Why Offshore Oil Stocks Surged Higher Today

Image source: Getty Images.

What happened

The price of oil has surged 8% higher today to $49 per barrel after OPEC and non-OPEC members agreed to reduce production by 1.8 million barrels per day. The increase in energy prices also sent shares of offshore producers Cobalt International Energy, Inc. (NYSE: CIE), Canadian Natural Resources Ltd (NYSE: CNQ), Petrobras SA (NYSE: PBR-A), and W&T Offshore, Inc. (NYSE: WTI) higher by at least 10% for a period of time today. If the move in oil holds, the future could finally be getting brighter for these companies.

So what

The keyword today is leverage. Oil explorers who have high fixed costs and will see a big increase in cash flow and profitability because of higher oil prices are experiencing the biggest bounce in shares today.

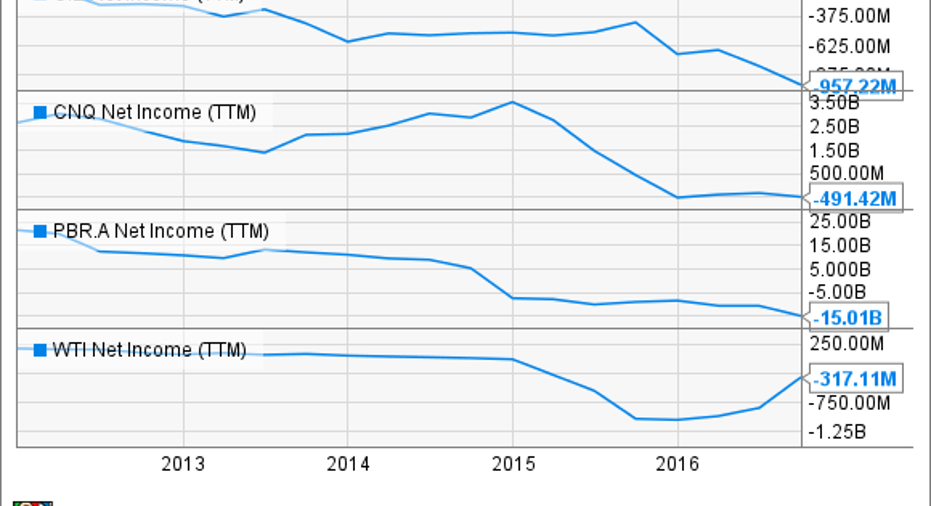

Offshore drilling, particularly deepwater offshore drilling that Cobalt, Canadian Natural, Petrobras, and W&T Offshore have big exposure to, involves spending hundreds of millions of dollars to begin oil production and very low marginal costs once the well is producing oil. That gives a lot of leverage to companies that have already spent the money on drilling for oil and will reap the rewards of higher oil prices. And if you look at the chart of net income below, you can see that all four companies could use a boost in prices to get back to profitability.

CIE net income (TTM) data by YCharts.

Now what

The gain in oil prices is still speculating that supply will come back in line with demand because of OPEC's cuts. But we've seen OPEC members fail to limit themselves to their quota in the past, so it's worth being cautious that the cartel will stick to the limit this time. What's encouraging for oil producers is that it's the first time in two years that a deal has included non-OPEC countries like Russia, which gives the deal a little more staying power.

The incentives for oil-producing countries are aligned with oil producers because higher oil prices lead to more revenue and profits. Even a small cut in production will more than be made up for in prices. And if the production cut sticks, prices could keep rising, which would be very good news, particularly for offshore oil producers right now.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Travis Hoium has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.