Kudlow: Wednesday's Fed announcements were dovish

Kudlow argues that price stability is the foundation of economic growth

Kudlow: Powell is talking the talk, but not walking the walk

FOX Business host breaks down the growing inflation crisis on 'Kudlow.'

First up, we focus on inflation and today's Fed meeting. Folks, I knew Paul Volcker. I actually worked for Paul Volcker at the NY Fed in 1975. and I can tell you Jay Powell is no Paul Volcker.

He may invoke the late Volcker's name and try to hide behind it, but if you took a look at the Fed's actions today, they were un-Volcker-like.

Mr. Powell, by the way, has not yet been confirmed for a second term as Fed chair. His new title is "chair pro tempore." Some people are calling him "the transitory chair," as in "transitory" inflation. Get it? But I digress.

Federal Reserve Chairman Jerome Powell speaks at a news conference following a Federal Open Market Committee meeting on May 04, 2022 in Washington, DC. (Photo by Win McNamee/Getty Images / Getty Images)

How do I know Jay Powell is no Paul Volcker? I'm looking at markets. Markets are telling me they do not fear Jay Powell's so-called anti-inflation take the punch bowl away policy. Powell's talking the talk, but he's not walking the walk.

The stock market is up over 900 points — no tight money fears there. Gold is up. The dollar is down. Oil is up and interest rates declined.

The Fed's target rate was raised 50 basis points to .75 to 1%, but everyday traders already knew that. People are saying it's the biggest funds rate hike in two decades, but the problem with that is, that we have the highest inflation rate in four decades. That's what's wrong with this picture. And Powell took 75-basis point future rate hikes off the table, which is a big mistake. Volcker would've kept them guessing, and Volcker knew that the Fed's target rate had to be higher than the inflation rate in order to vanquish widespread price hikes.

The basic inflation rate is running around 8%. That would require a 9% or 10% Fed funds rate, or even higher in the days of Volcker shock and awe. Volcker also reined in money supply growth and here, Powell completely struck out.

The Fed is not going to start running off their bond portfolio for another month and when they do, starting in June, it's only going to be $47.5 billion run-off of treasuries and mortgages, not the $95 billion that people were expecting and the Fed had previously mentioned.

In effect, relative to the inflation crisis, today's Fed announcements were dovish, and that's why inflation-sensitive market prices like the dollar, gold, interest rates, oil and stocks all went the wrong way.

HOW THE FEDERAL RESERVE MISSED THE MARK ON SURGING INFLATION

Will soaring inflation impact how much people spend on moms this Mother's Day?

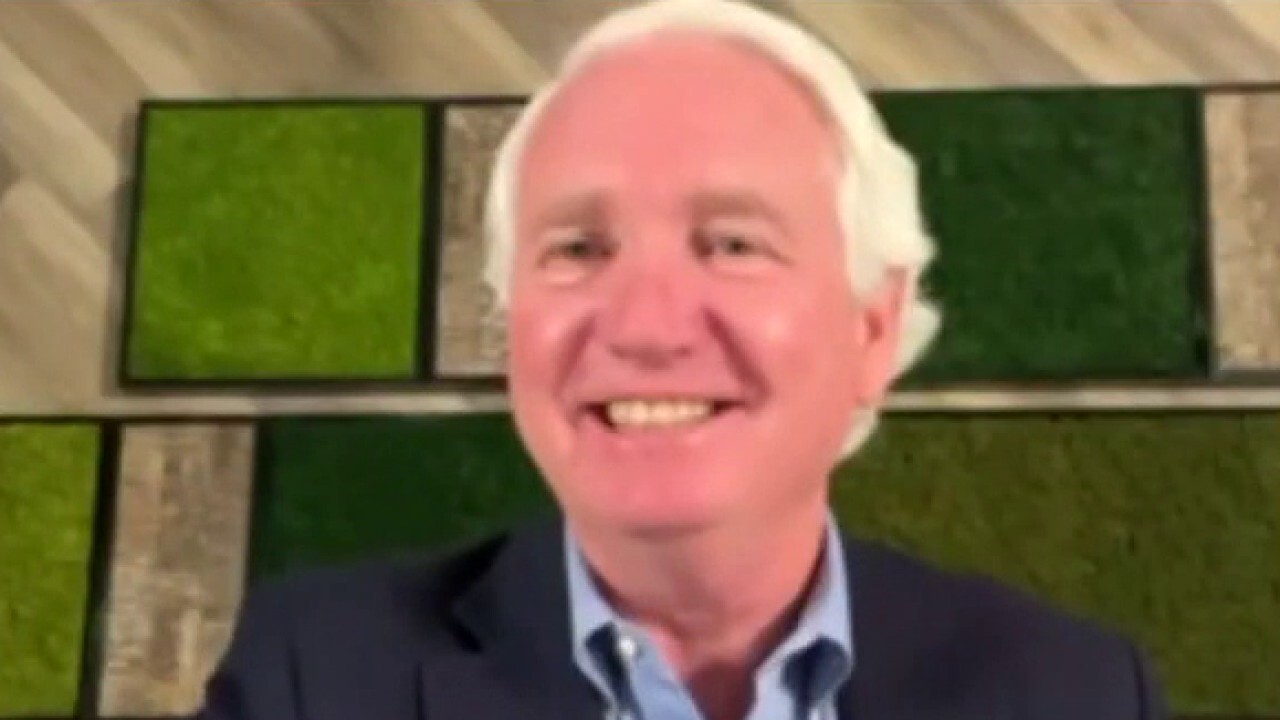

Chris McCann, president and CEO of 1-800-FLOWERS, discusses consumer demand and the impact of inflation, noting that the 'last thing we ever want to do as a retailer is pass costs onto the consumer.'

Here's a key point: As long as the Fed's inflation-reducing policy goes slow rather than fast, they will prolong the inflation crisis for many years. Their only hope would be a highly aggressive tightening right now. Jack up the target rate, sell bonds out of their portfolio.

There may be a mild recession next year. But the longer the Fed waits, the higher inflation interest rates are going to go and a future recession and rising unemployment with it will be much, much worse.

Here's a key point: Price stability is the foundation of economic growth. The dollars in your wallets and pocketbooks need to be worth more, not less. Hard work needs to be rewarded with higher, not lower real wages.

Gasoline and food prices will only come down if the Fed truly strengthens the dollar and gets back to its 2% inflation target or less. Getting from today's 8 back to their 2 is not going to be easy, but again, the longer they wait, the harder the ultimate landing is going to be.

What's more, both President Biden and Senator Chuck Schumer want to reverse the Trump tax cuts on the phony and fraudulent charge that they cause deficits to permanently rise and the rich didn't pay their fair share.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

President Joe Biden speaks about the COVID-19 relief package in the State Dining Room of the White House, Monday, March 15, 2021, in Washington. (AP Photo/Patrick Semansky / AP Images)

Here's a bulletin: Higher taxes will worsen the inflation crisis. They will damage the supply-side of the economy. More federal spending will likewise worsen the inflation crisis.

The Mundell-Laffer policy adopted by Ronald Reagan was to slash taxes and boost the value of the king dollar. It launched a near three-decade long prosperity. Trump followed Reagan's playbook. Biden's woke economics are completely wrong.

This article is adapted from Larry Kudlow's opening commentary on the May 4, 2022, edition of "Kudlow."