Kevin O'Leary shares the biggest lesson learned on his investing 'journey'

Sometimes taking a 'huge risk' can yield 'fantastic successes,' the 'Shark Tank' star said

Kevin O'Leary calls out VP Harris' 'all sugar, no protein' approach to policy: 'These people want answers'

O'Leary Ventures Chairman Kevin O'Leary reacts to report that Vice President Kamala Harris plans to focus on 'wealth creation' and which policies Harris needs to better explain to prove herself as a solid candidate on the economy.

"Shark Tank" star Kevin O'Leary shared the biggest lesson learned during his investment "journey" with LinkedIn viewers on Monday, urging them to take risks and rely on a little luck.

The O'Leary Ventures chair posted a video to the platform, reflecting on his hits and misses since selling his first company — The Learning Company (originally SoftKey) — to Mattel for $4.2 billion in 1999.

"If you're going to have a portfolio, if you're going to be an investor like I am, you need a lot of companies because the ones you think are going to be your best winners never are," he said, imparting some wisdom to his followers.

"And the ones that you think are going to be dogs — maybe you're taking a huge risk — they end up being fantastic successes, and the path that this occurs on is serendipitous," he continued.

KEVIN O'LEARY RIPS WORKERS WHO WASTE MONEY BUYING DAILY CUPS OF COFFEE: ‘WHAT ARE YOU, AN IDIOT?’

Investor Kevin O'Leary speaks onstage during the Massachusetts Conference for Women at Boston Convention & Exhibition Center in Boston on Dec. 8, 2016. (Getty Images)

"Markets change, economics change, products change — and the outcome of that is never known until you get to the end of the road."

O'Leary recounted losing millions in some instances and earning millions in others since striking the Mattel deal, with the caption reiterating the lesson he learned in the process: "You need a little luck."

"The companies you expect to win often don’t, and the ones you bet against? Sometimes they surprise you. It’s all part of the journey," the post continued.

KEVIN O'LEARY WARNS DEMOCRATS THAT ‘ANOINTING’ HARRIS WAS A MISTAKE: ‘NOT THE WAY TO RUN A CAMPAIGN’

O'Leary said losing millions in some cases and earning millions in others taught him that you need "a little luck" to succeed in investing. (Getty Images)

Many in the comments section appeared to agree.

"Kevin, your journey is a testament to the unpredictable nature of entrepreneurship. It's fascinating how the unexpected can often lead to the biggest wins," one said.

Another wrote in part, "Your story is a testament to the unpredictable nature of success—luck may tip the scales, but resilience keeps us in the game. Here’s to the surprises that make this journey unforgettable."

"In the end, it's about how much you keep getting up and learning from a loss. It sounds like you have taken a few bumps and bruises along the way and are still here," said a third.

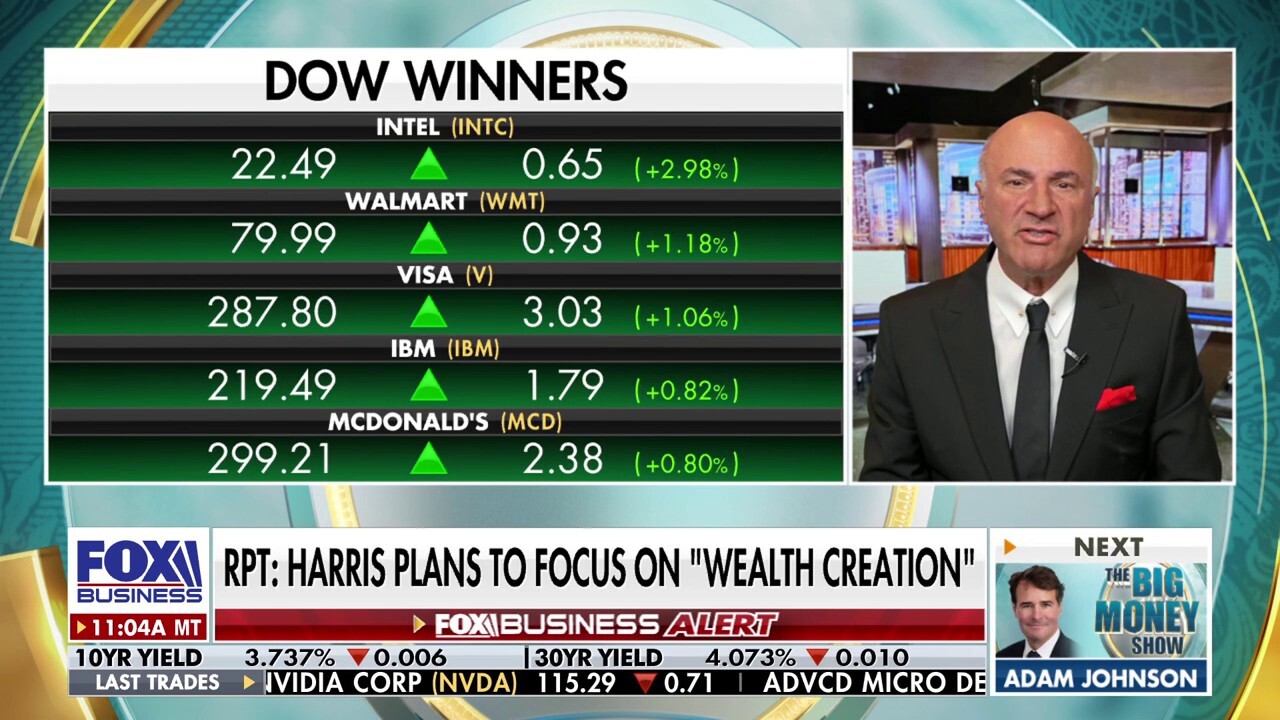

O'Leary also appeared on the FOX Business Network on Monday, where he revisited his criticisms of Vice President Kamala Harris for not disclosing her policy positions in detail and for allegedly dodging pressing interviews.

David Stryzewski on the opportunities from investing in gold, silver

Sound Planning Group CEO David Stryzewski makes the case for investing in gold and silver on 'Varney & Co.'

"The reality is for most of us… as investors [is] we have to deal with whoever is in the White House on Nov. 6. So we're really hungry for policy, and it looks like we might be getting some," he told "The Big Money Show."

"So far, the Harris narrative regarding any distinct policy has been all sugar, no protein, and it's worked. We've got the tightest race in recent times again, and all we care about are these counties in the seven battleground states, but these people want answers, and I think for all of us, no more sugar, please."

Harris has faced ongoing criticism for her reluctance to disclose specific policy plans or sit down for interviews with tough questions since taking the reins as the Democratic Party nominee.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Kevin O'Leary: I'm not partisan, 'I'm looking at the track record'

O'Leary Ventures Chairman and 'Shark Tank' star Kevin O'Leary weighs in on inflation data, Kamala Harris' yet-to-be-announced economic plan and Elon Musk's interview with former President Trump.

Commenting on this, O'Leary encouraged her to explain proposals like her floated price control plan, and proposed ideas to give a $25,000 down payment to first-time homebuyers and hike the corporate tax rate to 28%.

"Explain that to me. I know how to ask those questions. I'll do the interview. I'm happy to do it, and I know what the answers have to be in order to convince me," he said.

"And I'm just one investor. I understand why she's reaching out to giant corporate leaders. Some of them are endorsing her. Others are hedging their bets, as in the case of [JPMorgan Chase CEO] Jamie Dimon, because he's a pragmatic guy like I am, and I have to deal with her if she ends up being president, but none of the policies I've heard yet are going to be pro-GDP growth."