Why Shares of Etsy Slumped Today

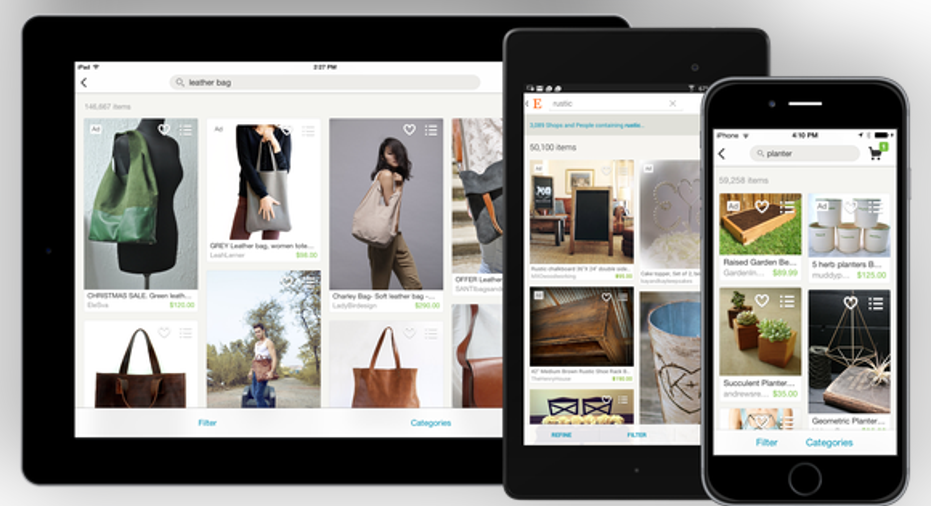

Image Source: Etsy.

What happened

Shares of Etsy (NASDAQ: ETSY) tumbled on Wednesday following the company's third-quarter report. Despite beating analyst estimates for revenue, reporting in-line earnings, and boosting its full-year guidance, the stock was down 13% at market close.

So what

Etsy reported quarterly revenue of $87.6 million, up 33% year over year and less than $1 million higher than the average analyst estimate. Revenue derived from Etsy's marketplace rose just 18.3%, to $38.1 million, while seller services revenue jumped 50%, to $48.5 million. Gross merchandise value increased 19.1%, to $677.2 million, while the number of active sellers and buyers rose by 11.3% and 20.1%, respectively.

EPS came in at a loss of $0.02, up from a loss of $0.06 in the prior-year period and in-line with analyst expectations. Total operating expenses grew by 28.7% year over year, a bit slower than revenue growth, helping to push Etsy into the black on an operating basis.

Along with the earnings announcement, Etsy disclosed that CFO Kristina Salen planned to leave the company at the end of March 2017. Etsy will be launching a formal search for her successor immediately.

Etsy now expects to produce at least 30% revenue growth and 17% gross merchandise value growth in 2016. The company also expects revenue and gross merchandise value to grow at annual rates of 20%-25% and 13%-17%, respectively, through 2018.

Now what

There was a lot of good news in Etsy's report, including better-than-expected revenue growth and a guidance boost. But slower growth in gross merchandise value, active sellers, and active buyers could be giving investors pause. Big increases in seller services revenue, which was the standout during the third quarter, won't be sustainable if the number of sellers doesn't grow quickly enough.

It's also important to remember that Etsy trades at a premium valuation. Even after Wednesday's decline, the stock trades for nearly five times 2015 sales. With gross merchandise value expected to grow by a mid-teens percentage annually going forward, the market may still be overly optimistic on the stock.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

Timothy Green has no position in any stocks mentioned. The Motley Fool owns shares of Etsy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.