FTX's Sam Bankman-Fried's ex-Caroline Ellison to take stand

Alameda Research CEO Caroline Ellison is expected to take the stand this week

Sam Bankman-Fried prosecutor must have a 'rock crusher case': Elliot Felig

Former Manhattan DA prosecutor Elliot Felig joins 'Varney & Co.' to discuss Sam Bankman-Fried's fraud trial after the former FTX CEO was not offered a plea deal.

11/20/22 – The trial over the collapse of cryptocurrency exchange FTX and its founder Sam Bankman-Fried begins its second week.

The star witness, who is expected to take the stand either Tuesday or Wednesday, is his former girlfriend, Alameda Research CEO Caroline Ellison.

Alameda, the sister cryptocurrency firm to FTX, may have had a back door to withdraw billions in customer funds, according to The Wall Street Journal.

Ellison may also disclose more details that could shed light on whether the collapse was a result of fraud or simply the outcome of a mismanaged company that got burned when crypto prices dropped in the so-called crypto winter.

SBF'S BIGGEST FEAR ISN'T JAIL: MICHAEL LEWIS

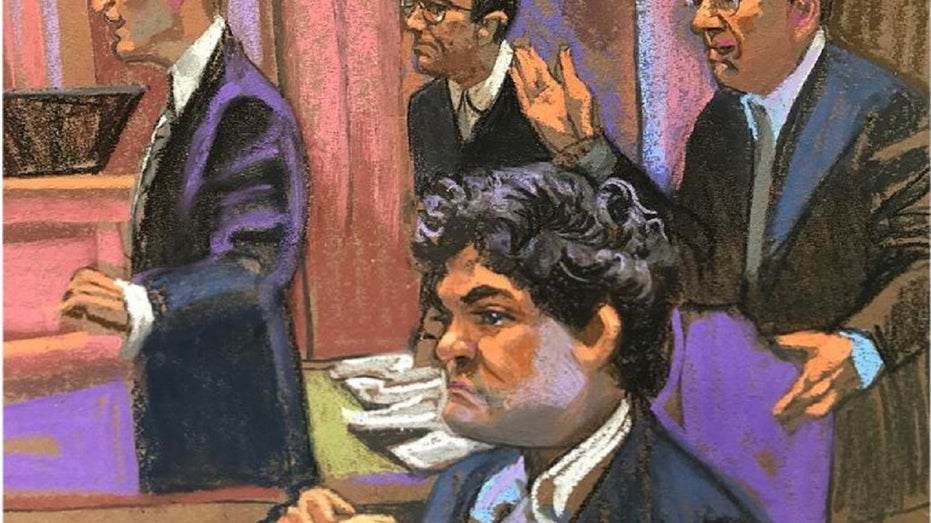

In this courtroom sketch, Sam Bankman-Fried, backed by his defense team, sits in Manhattan federal court in New York City on June 15, 2023. (Christine Cornell / Fox News)

FOX Business takes a look at the woman who may play a critical role for the prosecution.

How Caroline Ellison met Sam Bankman-Fried

Ellison, 28, was raised by two MIT economists and graduated from Stanford with a degree in mathematics. She met Bankman-Fried at the trading firm Jane Street Capital. Bankman-Fried, like Ellison, was raised by professors, and the pair embraced the philosophy of "effective altruism," which involves making large sums of money to fund philanthropic pursuits that benefit society to the greatest extent possible. The two reportedly were involved in an on-and-off relationship, according to CoinDesk.

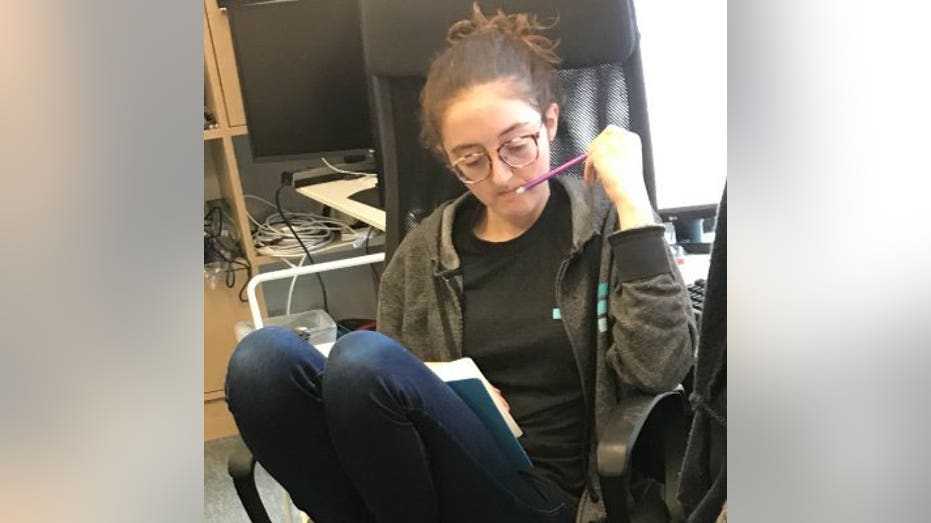

Alameda Research CEO Caroline Ellison. (Twitter @carolinecapital)

When Bankman-Fried left Jane Street in 2017 to found his own hedge fund known as Alameda Research, Ellison joined him shortly thereafter in what she called "a blind leap into the unknown." She became one of the lead traders at the new firm, and said on an FTX-related podcast that joining Alameda was "too cool of an opportunity to pass up" but dealing with capital was "kind of daunting" when she first started at the firm in 2018.

FTX founder Sam Bankman-Fried leaves Manhattan federal court after his arraignment and bail hearings in New York City on Dec. 22, 2022. (Michael M. Santiago/Getty Images / Getty Images)

"Mostly, sort of, it was something I wasn’t used to thinking about," she said. "So it was sort of — I don’t know, I guess I was like a trader for, I mean, not that long at Jane Street but a year and a half, which was kind of more trading experience than a lot of Alameda traders had at the time. I kind of wanted to come in and be like an expert on everything, but there was still lots of stuff in the crypto world that I knew nothing about."

At its peak, FTX amassed a valuation of roughly $32 billion and was the world's third-largest cryptocurrency exchange by volume. (Reuters/Marco Bello / Reuters Photos)

FTX FILES FOR COURT RELIEF TO PAY VENDORS, BEGINS REVIEW OF ASSETS

Alameda and FTX

Alameda was a major trader in the cryptocurrency space and traded frequently on FTX's platform, according to The Wall Street Journal. Though Bankman-Fried was the founder and majority owner of Alameda, he eventually ceded control of its operations and focused primarily on his role as CEO of crypto exchange FTX, which he founded in 2019. At its peak, FTX amassed a valuation of roughly $32 billion and was the world's third-largest cryptocurrency exchange by volume.

The fast-paced atmosphere and rapid growth of both Alameda and FTX increased the strain on those at the helm. The Wall Street Journal previously reported that the use of stimulants was commonplace among those in Bankman-Fried's upper echelon. Ellison tweeted last year, "Nothing like regular amphetamine use to make you appreciate how dumb a lot of normal, non-medicated human experience is."

Sam Bankman-Fried, founder and CEO of FTX Cryptocurrency Derivatives Exchange, speaks during the Institute of International Finance annual membership meeting in Washington, D.C., on Oct. 13, 2022. (Ting Shen/Bloomberg via Getty Images / Getty Images)

Crypto Winter

In October 2021, Ellison was named co-CEO of Alameda with Sam Trabucco. She became CEO in August 2022 when Trabucco announced on Twitter he was stepping down from the role. Trabucco said leading Alameda alongside Ellison had been "difficult and exhausting and consuming," but added that he would "stay on as an advisor."

Cryptocurrency prices were near all-time highs in the fall of 2021, but in early 2022, the digital currencies were plummeting and many investment and lending firms in the sector were facing financial pressure. The state of the industry has been coined "crypto winter."

NEW FTX CEO HIGHLIGHTS ‘PERVASIVE FAILURES’ IN COURT FILING

Binance backs out of FTX rescue

By early November of 2022, concerning reports about the financial health of both Alameda and FTX were mounting. Rival crypto exchange Binance scuttled a tentative plan to acquire FTX after due diligence revealed what Binance CEO Changpeng Zhao called a "chaotic" balance sheet in an interview with Fox Business's Susan Li.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The interconnected relationship between the two firms ultimately led to their collapse, as FTX lent billions of dollars of customer funds from the exchange to Alameda in an effort to shore up the firm's finances. When unnerved investors went to withdraw funds from FTX, it was unable to fulfill those requests and spiraled into insolvency.

Zhao Changpeng, CEO of Binance, speaks during a Bloomberg Television interview in Tokyo on Jan. 11, 2018. ((Akio Kon/Bloomberg via Getty Images) / Getty Images)

During a video meeting before the firm and FTX filed for bankruptcy, The Wall Street Journal reported that Ellison informed Alameda staff about FTX using customers' funds to help Alameda meet its liabilities, and added that she, Bankman-Fried and other members of the firms' leadership were aware of the decision.

Ellison to pitch for prosecution

In late 2022, Ellison said she and FTX co-founder Bankman-Fried misled lenders about how much the company was borrowing from the cryptocurrency exchange.

Ellison revealed her actions in a Dec. 19 plea hearing in a Manhattan federal court, Bloomberg reported.

"I am truly sorry for what I did. I knew that it was wrong," she said, according to a transcript of the hearing in which she acknowledged the financial ties between her company and FTX.

Leaked dairies, jilted lovers

Subsequently, Ellison's personal diaries were leaked publicly, allegedly by Bankman-Fried.

Prosecutors accused him of sharing Ellison's diary with The New York Times. They say it is a clear attempt to taint the jury pool with a narrative that "Ellison was a jilted lover who perpetrated these crimes alone."

Bankman-Fried's attorneys denied that their client did anything wrong in regard to trying to discredit his former girlfriend and main witness on the case.

Still, the circumstances prompted U.S. District Judge Lewis A. Kaplan to revoke Bankman-Fried's $250 million bail and sent him to wait out his trial in a Brooklyn, New York, jail.

FOX Business' Kayla Bailey and Aislinn Murphy contributed to this report, as did Fox News' Marta Dennis.

This story has been updated on 10/9/2023 with the FTX trial underway.