College loans: When is it good to go in the red for higher education?

Talk to anyone about the sacrifices they've made for higher education and you'll likely hear about late-night study sessions, cramming for finals and stressing over getting the right internships to find the perfect job.

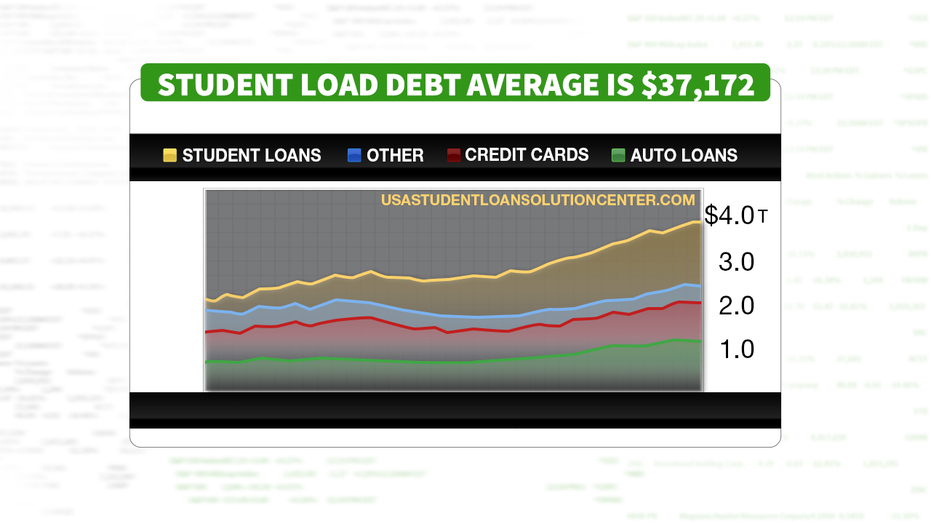

But the cost of getting those notches on your belt has never been higher, and for more than one in four Americans, that means taking out a loan to pay for it.

Figuring out how to pay back that bill, and whether or not it's worth it, depends on a few factors, like the type of loan you have and your individual financial situation.

So when is a student loan considered good debt?

Quenton and Marchelle Ross are two of the 44 million people saddled with a student loan, owing almost $120,000 together. For them, the debt was a good investment:

“I never really heard about [people paying off student loans] too much,” Quenton told Fox Business. “My mom had loans for, like, 20 years after she graduated. It was just kind of something that you assumed would always linger around and never go away.

“So that's kind of how I looked at it.”

But after taking a hard look at their budget, cutting back on some expenses and using their degrees to open a business and bring in more income, they beat the odds.

Good debt = When you borrow money to invest in something that will appreciate or increase in value over time then you have good debt. A mortgage loan can be “good” debt, when your home increases in market value over the life of the loan.

“When I think about the value of college,” Quenton said, “I tell people that a degree doesn't prove you learned a lot in class. It shows that you were able to matriculate through a structured system while having the freedom to do whatever you wanted.”

And paying off debt is almost the same: “You have to commit to the process while having the freedom to spend your money on other things. You have to read on your own, study on your own and understand that everything matters. Even the small payments you think are irrelevant are needed and will be applied toward your end goal.”

There's no "wrong answer" to paying back, Betsy Mayotte, the president of nonprofit The Institute of Student Loan Advisors, told FOX Business, as long as you understand how interest works and understand where your payments are going.

"Every borrower has their own individual story," she said. "Whether student loan debt is good debt or bad debt varies for the individual borrower. I have worked with people who owe $300,000 to $400,000 in student loan debt and it is absolutely good debt because they are going to qualify for public service loan forgiveness, and if it wasn’t for this debt they wouldn’t have been able to pursue their passion."

CLICK HERE TO READ MORE ON FOX BUSINESS

For example, she added, "they wanted to be a public defender and work with low-income defendants and they wouldn’t have been able to do this if it wasn’t for the loans that allowed them to go to law school. They may have $300,000 or $400,000 in student loan debt, but they’re going to make enough money to be able to pay that loan debt off comfortably and have the larger income for the rest of their lives."

That isn't always the case, though.

When getting a loan goes bad

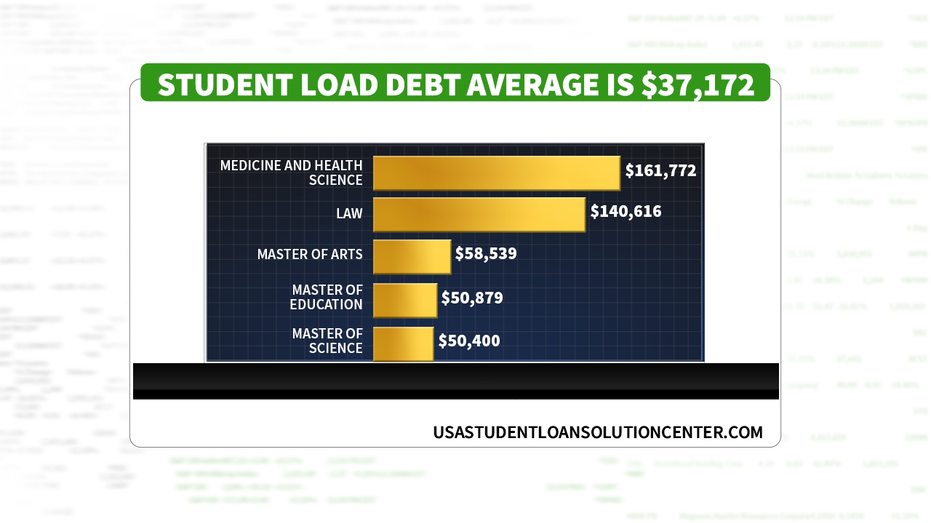

Experts say things start to go south — and the debt turns sour — when the degree cost doesn't match the projected income from a job post college.

Biblical Studies and Animal science, for example, were ranked in the top 10 college majors with the lowest salaries. Gina, a college graduate who studied philosophy, said she is experiencing bad debt first hand. She preferred not to use her last name when talking about her personal debt situation.

"I would say my degree has not paid off yet," she told Fox Business. "While I really enjoyed learning about philosophy and taking the classes and interacting with other students, it hasn't paid off much in terms of annual income since college."

Greg McBride, Bankrate’s chief financial analyst said while college debt is typically good, there's the "caveat that you are earning a degree that will provide sufficient earning power to pay back the loan and justify having taken it in the first place.

Bad debt = borrowing money for something that drops in value over time. Credit cards can become bad debt if you don’t keep the balances in check and interest payments get out of control.

Mayotte agreed: “It’s bad debt if the return on investment is not only not positive, but the student debt impacts your life in the long-term in a negative way and holds you back from your personal financial goals."

The amount of debt isn't always the factor either. Some borrowers find themselves buried under bad student loan debt after borrowing much less than a doctor or lawyer.

“I’ve worked with other borrowers [who] only borrowed $5,000 or $10,000 and it turned out to be bad debt for them because they never finished their program, so they are no better off then they were before," Mayotte said. "They have nothing to show for that debt and yet they still owe it.

“And they are making minimum wage, so even though they only owe $5,000 or $10,000, that’s a huge amount for them.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

McBride said breaking down the difference is simple.

“Borrowing $30,000 to get a degree in engineering is good debt. Borrowing $100,000 to get a degree in anthropology is not.”