Cash is still king in the United States — but for how much longer?

Cash is still king in the United States — at least for now.

A 2018 report from the U.S. Federal Reserve found that paper money continues to beat out digital spending, with 30 percent of all transactions and more than 50 percent of sales under $10. And while online shopping is growing, 77 percent of payments were made in-person.

CreditCards.com reported earlier this year that cash is the preferred payment method even among credit card rewards members. For sales under $10, 43 percent of shoppers opted to pay with cash, compared with 31 percent who paid with credit and 26 who used debit.

But the lean toward cash declining.

Already, just 13 percent of adults in Sweden reported using cash for a recent purchase last year, down from 40 percent in 2010. More U.S. adults are going cashless, too.

The Pew Research Center polled 13,000 adults in 2018 and found a third of Americans made no cash purchases in a typical week, and the share of respondents who said all of their purchases were made with cash fell to 18 percent last year from 24 percent in 2015.

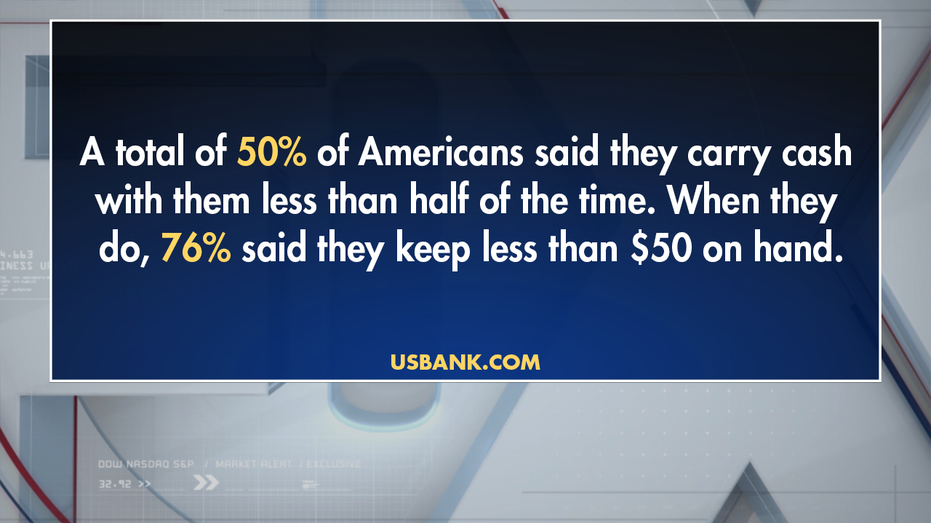

U.S. Bank found similar trends: In a survey of 2,000 Americans, 50 percent said they carry cash less than half the time they’re out, and when they do, 80 percent keep less than $50.

It’s mostly young people paving the way for more digital sales and less cash, using mobile apps like Apple Pay, CashApp and Venmo. More than one in 10 millennials use their digital wallet for every purchase, according to Experian, particularly on food, rent and Uber.

“Many consumers view credit cards, debit cards, mobile payments and other cashless payment methods as faster and more convenient than paying with cash,” Ted Rossman, an industry analyst at CreditCards.com, told FOX Business. “With these approaches, there’s no need to fumble with bills and coins and no need to reload your wallet at the ATM, which can carry hefty fees of about $5 for each out-of-network transaction.”

Plus, he added, “credit cards in particular offer lucrative rewards programs that incentivize consumers to choose that payment method. As long as you’re able to pay your credit card bills in full and avoid interest, rewards are a great way to get cashback or travel points.”

Still, there are drawbacks to going paperless. Studies show people tend to spend more when using plastic, and cashless payments can come with a litany of privacy risks.

A hack at candymaker Russell Stover Chocolates in August, for example, affected the information of thousands of customers’ credit and debit cards. The first six months of 2019 alone have seen nearly 4,000 publicly disclosed breaches, according to intelligence-data website Risk Based Security, exposing 4.1 billion compromised records.

As such, “some people are uncomfortable with banks and technology companies being able to track their purchases and whereabouts,” Rossman said. Whereas, cash is a bit safer.

The unbanked are another concern to going cashless, Rossman added, especially for retailers considering all-digital policies. The Federal Deposit Insurance Corporation reports around 20 percent of households are underbanked and 7 percent are completely unbanked.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“That’s a lot of people,” Rossman said. And many cities are taking notice. Philadelphia recently became the first large American city to prohibit retailers from going cashless. Lawmakers across the country are working to pass bills forcing retailers to accept cash.

There’s a noticeable shift from cash to digital, he said, but “cash is still number one.”