't need to run the numbers yourself to find out how much you'll get in benefits. The Social Security Administration provides two ways for you to learn how much you're likely to receive in monthly benefits. You can either use their calculator to estimate your benefit or you can set up an account so that you can log in to view your projected benefit.

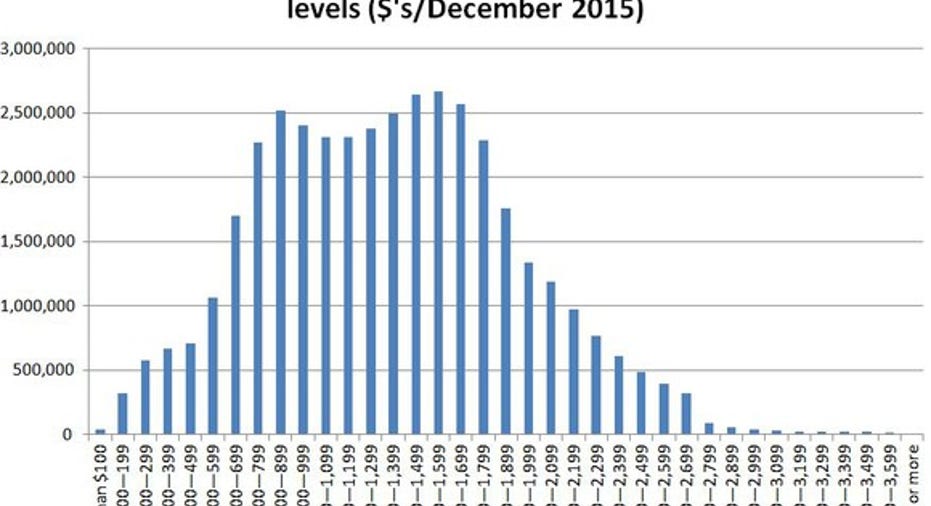

Overall,Social Security is designed to replace roughly 40% of the average American worker's pre-retirement income, however, as the following chart shows, the amount Americans receive in benefits varies widely.

Image source: Social Security Administration.

How to get a bigger Social Security check

Obviously, the best way to get more Social Security in retirement is to earn more money. Workers pay a payroll tax that applies to income earned up to $127,200 in 2017 (up from $118,500 in 2016), so if you earn less than that, increasing earnings can net you a bigger Social Security check in the future. Also, if you've already worked 35 years, know that higher income earning years will replace lower income earning years in your benefit calculation, further boosting your benefit.

Another way to increase your Social Security income is to take advantage of delayed retirement credits. Delayed retirement credits increase your payment if you claim Social Security after your full retirement age.In 2017, the full retirement age is 66 years and 2 months. If you were born in 1955 and you wait until age 70 to claim your benefits, then your monthly check will be 130 2/3% bigger than the amount you would otherwise receive at full retirement age.

Waiting to claim can also increase your payment if you're already scheduled to receive the maximum monthly benefit amount. For instance, retiring at age 70 results in a maximum monthly benefit of $3,538 in 2017.

Of course, deciding when to claim Social Security is a personal decision that will depend on your health, savings, and many other things. If you're closing in on retirement, though, waiting to claim could be your best strategy to maximizing your Social Security benefit.

The $15,834 Social Security bonus most retirees completely overlook If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $15,834 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after.Simply click here to discover how to learn more about these strategies.

Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.