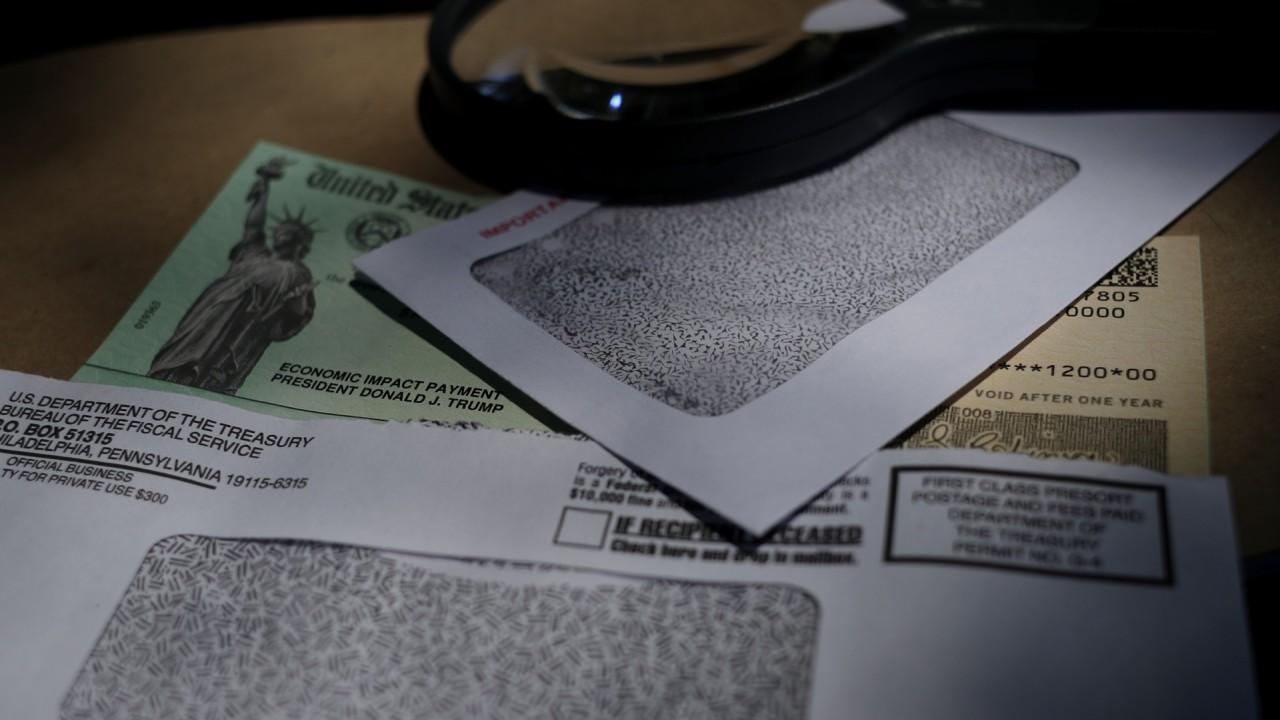

New data reveals how Americans are coping with financial challenges during COVID-19 pandemic

The coronavirus has led a quarter of Americans to use personal savings for living expenses

The COVID-19 crisis has affected many people in different ways. Some have lost their jobs completely. Others have seen their hours or income reduced. And some Americans haven't lost income at all, but rather, are grappling with general financial uncertainty -- the kind that's enough to keep anyone awake at night.

Either way, a lot of people are struggling to cover their regular living expenses right now, and are taking difficult steps to avoid falling behind on bills. Here are three specific moves Americans are making, according to the latest findings from Northwestern Mutual's 2020 Planning and Progress Study.

AMERICANS’ BIGGEST MISCONCEPTIONS ABOUT THE CARES ACT

25% are dipping into personal savings

The fact that 25% of Americans have savings to withdraw from is a good thing, as numerous reports have emerged in the past pointing to the fact that U.S. adults are glaringly lacking emergency savings. If you have an emergency fund and are having a hard time paying your regular bills, now's the time to tap it without feeling guilty. After all, if a recession and pandemic combined don't count as an emergency, what on earth does?

That said, it's definitely a good idea to map out a plan for rebuilding your emergency savings once the crisis is over. That could mean rethinking your spending or reducing some expenses. For example, you may not be in a position to move right now, but once it's safe to house-hunt, you may want to find a place with lower rent, as that will help you replenish your savings.

14% are borrowing from family or friends

If you have friends or family members who are in a good spot financially, asking for a loan is a good way to access money without racking up loads of interest charges. Of course, just because 14% of Americans are borrowing from friends and family doesn't mean you'll have that option, but if that's not the case, think about how you can borrow most affordably.

If you own property, a home equity loan or line of credit is probably your best bet, and usually, they're both fairly easy to qualify for. If you don't own a home to borrow against, think about applying for a personal loan, as you might score an affordable rate on one if your credit is good. Just be wary of credit cards -- they tend to charge exorbitant interest and can wreck your credit score in the process.

US HOUSEHOLD NET WORTH FALLS BY TRILLIONS OF DOLLARS IN HISTORIC DECLINE

10% are tapping their retirement accounts

The CARES Act, passed in late March, made it possible for those affected financially by COVID-19 to take up to a $100,000 withdrawal from a 401(k) or IRA penalty-free. Normally, withdrawals taken before age 59 1/2 incur a 10% penalty.

It's not shocking to see that 10% of Americans are turning to their retirement accounts to access money in a pinch. After all, with a retirement plan withdrawal, you don't need to apply for a loan and face rejection; you simply access money that already belongs to you. But while raiding a retirement plan might seem like a good solution to your financial woes, it's one that can easily backfire.

First of all, removing money from a retirement plan today means not having that money available later in life. Secondly, when you take a retirement plan withdrawal, you lose out on the opportunity to grow that money into a larger sum.

Say you need $5,000 immediately to pay bills, so you withdraw it from your IRA. If you're 20 years away from retirement and your IRA normally generates an average yearly 7% return (which is a few percentage points below the stock market's average), you'll wind up losing out on over $19,300. Ouch.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

If you're really out of options, you may have no choice but to tap your retirement savings. But first make sure that's truly your last resort. You should, for example, try negotiating or asking to defer some bills before going that route.

Clearly, Americans are taking different steps to cope with income struggles and losses. No matter what course of action you pursue, think things through before risking a decision you wind up regretting.

10 stocks that could be the biggest winners of the stock market crash

When investing geniuses David and Tom Gardner have an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the ten best buys for investors right now… And while timing isn't everything, the history of Tom and David's stock picks shows that it pays to get in early on their best ideas.