Tenant says property manager illegally tracked his coronavirus stimulus check online for rent

Austin Goodrich recalled that the experience made him feel 'vulnerable and upset'

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

Austin Goodrich was among the nearly 80 million Americans to receive his coronavirus stimulus check last Wednesday, but just a few hours after the government aid arrived in his bank account, he received an unsettling text from his property manager: Did he plan to use the cash to pay rent?

Goodrich, a Forest Grove, Oregon resident, told FOX Business that he had not informed his landlord or property manager about the cash. But on April 15, the property manager — who Goodrich has not named— sent him a text message saying they were aware Goodrich had received the payment.

“I was initially questioning how my property manager accessed this information, and after discovering the truth, I was overwhelmingly feeling vulnerable and upset that my private information was utilized in this way in an attempt to ask for rent,” Goodrich told FOX Business via email.

The property manager explained they had used his Social Security number without permission to check the payment status via the “Get My Payment” tool set up by the IRS.

"You got your stimulus, just asking are you going to pay rent or part of rent with any. I am trying to close out the books for April," the property manager wrote to Goodrich, according to screenshots of the text messages posted online.

“How do you know I got my check?” Goodrich responded.

“Because I had to check several people today and checked yours also,” the property manager wrote back.

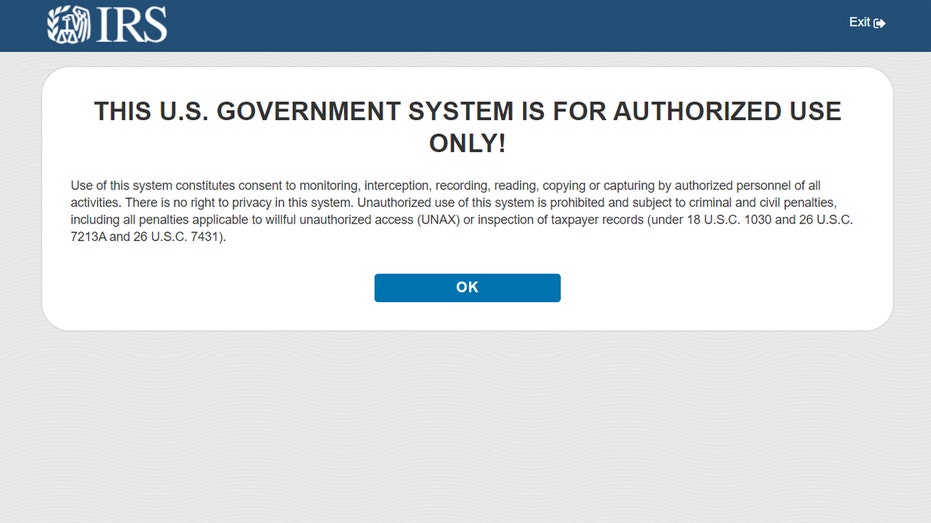

To access the tracking system, users must enter their Social Security number, date of birth, street address and zip code — information that landlords typically have since they run credit checks before a tenant can move in. But before users can input their personal information, a warning appears that reads "unauthorized use of this system is prohibited and subject to criminal and civil penalties."

The IRS did not respond to a request for comment about whether landlords could use the tool to track the status of their tenants’ checks.

Oregon, at the end of March, joined a slew of states and cities placing a temporary moratorium on evictions as a result of the coronavirus pandemic, which has left 22 million Americans unemployed, including Goodrich, who lost his job as a security guard as the virus stunned the U.S. economy. Though he said he had multiple job interviews lined up, he said it was unlikely he would start working for those companies until after strict stay-at-home measures are lifted.

STILL NO STIMULUS CHECK IN YOUR BANK ACCOUNT? WHY IT MAY BE DELAYED

In a statement posted online, Goodrich said he blames the IRS for creating an unsecured system and urged the agency to take action to protect users’ personal information, either by providing users with a list of confirmed or attempted access to their data, and by making a list of computers that have tried to access multiple accounts.

“This is a problem that extends beyond myself,” he wrote. “For every one landlord or debt collector that admits to this illegal intrusion of privacy, there might be 100 out there that don’t.”

Goodrich told FOX Business that he’s considering pursuing suing his property manager and landlord if an amicable settlement is not accepted on April 22.

To dull the financial pain brought on by the dual health and economic crises, the federal government last month expanded unemployment benefits by $600 per week and sent a one-time cash payment of $1,200 to individuals who earn less than $75,000. In December 2019, the median rent in the country for a two-bedroom apartment was $1,343.

HERE'S HOW EXPANDED UNEMPLOYMENT BENEFITS WORK

The government has not stipulated how Americans are to spend the cash, but in some, banks and private debt collectors have seized the payments from people who have overdraft fees, delinquent loans or other debt obligations.

Underscoring the problem, about 12 percent of Americans have said they are unable to cover an unexpected $400 expense, while 27 percent said they would need to borrow money or sell something in order to be able to do so, according to a recent Federal Reserve study.

In April, nearly a third of apartment tenants did not pay any rent during the first week of the month, according to data from the National Multifamily Housing Council and a group of real-estate data providers.

The number reflects data from 13.4 million rental apartments across the country analyzed by several real-estate data firms, including RealPage, Yardi and ResMan. It does not include public housing and other subsidized affordable housing or single-family homes.

GET FOX BUSINESS ON THE GO BY CLICKING HERE