Older adults worried about retirement are going back into the workforce

A recent survey found that more than 25% say they are not retired, nor ever expect to

Older adults worried about retirement funds running out

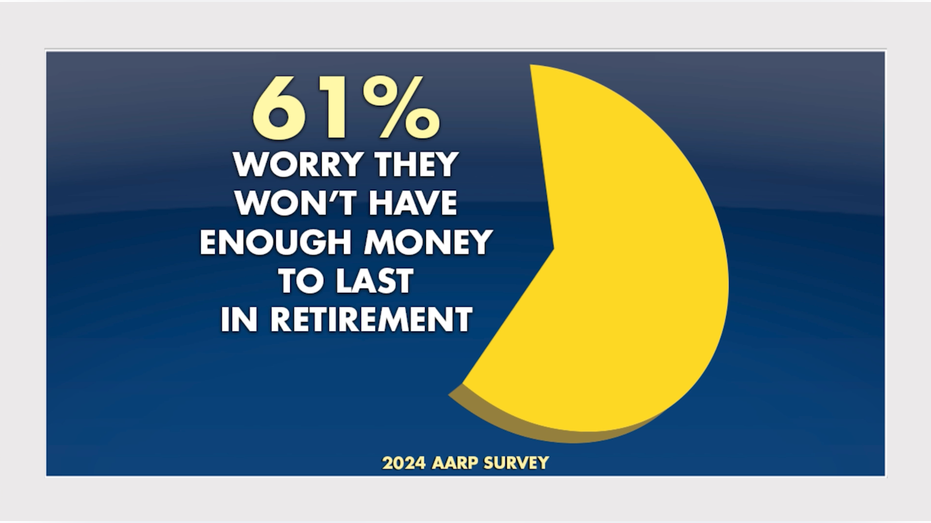

A recent AARP survey finds over half of adults over 50 are worried about having enough money for retirement.

People over 50 are saying they are worried about prices rising faster than their income. A recent survey by AARP found that more than 25% say they are not retired yet and never expect to reach that point. This is causing some older adults to go back into the workforce so they can pay for necessities.

"Well, we're gonna have to have meatless meals because it's so expensive," said Laura Wright, an older adult in St. Louis who said she is going to find another source of income to comfortably pay her bills.

MOST BABY BOOMERS HEADING TOWARD RETIREMENT HAVE LITTLE SAVED: STUDY

AARP's 2024 survey finds older adults worried about money (Olivianna Calmes / Fox News)

"It won't be a side hustle, it would be me going full forward in trying to develop an income for myself and others," said Wright, who added she’s grateful for an increase in social security money, which the government did to keep up with inflation. She’s still struggling, however, and so are other older adults she knows.

"I've seen seniors lose their homes because they didn't have enough money to keep up the taxes or to upkeep the property…especially those who don't have children or someone who can help them," Wright said.

MOST SENIORS REGRET RETIREMENT PLANNING DECISIONS, WANT DO-OVER: SURVEY

Senior programming department at LifeWise St. Louis (Olivianna Calmes / Fox News)

Samantha Ferguson Knight, who works as the director of senior programming at LifeWise St. Louis, said age has everything to do with this struggle.

"The average older adult needs to make at least $2,087 dollars in the St. Louis region in order to just make ends meet. But the average social security benefit is $1,700 dollars," Knight said.

She said those numbers from the elder index by UMass Boston tell the story of many older adults, even ones who prepared for retirement but have now run out of funds, which 61% of participants in the AARP survey indicated they are worried about.

MUST-KNOW HOUSE ACCESSIBILITY TIPS FOR OLDER, INDEPENDENT ADULTS

Older adults say it is difficult to pay bills (Olivianna Calmes / Fox News)

"They believe that they can't have budgets because they're on a limited income, so I try to debunk that belief that they have and just reassure them that they can save, even if it's $1 or $5 a month," said Tyra Cole, financial social worker at LifeWise.

She says LifeWise encourages older adults to save, even just a tiny bit to help themselves out later.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Knight said one way older adults can get some income is through the US Department of Labor’s Senior Community Service Employment Program. Knight said AmeriCorps also has a similar program. They offer tax-free stipends for volunteering while improving their skills.