Will Whole Foods Market's New Loyalty Program Make a Difference?

Whole Foods Market (NASDAQ: WFM) is doing everything it can to boost its slowing traffic and deliver more sales growth, as its market-leading position in natural and organic foods has been eroded by lower cost competitors. To push back, Whole Foods has started to offer discounts and even rolled out a new, smaller footprint store concept.

Now, the company is following up on those efforts with a customer loyalty program. Will it help Whole Foods deliver the turnaround it needs?

Fighting back with a lower price strategy

Whole Foods once dominated its organic and natural foods niche, but increased competition has taken its toll. Whole Foods is expected to lose its market leading position to Kroger some time this year or the next. The core problems come down to price and convenience, two areas where larger competitors have a distinct advantage. Whole Foods' same-store sales were down 2.6% year-over-year in the third quarter ended July 3. This important metric has steadily dropped from nearly 8% growth in the third quarter of 2013 to this recent low.

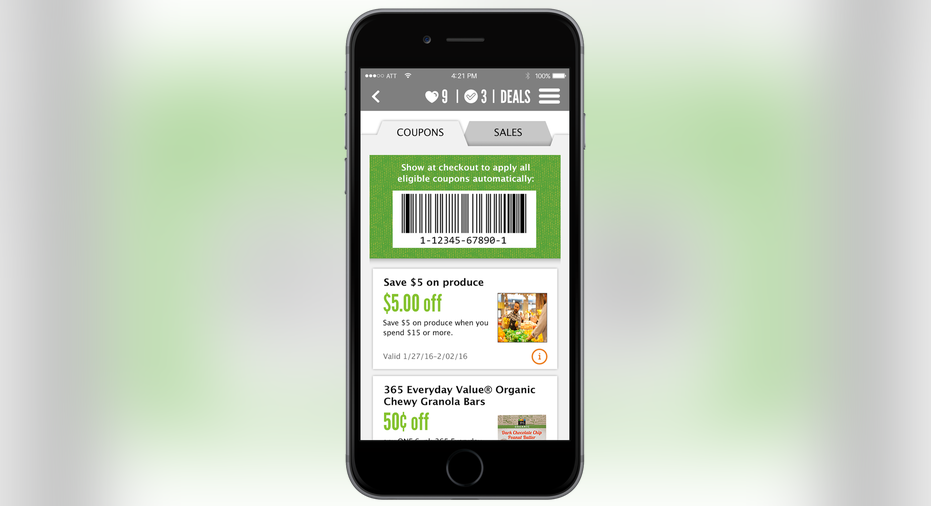

The Whole Foods app displaying a coupon. Image source: Whole Foods Market.

To fight back, Whole Foods has taken on a value strategy. The company announced last year that it would open a new store concept called "365 by Whole Foods", a lower cost and convenience-focused store that offers mostly Whole Foods private-label items, has more automated and mobile checkout options, and provides other cost and time efficiencies. The first of these new stores opened in recent months, first in Los Angeles and then in Oregon.

Whole Foods has also started an initiative to give out digital coupons as an incentive to price-conscious shoppers who would value the discounts and download the Whole Foods mobile app to get them.

In a similar vein, the company has now created a loyalty program, which has begun to roll out in test markets this year.

The loyalty program goes live

"Today, we took another big step forward in our efforts to better understand and provide personalized offerings to our customers with the market-test launch of our new rewards program in the Dallas and Fort Worth metro areas," said management in the company's recent earnings call. The Texas cities join Philadelphia as test sites for the loyalty program, in which customers will "save instantly on member-only deals like 10% off their first purchase, earn rewards for free products, and receive surprises just for shopping in our stores."

Whole Foods expects the new offering to see enthusiastic adoption among customers similar to Whole Foods' current mobile app, which management says has enjoyed close to 50% more activity since the new coupon strategy was implemented. Once the tests of the loyalty program in Dallas-Fort Worth and Philadelphia are complete, the company intends to roll it out nationally in 2017.

Will the new strategy create shareholder value?

One example of a very successful loyalty program is that of Starbucks, whichfaced a similar situation with lower cost competitors cutting into its store traffic and sales. So in 2009, the company created a loyalty program offering discounts and rewards for repeat customers. It now has more than 12 million users, more than $1 billion in prepaid value, and the program is generally credited as a major reason the company has managed to successfully grow same-store sales year after year.

So will Whole Foods see similar results? The value strategy will lead to lower margins, so the traffic and sales increases needed to combat the reduced profitability for improved earnings growth could take some time.

However, while the market waits to see how long it will take for the strategy to be successful (if at all), the stock currently trades at about $30.50 per share, sporting a very reasonable valuation of 20 times expected 2016 earnings. If traffic stabilizes or sees growth with this new value and loyalty-focused strategy, larger baskets could eventually help lift same-store sales as well. Then location growth, especially with the launch of the 365 stores, could also drive higher earnings in the years to come. For those with a long-term focus, that would make that current stock price attractive -- continue watching to see how the company's efforts play out.

A secret billion-dollar stock opportunity The world's biggest tech company forgot to show you something, but a few Wall Street analysts and the Fool didn't miss a beat: There's a small company that's powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

John Mackey, co-CEO of Whole Foods Market, is a member of The Motley Fools board of directors. Seth McNew has no position in any stocks mentioned. The Motley Fool owns shares of and recommends Starbucks and Whole Foods Market. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.