Year of the Unicorn: Sleepy IPO Market Ready for Action in 2017

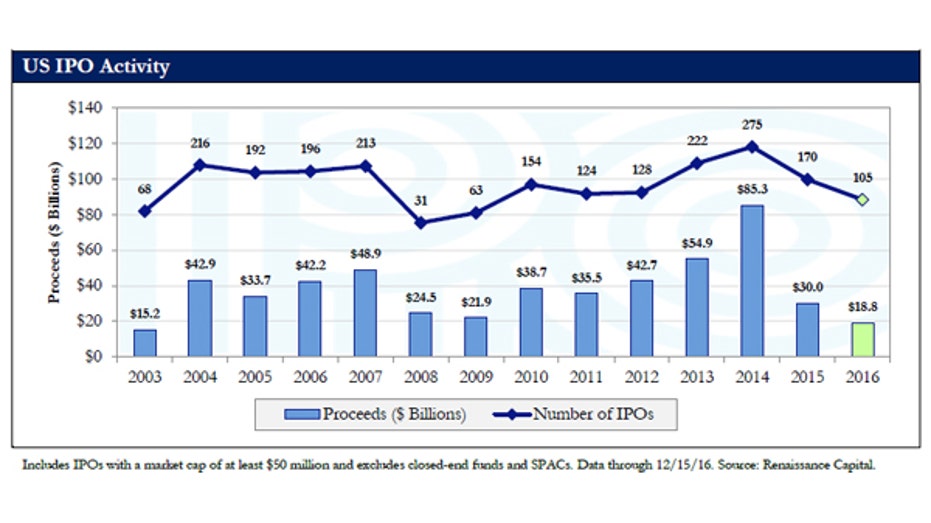

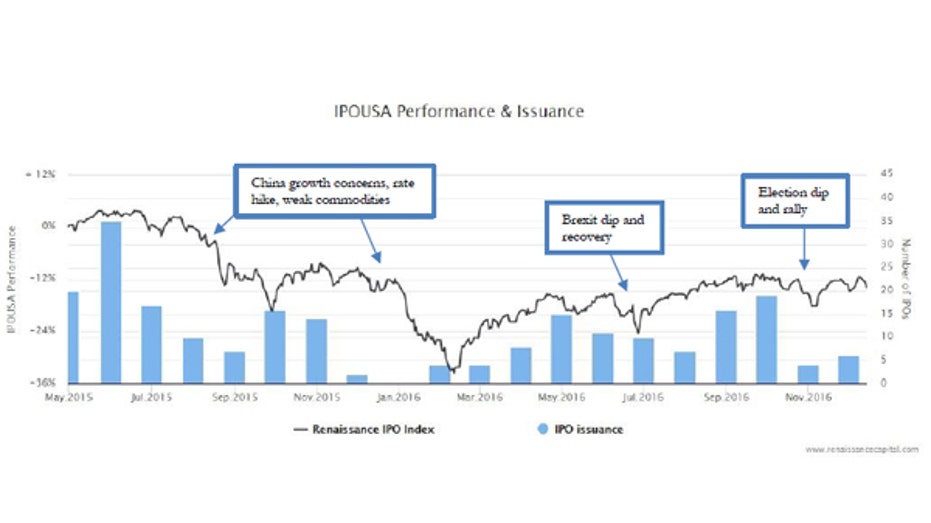

Investor sentiment zigzagged through much of 2016, a year characterized by incredible uncertainty thanks to global-growth worries in the first quarter, Brexit by summer, and an unpredictable U.S. election in November. A lack of risk appetite around the globe forced IPO activity to the lowest level since 2009, but signs of increasing momentum are on the horizon in 2017.

One-hundred five U.S. companies with a market cap of at least $50 million made their public debut in 2016, a 30% decrease in volume from the year before, according to data from Renaissance Capital. Globally, IPOs raised just $103 billion from already subdued 2015 levels, and 31% below the 10-year median.

Initial public offerings from financial companies made up nearly 40% of total proceeds, while activity in the tech sector froze, falling 54% from the prior year. However, the tech companies that did move ahead with public listings, including Acacia (NASDAQ:ACTG) and Twilio (NYSE:TWLO), were among the best IPO performers. Overall, IPOs have outpaced the S&P 500 for the year, with the average price return clocking in at 25.5% to the S&P’s 11% return, according to data from Dealogic.

“Some of the hesitation around IPOs is volatility and uncertainty built into the market. Generally IPOs need a pretty stable environment because they’re riskier assets,” said PricewaterhouseCoopers U.S. deals partner Neil Dhar.

Amid the uncertain global backdrop, companies have opted to stay private, continuing to rely on funding from their own profit-generating models and, in some cases, venture capital and private-equity sources. But with global central banks backing away from easy-money policies, more robust performance in equity markets, and a generally more confident mood across financial markets around the world, 2017 is shaping up to be a rebound year for IPO activity.

Because of the tendency for companies to stay private longer, what used to be a five to six year timeframe leading up to an IPO could now take as long as 11 years on average, said Bob McCooey, senior vice president of listing services at Nasdaq OMX Group (NASDAQ:NDAQ). That lag has created a robust pipeline, and the backlog of companies looking to go public thanks to the slowdown of the last two years is ready to ease.

“Companies and individuals are willing to invest in these companies now, they need performance in their portfolios and IPOs are providing that,” McCooey explained pointing to the year-to-date IPO returns. “We’ve seen very strong performance, which drives interest in the market, and that bodes well for both the company’s desire to go public and the receptivity from retail and institutional investors.”

Billion-Dollar Companies Might Finally Pull the Trigger

Alongside energy and health care, technology is poised for a breakout year as Wall Street anticipates the debut of tech unicorns – or companies with a private valuation of $1 billion or more – including ride-sharing service Uber, music-streaming platform Spotify, and social media star, Snapchat, which confidentially filed for IPO last month. The appeal for these companies, though, is about more than just the cash a move to the public markets will bring, said EY Americas IPO leader Jackie Kelley.

“That IPO for a unicorn is more about the market credibility, attracting talent, about different things like liquidity in general than it is about cash to grow the business…they can get that,” she said.

With equity markets rounding out the year at all-time highs, Kelley warned profit taking at the start of the year could present a challenge for newly-public companies since stock prices are subject to volatile day-to-day swings. Her advice: Stay the course, focus on the long-term goals.

“It’s very important that as companies are building their investor pools and managing expectations, that there is a clear strategy they can execute, strong forecasting processes that can withstand movement in the market while they continue to focus on driving growth,” she said.

To that point, McCooey said a strong company should be able to go public in virtually any market environment – during fluctuations caused by profit taking, or amid rising interest rates and higher borrowing costs.

“The fact that the Federal Reserve has signaled higher rates next year, companies can factor that into their equation…it’s not creating volatility in the markets, which would have created the negative impact for companies set to IPO like we saw in the first quarter. I don’t see it being a big risk for 2017 at this point,” he said.