How do unemployment taxes work?

Unemployment is at the highest level since the Great Depression

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

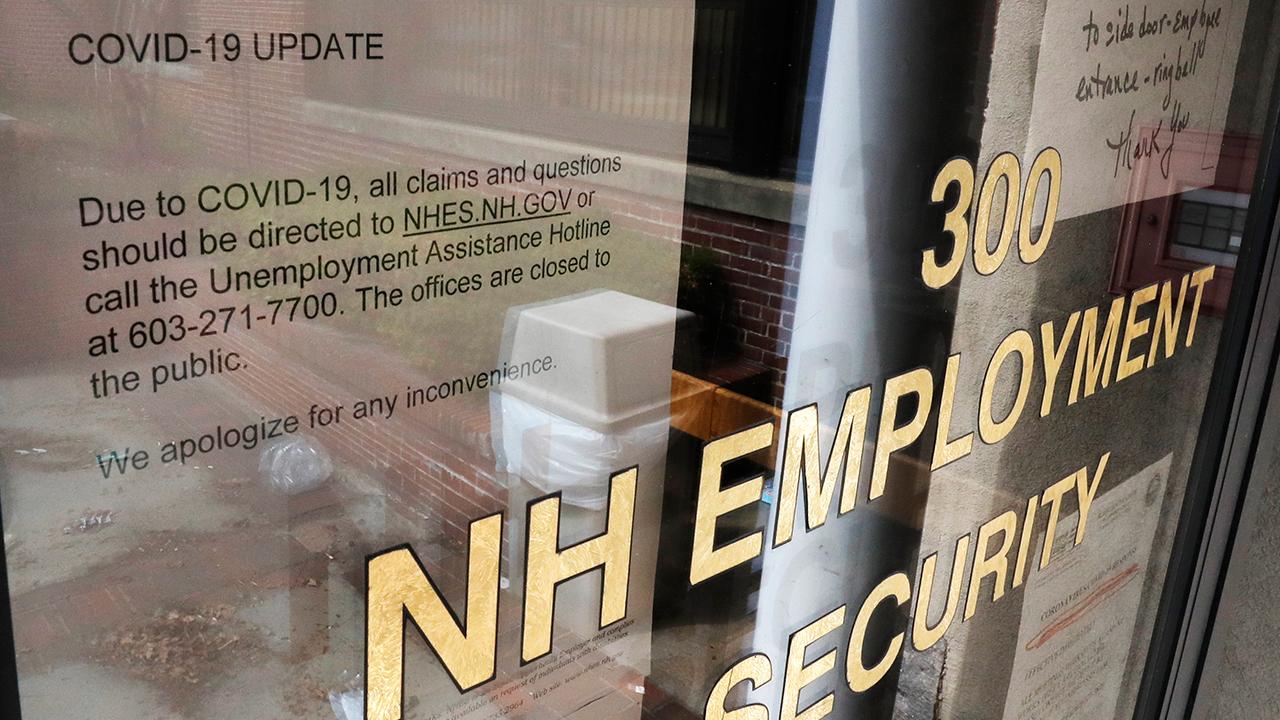

Millions of Americans have filed for unemployment benefits because the economic standstill triggered by the coronavirus pandemic has pushed the nation's jobless rate to the highest level since the Great Depression.

CORONAVIRUS LAYOFFS HURTING LOW-INCOME WORKERS THE MOST, STUDY FINDS

The staggering number of unemployment claims has left half of U.S. states with double-digit percentage declines in their insurance programs since the end of February. States use the money to administer regular unemployment benefits, while the extra $600 weekly payments for laid-off workers stems from the federal stimulus package signed at the end of March.

But where do states get that money from?

Under the Federal Unemployment Tax Act, the government can tax businesses in order to collect money that will then be repurposed to state unemployment agencies and paid out to workers who have been laid off.

HALF OF WORKING AMERICANS MIGHT NOT HAVE A PAYCHECK IN MAY

In 2020, the FUTA tax rate was 6 percent of the first $7,000 paid to workers annually. Although the tax is based on an employees' salary, the levy is only paid by the employer -- not by their workers. For a company with 10 employees who each earns $7,000 per year, the company would be required to pay a 6 percent fee on each of those salaries, or $4,200.

Business owners have multiple unemployment tax obligations, however: States also impose a payroll tax on employers for unemployment (the State Unemployment Tax Act, or SUTA). The tax rate depends on the state that businesses are located.

There are two factors that determine the tax calculation of the SUTA: A company’s taxable wage base and the tax rate. For instance, in 2019, the taxable wage base for employees in Texas was $9,000, and the tax rates range from .36% percent to 6.36 percent.

Each business receives a credit toward FUTA taxes, based on their SUTA tax payments.