Live-action Mulan to debut on Disney+ as COVID-19 spurs cord-cutting

U.S. subscribers will have to pay a one-time fee of $29.99 for Premier Access, or they can wait until Dec. 4 for free access.

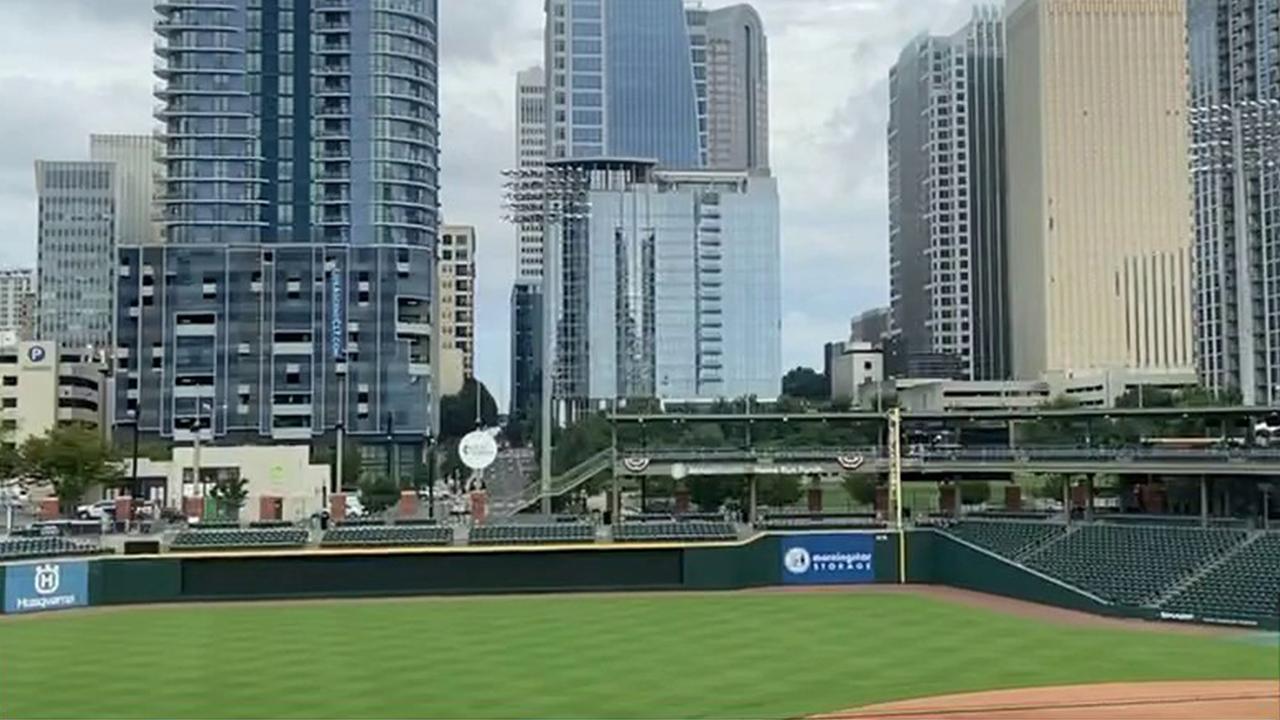

After coronavirus cancellations, sports venues look for alternative revenue streams

Charlotte Knights chief operating officer Dan Rajkowski says his stadium has found creative ways to generate revenue during coronavirus cancellations, such as private batting practices, movie showings and dance recitals.

Disney's live-action "Mulan" is finally set to make its debut on Disney+ starting Friday, Sept. 4 in the United States, Canada, Australia, New Zealand and parts of Europe.

The long-awaited update of Disney's animated classic was originally scheduled to be one of Disney's blockbusters in movie theaters. Originally slated for release in March, the coronavirus pandemic shutdown of movie theaters forced two postponements before Disney decided to move the film to its new streaming service.

Photo courtesy of Disney+

Unlike most content dropped on the streaming service, U.S. subscribers will have to pay one-time fee of $29.99 for Disney+ Premier Access to watch the film, separate from the normal $6.99 per month cost.

The Premier Access offer will be available until Nov. 2 at 11:59 p.m. Pacific Time, allowing subscribers to watch as many times as they want. Access to Mulan will continue as long as you are an active Disney+ subscriber. For those watching their wallets, the film will be available at no additional cost to all Disney+ subscribers beginning December 4.

DISNEY LOOKS TO TAKE LIVE THEME PARK ACTS TO NEW HEIGHTS WITH DRONES

Disney CEO Bob Chapek told analysts in the company's third quarter earnings call that executives "thought it was important to find alternative ways to bring [Mulan] out in a timely manner." However, Chapek did say that the film will have a theatrical release in certain markets where Disney+ is not available and where theaters are open.

This image released by Disney shows Yifei Liu in the title role of "Mulan." The film is no longer headed for a major theatrical release. The Walt Disney Co. said Tuesday that it will debut its live-action blockbuster on its subscription streaming ser

The decision to drop the film directly to Disney+ comes as the media giant is stepping up its efforts to compete with Netflix and other services during the pandemic.

THIS DISNEY WORLD HOTEL WON'T REOPEN THIS YEAR AS OTHERS STAY CLOSED INDEFINITELY

According to Nielsen's Total Audience Report for August, the coronavirus pandemic has accelerated consumers' move to cut the cord from traditional cable altogether. Nielsen found that consumers have become more willing to dole more money out for streaming services, with 25% of adults adding a new service in the past three months.

A cord-cutting study by Roku in July found that approximately 32% of U.S. TV households do not have a traditional pay TV subscription while another 25% of households identified as "Cord Shavers" cut back their service. When asked about intent to cut the cord fully in the next six months, 45% of Cord Shaver households said they were likely to do so.

Only 17% of households said they would be willing to resubscribe to pay-TV for live sports compared to 52% who would likely reduce their package if sports did not return. Meanwhile, 31% said they are likely to subscribe to a live sports streaming service.

Some 40% of recent cord cutters citing the free trials of premium subscriptions as the reason for cutting the cord. Respondents added the move led to savings of approximately $75 per month.

BERLIN, GERMANY - FEBRUARY 21: Symbol photo: The logos of the streaming services Amazon Prime Video, Netflix, amazon music and youtube can be seen on a television on February 21, 2020 in Berlin, Germany. (Photo by Thomas Trutschel/Photothek via Getty

"While we entered 2020 with significant momentum around cord-cutting, we’re now seeing that the COVID-19 pandemic and the pause of live sports has caused consumers to rethink how they access home entertainment and what they are willing to pay," said Roku Chief Marketing Officer Matthew Anderson in the study. "It’s clear that value matters more than ever and the abundance of free content, free trials to premium streaming services and the savings that consumers achieve are fueling the shift to streaming."

Overall, the vast majority of cord-cutters told Roku they are "satisfied with the decision and wish they had cut their traditional pay TV service earlier."

NETFLIX 'DEEPLY SORRY' AFTER USING 'INAPPROPRIATE ARTWORK' FOR FILM ABOUT YOUNG GIRLS

According to Leichtman Research Group, the largest pay-TV providers in the U.S. – representing about 95% of the market – lost about 1.57 million net video subscribers in the second quarter following a loss of more than 2 million in the previous quarter.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CMCSA | COMCAST CORP. | 31.38 | -0.22 | -0.70% |

| ATUS | NO DATA AVAILABLE | - | - | - |

| CGEAF | COGECO COMMUNICATIONS INC. | 51.27 | +1.40 | +2.81% |

| CABO | CABLE ONE INC | 104.89 | -9.79 | -8.54% |

| CHTR | CHARTER COMMUNICATIONS INC. | 231.54 | -7.60 | -3.18% |

The research firm found that the top seven cable companies lost roughly 500,000 video subscribers in the second quarter of 2020 compared to a loss of about 455,000 subscribers during the same period the previous year. In the second quarter, Comcast had a net loss of 477,000 subscribers, Cox lost 50,000, Altice lost 34,600, Mediacom lost 17,000, Atlantic Broadband lost 2,800 and Cable One lost 13,000.

Charter Communications was the only one to gain in the second quarter, with 102,000 new subscribers.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| DISH | NO DATA AVAILABLE | - | - | - |

| T | AT&T INC. | 27.86 | +0.00 | +0.00% |

Satellite TV lost about 885,000 subscribers for the quarter, with Dish reporting a net loss of 40,000 subscribers, while AT&T posted a net loss of 886,000 premium pay TV subscribers, including Direct TV, U-verse, and AT&T TV subscribers.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In comparison, the streaming services who have revealed their latest subscriber numbers have all recently seen significant growth.

Netflix added 10 million subscribers in the second quarter, bringing its total growth to 192.95 million paying streaming subscribers worldwide. Disney said its streaming service has surpassed 60.5 million subscribers globally in its third-quarter earnings while Hulu had 32.1 million paid subscribers and 3.4 million Hulu and Live TV subscribers for a grand total of 35.5 million. Even newer services like Peacock and HBO Max have both seen growth since their launches, with 10 million and 4 million subscribers respectively, despite the pandemic's impact on content.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NFLX | NETFLIX INC. | 77.00 | -0.99 | -1.27% |

| DIS | THE WALT DISNEY CO. | 106.02 | -1.10 | -1.03% |

Streaming analyst Dan Rayburn argues that pay TV is far from extinction, however, telling FOX Busines that the majority of consumers still appreciate cable's simplicity and quality and that streaming bundles are just "the new pay TV bundle."

"Pay TV is not having the death that people expected because it's simple and it works," Rayburn said. "We know the quality of the video and HD is HD, and there's not a limit in terms of how many streams."

According to Statista, the streaming market is estimated to grow to 1.3 billion users worldwide by 2025.