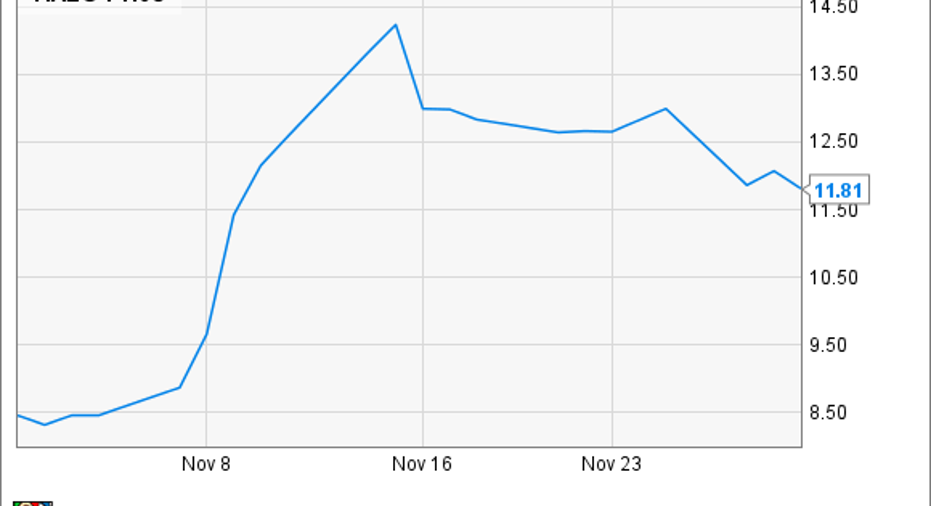

Why Halozyme Therapeutics, Inc. Stock Soared 39.6% in November

Image source: Getty Images.

What happened

Shares of Halozyme Therapeutics, Inc. (NASDAQ: HALO), a biotech focused on boosting other companies' cancer therapies, soared 39.6%% in November, according to data from S&P Global Market Intelligence. Expansion of its partnership with oncology heavyweight Roche (NASDAQOTH: RHHBY) propelled the stock upward.

So what

Halozyme's claim to fame is an enzyme that breaks down a component of connective tissue and gives other therapies increased access where they're needed. The company sells Hylenex to healthcare providers and collects royalties from Roche for sales of MabThera SC.

MabThera SC is a version of Roche's cancer therapy Rituxan that contains Hylenex. It's only available in the EU, but that could change soon. Early last month, the FDA accepted an application for the therapy. A U.S. approval would boost Halozyme's bottom line significantly.

Halozyme is also developing a longer-lasting, pegylated version of its product called PEGPH20 that some analysts believe could eventually contribute around $1 billion to the company's top line each year. A week after announcing the FDA's acceptance of Roche's application for subcutaneous Rituxan, Halozyme also announced the Swiss oncology powerhouse would begin a study exploring PEGPH20 in combination with its exciting new immuno-oncology drug Tecentriq.

Sales of Tecentriq could top out around $3 billion annually. If combining it with Halozyme's compound becomes commonplace, it could lead to a windfall of high-margin royalty revenue.

Now what

Halozyme is still losing money, but there's a good chance it could begin generating sustainable positive cash flows without increasing its debt level or diluting shares with another equity offering. Total third-quarter revenue grew 53% over the previous-year period to $31.9 million, largely driven by increasing royalty revenue.

Halozyme already has a long list of collaborations with some of the world's biggest drugmakers. Given Hylenex's success so far, a widely expected approval for longer-lasting PEGPH20 would probably bring more potential partners to the table.

Before you get too excited, it's important to point out that Halozyme at this point is essentially a one-trick pony. Hylenex is doing well, and PEGPH20 could do much better, but it's got all its eggs in the same basket. PEGPH20 is the only candidate the company has in clinical trials at the moment. If that makes you nervous, it might be best to watch this company's growth story unfold from a safe distance.

10 stocks we like better than Halozyme Therapeutics When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now... and Halozyme Therapeutics wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of Nov. 7, 2016

Cory Renauer has no position in any stocks mentioned. You can follow Cory on Twitter @coryrenauer or LinkedIn for more investing insight.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.