LARRY KUDLOW: Blaming the rich and businesses won't incentivize the investment our economy needs

Kudlow reacts to Biden's economic policy

Larry Kudlow: Biden is not serious and that's why his poll numbers keep dropping

FOX Business host Larry Kudlow reacts to President Biden's declining polls and weighs in on the Fed's efforts to fight inflation on 'Kudlow.'

So, folks, I've already spent a couple days beating up on Joe Biden's terrible and dishonest big government socialism State of the Union message and we're going to talk in a few moments with Congressman Byron Donalds and Steve Moore about Joe Biden's dishonest distraction about Republicans cutting Social Security and Medicare.

It's dishonest because it's not true and it's a distraction because he'll do anything not to talk about Republican efforts to restrain his inflationary spending spree of the past two years.

Biden, of course, never mentioned his debt talks with Speaker Kevin McCarthy, so who knows whether there's going to be a second meeting, or another date, or they’re going to hit a drive-in move together or maybe even a serious negotiation. Right now, Biden is not serious. He doesn't look serious, doesn't sound serious and that's why his polls keep dropping.

In fact, it's why polls are showing nobody really liked his speech. It’s very interesting. He had a "very positive" reaction of only 38%.

BIDEN KEEPS MAKING CLAIMS ABOUT THE ECONOMY THAT JUST AREN'T TRUE. THESE FACTS DON'T LIE

To put that into context, Barack Obama had 50%, George W. Bush had 53%, and Donald Trump and Bill Clinton both had 54%. That’s "very positive" reactions to their State of the Union speeches.

So, Mr. Biden's not kidding anybody with his antics and it ain't gonna work. So, I am going to set that aside for a moment. I want to turn briefly and be a little bit technical about the Federal Reserve that is fighting inflation.

I'm worried the Fed’s going to overdo it. The latest Fed mantra, echoed of course by Wall Street, is that the central bank has to tighten much, much more, because financial conditions are easing. I want to say this is nonsense. For one thing, as Joe Lavorgna has pointed out, the Fed is focusing on the wrong measure of financial conditions. The recent rally in stock prices and the decline in long-term interest rates doesn't mean the Fed is failing.

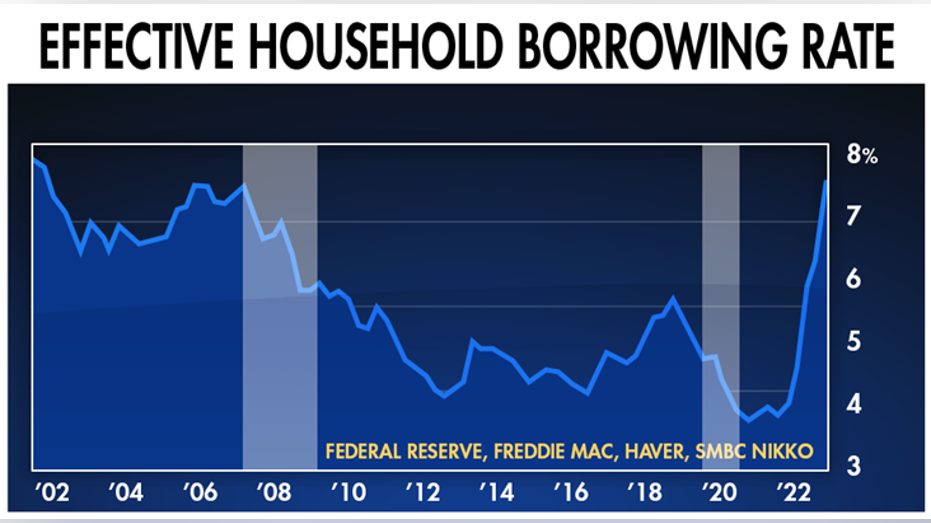

In fact, ironically, it means the Fed is actually succeeding in reducing inflation fears and the actual inflation rate. That's why bond yields have dropped and one reason that stock prices have improved really going back to last October, as one of our guests tonight, Ed Yardeni, has been writing about. I don't mean to be too technical and in the weeds too much, but I think this is an important topic. Fed rate hikes have actually jacked up household consumer borrowing rates as the accompanying chart shows.

You're over 7%. This includes credit cards, mortgages, personal loans, student debt, etc. Over 7% puts it back to the financial meltdown recession in 2008 and 2009.

It shows financial conditions for consumers are very tight, not easing. In addition, the Federal Reserve survey of bank loan standards shows a big tightening in lending standards for C&I business loans and the same for commercial real estate loans.

That's the stuff the Fed should be looking at and those lending conditions are already sufficiently tight. That’s what the Fed should be looking at. Let me add a few more pictures for you.

You can see the crash in the M-2 money supply and the plunge in the index of leading indicators.

SNAP EMERGENCY FOOD BENEFITS ENDING FOR MILLIONS OF RESIDENTS

These are powerful recessionary signals. Disinflationary? Yes, but recession also. Finally, we have a picture of the CRB commodity index, which shows a big drop-off last spring, and look how flat it's been at the lower level for about six months.

These commodity indices are a leading indicator of inflation and they also show that the commodity value of the dollar is now steadied and stabilized. That is the real value of the dollar. It used to be a discipline that people like Wayne Angell and Manley Johnson on the old Federal Reserve Board under Ronald Reagan.

Now, another positive sign for lower future inflation. This is the stable dollar low commodity. The Fed may have a little more work to do on getting their target rate up a wee bit more, but if they don't look at the right indicators, they're going to make another very big mistake. Looking at financial conditions, just because bond rates have come down, is the wrong idea. I know some very smart economists that were talking about that and they shouldn’t

Finally, speaking of mistakes, if Joe Biden weren't such a disciple of Bernie Sanders, he would understand why raising taxes and chronic over-regulation from his posse of central planning bureaucrats is doing great harm to the economy.

CLICK HERE TO GET THE FOX NEWS APP

It may sound great for Lenin or Castro or Xi Jinping, but blaming rich people and businesses will not incentivize the kind of investment that our economy needs to grow.

Here's a thought: President Biden, guess what, sir? It is businesses who hire people and pay them. Your trouble, sir, is you like employment. You just don't like the employers who hire them. Save America. Help business for a change. How about that? You’ll also be helping middle income blue-collar working folks and their families.