Switching jobs? If you're thinking about your 401(k), you might want to reconsider

Frequent job switching can reduce the contribution amount put into a 401(k)

Harvard professor Arthur Brooks shares his ‘Happiness 401(K)’ in new book

Harvard professor Arthur Brooks joined ‘Varney & Co.’ to discuss his new book and the ways in which it can offer insight into how readers can build a happier life.

If retirement savings tops your list of concerns, you might want to think twice about switching jobs.

A report from The Wall Street Journal raises concerns that changing employment could lead to lower contributions to 401(k) plans, underscoring the importance of considering long-term savings goals before pursuing new opportunities.

According to the report, "Many job switchers either forget to sign up for the new 401(k) plan, or get auto-enrolled at a lower savings rate," a problem highlighted by Vanguard Group's research.

The implications are stark: staying in one job could result in significantly more retirement savings. When comparing a worker who frequently changes jobs with one who does not, the report estimates a potential difference of about $300,000 in retirement savings.

THIS AVOIDABLE SPENDING HABIT IS CREATING A RETIREMENT ‘CRISIS,’ FINANCIAL EXPERT WARNS

Switching jobs may hinder your 401(k) savings, research from Vanguard Group warned. (iStock / iStock)

"For a worker earning $60,000 at the start of their career who switches jobs eight times across employers (for a total of nine jobs), the estimated loss in potential retirement savings could be about $300,000— enough to fund an estimated six additional years of spending in retirement," the report states.

The authors highlight the structure of 401(k) plans as well, noting they are not made to accommodate consistent job switching, and savings details put in place in specific roles may not seamlessly transfer, resulting in potential breaks in retirement saving patterns and challenges in maintaining the intended savings trajectory across different employers.

401(k) plans often feature mechanisms like automatic increases in savings rates, designed to build a robust retirement fund over a period of stable, long-term employment. This set-up implies that for those focused on their retirement savings, staying put at their current job could be more beneficial.

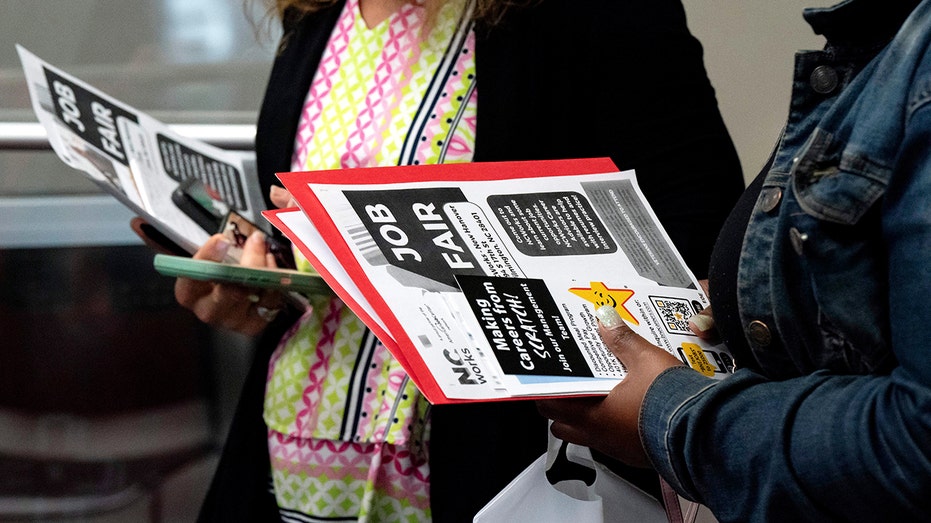

Nevertheless, not all workers are in jobs that lend themselves to this traditional long-term approach. The report specifically points out: "Workers in certain service sectors such as retail and hospitality also tend to have lower tenure than the median." This observation suggests that the standard 401(k) plans might not be the best fit for an increasingly mobile workforce, particularly in high-turnover industries.

SOCIAL SECURITY COST-OF-LIVING ADJUSTMENT WILL BE 2.5% IN 2024, LESS THAN PRIOR YEAR

Jobseekers hold flyers during a career fair at a NC Works Career Center in Wilmington, North Carolina on March 20, 2024. Though switching jobs can bring some benefits, numbers indicate it can also come with drawbacks. (Allison Joyce/Bloomberg via Getty Images / Getty Images)

Frequent job switches, common in such sectors, can disrupt the smooth accumulation of retirement savings. Since 401(k) plans are optimized for consistency, workers moving from job to job may find the automatic saving advantages of 401(k) plans less effective, posing challenges to growing their savings effectively over time.

In fact, Vanguard's research indicates that the average U.S. worker has nine employers throughout their career.

Amid these transitions, the median job switcher generally receives a "10% increase in pay but a 0.7 percentage point decline in their retirement saving rate when they switch employers."

Such findings point to a trade-off: while job changes can lead to potentially higher immediate income, they can also disrupt the continuity of retirement contributions.

Social Security 'should not be your parachute' into retirement: Ramsey Solutions' Jade Warshaw

Ramsey Solutions personality Jade Warshaw breaks down how to get the most out of your Social Security check and more on 'The Bottom Line.'

Though the suggested amount to put into your 401(k) annually varies, experts typically suggest approximately 15% of pretax income, including employer contributions.

Meanwhile, The Wall Street Journal's report indicates the most common default rate for employers automatically enrolling their workers is 3%, with a typical 1% increase annually until the contribution reaches 10% of that employee's pay.

By frequently switching jobs, that contribution continues to drop back to the beginning rate and can take some time to rise to the contribution the employee had in their previous position.

Vested balances, while less frequently discussed, may also play into that decrease.

Diners weigh in on retirement as new study shows what it would take to retire comfortably

FOX Business' Ashley Webster talks to diners in The Villages, Florida about retirement as a Northwestern Mutual survey claims it will take $1.46M to retire comfortably.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

For instance, money personally contributed to a 401(k) is always vested (the amount of money you fully own and that cannot be taken back by an employer) and can be taken with you upon switching to a new job.

However, many employer matches will only be fully vested after a specific period of employment, meaning, in some instances, employer contributions are fully vested after a certain number of years while, in other cases, the vestment occurs gradually over several years.