Former auto executives warn electric vehicle push happened 'too soon and too fast'

Chrysler's Nardelli and former Big Three exec Bob Lutz discuss the challenge of selling EVs to Americans

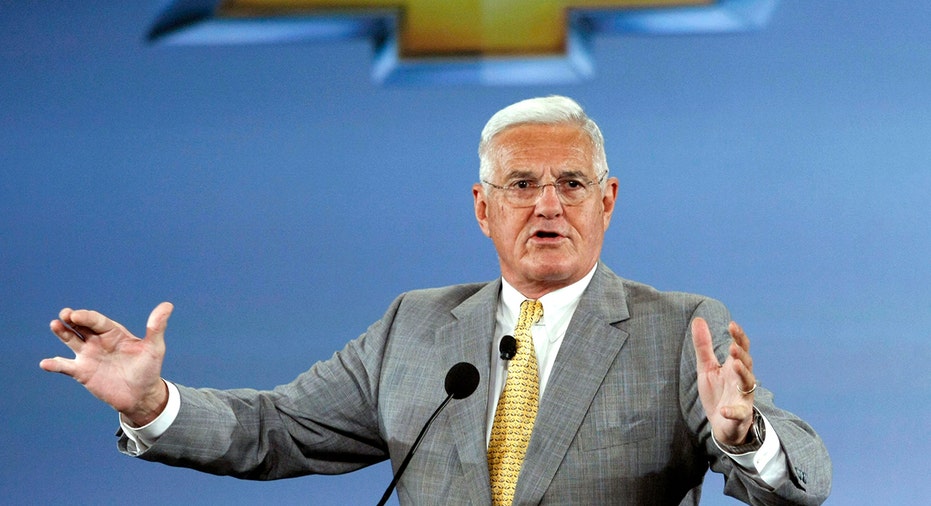

EV revolution is happening ‘too soon and too fast’: Bob Lutz

Former Chrysler CEO and Chairman Bob Nardelli and Big Three executive Bob Lutz spoke with Fox News Digital about automotive industry implications of a forced transition to electric cars.

Data may say it all, but former auto industry executives are setting the record straight on the electric vehicle push.

Former Ford, Chrysler and General Motors executive Bob Lutz and ex-Chrysler Chairman and CEO Bob Nardelli told Fox News Digital that while electric vehicles (EVs) could change the entire auto industry, thus far, it's been handled all wrong.

"In the short term, I'm afraid, it's going to be a challenge," Nardelli said. "It's going to be a challenge to convince the consumer that the EV is a reliable and affordable means of transportation."

"You could see what's happening out there," he continued. "We're seeing the cascading effect of a failed initiative."

AL GORE'S SON CARRYING ON FATHER'S CLIMATE CHANGE LEGACY AS NEW FACE OF E.V. POLICY

"The problem with the whole EV movement is that there was a colossal amount of hype behind it, largely from what I like to call the liberal mainstream media, making it sound like everybody's next vehicle was going to be an EV," Lutz also told Digital. "And of course, the government was pushing it, because of their climate change policies. And it just plain wasn't going to happen."

Former Ford, Chrysler and General Motors executive Bob Lutz and ex-Chrysler Chairman and CEO Bob Nardelli speak to Fox News Digital about the current state and future of the electric vehicle market. (Fox News)

Lutz added: "And yes, it did come too soon and too fast."

From Nardelli’s perspective, the forced transition to zero emission transportation in the U.S. began on "Day One of this administration," when President Joe Biden pulled the plug on oil and drilling projects while boasting a plan to make more than half of new car sales to be electric by 2030.

"Major auto companies are preparing for 50% of future sales to be electric vehicles by 2030, 100% by 2035," President Biden said during remarks on rising prices in June 2022.

In 2022, EVs made up less than 1% of all U.S. vehicle registrations. Since then, Elon Musk’s Tesla severely missed 2023 Q1 expectations, Ford announced production stops on its electric trucks and cars and Rivian, Nardelli noted, lost a sizable $5.4 billion in the last year alone.

Electric vehicle startups are 'not going to make it': Bob Nardelli

Former Chrysler and Home Depot CEO Bob Nardelli on consumer expectations clashing with EV market results and the state of the U.S. economy.

Rivian also announced this February that it would lay off 10% of salaried staff and projected flat vehicle output due to "economic and geopolitical pressures." The EV maker has also paused work on its billion-dollar manufacturing plant in Augusta, Georgia.

In a statement to Digital, a Rivian spokesperson said the company holds a "deep conviction that the entire automotive industry will electrify over the long-term… We believe Rivian has demonstrated a unique ability to resonate with customers as evidenced by the R1S becoming the top selling EV in the U.S. priced over $70,000. Additionally, when R2 arrives in the first half of 2026, pricing is expected to start around $45,000, and R3 will be priced below R2, making Rivian vehicles more accessible to more people."

Claiming that these market moves have a "ripple effect" internally on the car brands, Nardelli argued automakers and the Biden administration would have seen more sales success and EV acceptance by first putting an emphasis on hybrid vehicles. Lutz countered by pointing out that hybrids were introduced to consumers before Tesla revolutionized the fully-electric car.

Tesla Motors CEO Elon Musk (L) and General Motors executive Bob Lutz in New York City on April 22, 2011. | Getty Images

"The focus on hybrids would have been well-placed as an evolution towards EV. It would have allowed for charging stations and would have allowed for the massive grid network, maybe to bolster their base supply to be able to absorb this," the Chrysler exec who headed the company from '07 to ‘09 said. "The utilities, the electrical system in this country is going to put us at a tremendous disadvantage as we advance further with electrical demand. That's going to be a shortfall."

"I was the father of what was arguably the first American extended range EV, which was the 2007 Chevorlet Volt," Lutz said. "Hybrids did come first. We had the Toyota Prius… Ford had hybrids, several models, as did General Motors… We did do hybrids first, then they went out of favor, and now they're back because hybrids are a way of getting Americans into an electrically driven vehicle with a range of, say, 30 to 50 miles, which is plenty for most trips for most people."

TESLA STOCK SLIDES ON BIG DELIVERIES SHORTFALL

Polling shows most Americans consider emissions when buying a new car. However, despite the push for electric vehicles, data shows consumers prefer other "green" alternatives, like hybrids.

Hybrids accounted for 9.3% of new light vehicle registrations in the U.S. from January to November 2023, outstripping those of EVs by 1.8 percentage points, according to S&P Global Mobility data.

Nardelli put emphasis on the importance of boosting America’s oil supply, claiming the sector is the "biggest geopolitical card we could play." Lutz soothed business leaders’ trade war concerns that China may soon produce and export more EVs than American auto brands.

"I am very concerned with the trade balance on the auto industry. And if the government puts a heck of a tariff or an embargo on [Chinese EV maker] BYD coming here in an attempt to bolster… U.S. manufacturing, again, I think it's just going to create tremendous tension already between U.S. and China," Nardelli said.

Ford reducing electric truck production, a move that could impact more than 1,000 workers

FOX Business' Jeff Flock reports from the Celebrity Ford of Toms River dealership, where electric F-150s aren't driving off the lot fast enough.

"The Chinese automobile industry is a formidable force, but they are not going to destroy the American automobile industry, which probably needs a new challenge in terms of getting lean, getting more focused, getting rid of unnecessary things," Lutz said. "That's always a good thing to do, but the Chinese are like everybody else. They're not 10-[feet] tall. They're competitors in the automobile industry, but they are not the force that's going to destroy the American industry."

Hoping the industry advances forward with a market-focused, consumer-centric mentality, the CEOs both admitted the gradual transition to EVs is inevitable, while Nardelli warned the shift could erase the car dealership experience.

"I think it's going to be an exciting transformational opportunity. And whoever is leading these industries is going to have to be able to move at a rapid pace and be extremely flexible to switch technologies, infrastructure, delivery," Nardelli said.

"Will the dealer system still be here 10 years from now?" he posited. "It's a big question."

"You look at what Amazon did in transformation and [it] very well could happen where home delivery is a thing. We're seeing it with Carvana," Nardelli pointed out.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Tesla's Cybertruck is the ugliest vehicle I ever laid eyes on: Mike Caudill

Auto expert Mike Caudill argues Elon Musk's design of the Tesla Cybertruck will push potential buyers away on 'Cavuto: Coast to Coast.'

"If the Democrats win the November election, we could have something approaching. An EV mandate where they establish emission regulations that are so tough that basically the industry is left [with] no choice but to produce nothing but EVs. And the American public is left [with] no choice but to buy EVs, because that's all there is out there," Lutz said.

Ultimately, the former Big Three exec believes the more likely outcome would be EVs would represent about a quarter of the industry.

"My guess for a 10-year period, which I might be around to witness, but at 92, one can't be sure. I would say EVs could, without a government forced job, EVs could be 25 to 30% of the market. And then continually going up from there."

FOX Business' Breck Dumas contributed to this report.