Where did the money go in FTX crypto collapse?

FTX's new leadership team has organized its efforts to recover funds from the collapsed crypto firm into four silos.

FTX founder Sam Bankman-Fried issued himself loans using company money: CEO

FTX CEO John Ray testified Tuesday that founder Sam Bankman-Fried issued himself loans using company money, part of more than $1 billion in loan disbursements to "insiders," Ray said.

The collapse of FTX, a cryptocurrency exchange once valued at $32 billion — and founder Sam Bankman-Fried's arrest Monday on a number of charges alleging he defrauded his investors — have prompted many to ask simply – where did the money go?

Current FTX CEO John J. Ray III, a corporate restructuring expert who handled the restructuring of bankrupt energy trader Enron, appeared before the House Financial Services Committee Tuesday. He told lawmakers they're still in a "very preliminary stage" in their investigation, but it's evident Bankman-Fried and his colleagues were "grossly inexperienced and unsophisticated". Ray indicated that customers and investors who put their money into FTX and its affiliates shouldn't hold out hope for a full recovery, saying: "We will never get all these assets back."

In bankruptcy filings and documents provided to Congress and regulators, Ray and FTX's new leadership have organized their efforts to recover what they can of customers' and investors' funds by looking at four silos, or categories, into which corporate funds were funneled by Bankman-Fried and his associates: WRS, Alameda Research, FTX.com, and a variety of venture investments.

FTX FOUNDER SAM BANKMAN-FRIED ISSUED HIMSELF MILLIONS IN LOANS USING COMPANY MONEY: CEO

Ray noted the new leadership team believes no outside investor held greater than a 2% stake in any silo, but he has a low degree of confidence in FTX's financial documents and noted Tuesday that his team is essentially starting from scratch because FTX had "near zero" record-keeping infrastructure.

Here's a look at what went into each silo:

WRS (aka FTX US)

SEC CHARGES BANKMAN-FRIED FOR ALLEGED ‘MASSIVE, YEARS-LONG FRAUD’

West Realm Shires (WRS) Inc. is the corporate entity under which FTX US operated as a crypto trading company that bought, sold, and stored virtual currency for customers around the world. According to the flow chart, Bankman-Fried held a roughly 53% stake in this silo; Gary Wang and Nishad Singh, former FTX executives, held roughly 17% and 8%, respectively; and third-party investors held just over 22%.

The WRS / FTX US silo contains LedgerX, a crypto trading platform regulated by the federal Commodity Futures Trading Commission (CFTC) that FTX acquired and rebranded as FTX Derivatives; securities broker-dealer FTX Capital Markets; Embed Clearing, a broker clearinghouse; FTX Gaming; and FTX NFTs.

It also includes loans made to BlockFi, a crypto lender that received investment from FTX and also lent money to Alameda prior to entering bankruptcy amid the broader contagion in crypto markets caused by FTX's failure.

BLOCKFI'S BANKRUPTCY EXIT PLAN

Alameda Research

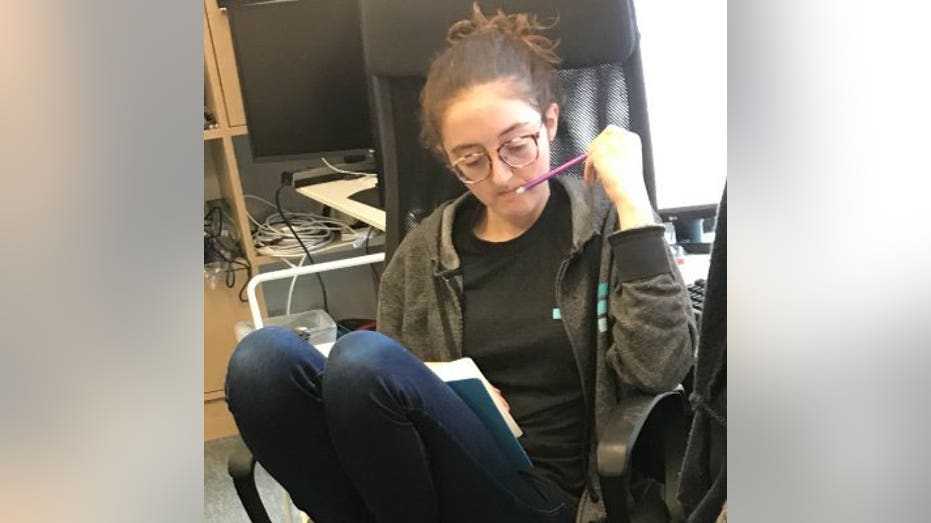

Alameda Research CEO Caroline Ellison via Twitter (Twitter @carolinecapital)

WHO IS CAROLINE ELLISON AND HOW DID SHE END UP AT CENTER OF FTX COLLAPSE?

Alameda is a hedge fund that specialized in trading within the crypto space. It was co-founded by Bankman-Fried and Tara Mac Aulay. Mac Aulay tweeted that she and "a group of others" all quit in 2018, in part due to concerns over risk management and business ethics. Bankman-Fried held a 90% stake in the firm, which was led by Caroline Ellison prior to its collapse.

Reports say Alameda improperly received billions of dollars in FTX customers' funds and leveraged those funds to make risky investments that didn't pan out and led to the failure of both the hedge fund and FTX when the firms were unable to repay their lenders. Notably, BlockFi filed a lawsuit against a holding company associated with Bankman-Fried that defaulted on a promise to repay Alameda's debts with shares in Robinhood Markets before the firms entered bankruptcy.

The Alameda silo contained cryptocurrencies, crypto ETFs, other digital assets, and treasuries. Alameda also made a number of venture investments of its own into crypto miner Genesis Digital Assets; Modulo Capital; Pionic (Toss); and others.

Venture Investments

Sam Bankman-Fried, founder and former chief executive officer of FTX Cryptocurrency Derivatives Exchange, speaks during an interview on an episode of Bloomberg Wealth with David Rubenstein in New York, US, on Wednesday, Aug 17, 2022. Crypto exchange (Jeenah Moon/Bloomberg via Getty Images / Getty Images)

The ventures silo includes a number of venture investments made by Bankman-Fried, who the flow chart notes potentially held a 100% stake in this category, although Gary Wang and Nishad Singh may have direct or indirect interests.

Among the entities that received funds within this silo include AI safety firm Anthropic; venture capital firm K5; financial app Dave Inc.; Sequoia Capital, which is one of the oldest and largest Silicon Valley venture capital firms; blockchain startup Mysten Labs; and other companies.

FTX CEO QUESTIONS ACTIONS BY BAHAMIAN AUTHORITIES AMID BANKRUPTCY

FTX.com

This illustration photo shows a smart phone screen displaying the logo of FTX, the crypto exchange platform, with a screen showing the FTX website in the background in Arlington, Va. on Feb. 10, 2022. ( / Getty Images)

FOR FTX CUSTOMERS, IRS PONZI RULES LOOM LARGE

Known as the "dotcom silo" in the flow chart, about 75% of this category was held by Bankman-Fried while third-party investors had a 25% stake. The parent company of the dot-com silo was FTX Trading Ltd., which operated as FTX.com.

Aside from holding the FTX exchange and a number of subsidiaries located in non-U.S. jurisdictions, this silo contained a number of real estate assets. Bankman-Fried and others associated with FTX have been accused of improperly buying homes and personal items in the Bahamas using corporate funds.

Ray has noted in bankruptcy filings that "there does not appear to be documentation for certain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advisors on the records of the Bahamas."

Fox Business' Kelly O'Grady contributed to this report.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

BlockFi bankruptcy a 'contagion' pattern from FTX fallout: Pete Pachal

Coindesk content chief of staff Pete Pachal predicts the FTX contagion will continue, and markets are waiting for the next 'domino to fall.'