Why Edwards Lifesciences Corp Got Crushed by Investors Today

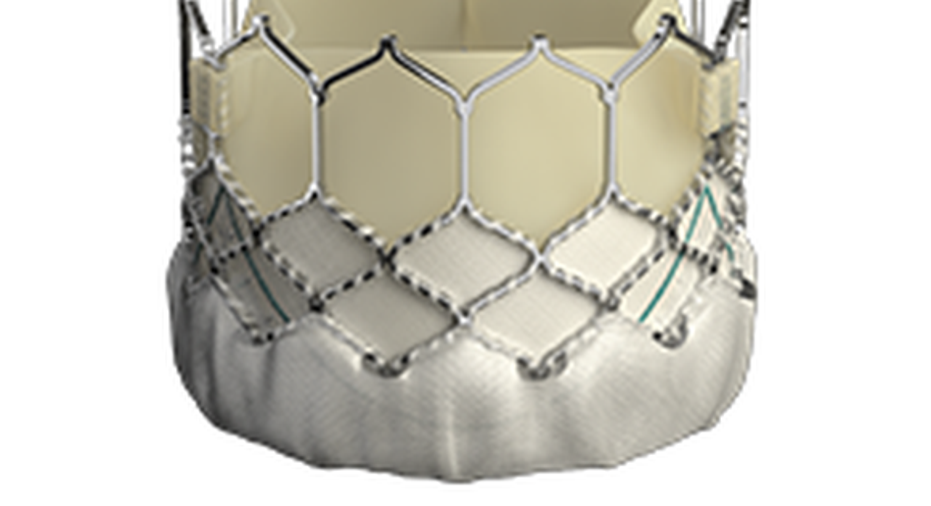

Sapien 3 transcatheter heart valve. Image source: Edwards Lifesciences.

What happened

Edwards Lifesciences(NYSE: EW) is down more than 13% at 12:10 p.m. EDT on Wednesday after the company released a less-than-stellar earnings report after the bell yesterday.

So what

"Less than stellar" is all relative of course. Edwards Lifesciences sales were up 20.1% year over year, a level of growth that many companies would love to have. But second-quarter sales increased 23.1% year over year, so Edwards Lifesciences' revenue growth has decelerated just a bit.

While it would be nice to see the company selling an increasingly larger number of its transcatheter heart valves, the company is limited to the number of patients requiring heart valve surgery. And, as with any product, there's low-hanging fruit that's easy to capture, but growth in market share is bound to slow down over time.

While there appears to be a little slowdown of growth, management still thinks it can hit the high end of its previous revenue guidance of $2.7 billion to $3.0 billion. On the bottom line, management increased the top and bottom of its adjusted earnings guidance range to $2.82 and $2.92 per share from a previous range of $2.78 to $2.88.

Now what

Going into the earnings report, shares of Edwards Lifesciences were trading near all-time highs, so there was likely some lofty expectations built into the stock price. It's not surprising that investors would hit the sell button on anything but an outstanding quarterly report.

But Edwards Lifesciences still has plenty of growth potential left. The company recently got its Sapien 3 transcatheter heart valve approved for intermediate-risk patients, opening up a larger market. And there's potential to expand into low-risk patients, too, if a clinical trial that's currently enrolling patients reports positive outcomes.

Long-term investors willing to accept some short-term volatility might be getting a decent deal today with shares on sale.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Brian Orelli has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.