A retirement plan for Americans who may live to age 150

It's never too early to begin saving for retirement, but it's a task that ranks last among many Americans' budget priorities.

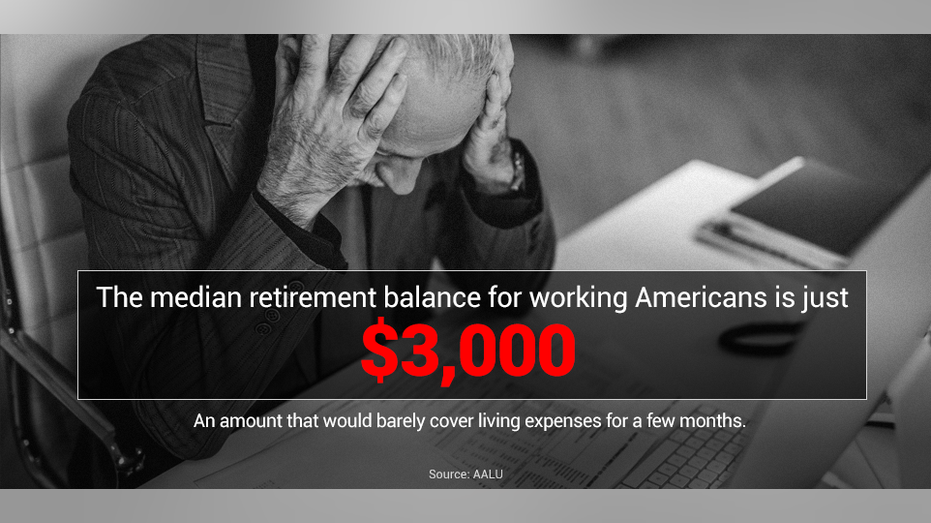

And that shows, as the median retirement balance for working Americans is only $3,000, an amount that would barely cover living expenses for a few months.

People are living longer, healthier lives today. According to Guinness World Records, the oldest person alive is currently 116 years old, Kane Tanaka, and they say that the first person to live to be 150 is alive today.

TOPSHOT - Kane Tanaka, a 116-year-old Japanese woman, celebrates the official recognition of Guinness World Records' as the world's oldest verified living person in Fukuoka on March 9, 2019. (Photo by JIJI PRESS/AFP/Getty Images)

For those who don’t want to work forever, a solid long-term retirement plan is critical. Fortunately, saving for retirement does not have to be daunting. It just requires discipline, time and a plan.

Make it a must

A great place to start is paying yourself first. Once you have found the amount that works to meet your financial needs, consider your retirement savings another must-pay bill and build the discipline to make it part of your regular routine.

In addition to discipline, time is one of the most powerful forces in preparing for retirement.

If you started a new job and were offered the choice of a $1 million salary or one that starts with a penny but doubles every day, which would you choose? It may seem like the million is the obvious choice. However, if you took the penny, within 30 days you would be receiving almost $5.4 million!

The same principal applies to a 20-year-old who saves $100 per month, and ends up with $150,000 in their 60s. Albert Einstein famously described compound interest as the Eighth Wonder of the World, saying, "He who understands it, earns it. He who doesn’t, pays it."

He who understands it, earns it. He who doesn’t, pays it.

The three steps

If every American prioritizes saving and follows three simple steps, they will be better prepared for retirement: participate in a retirement plan, secure permanent life insurance and ensure a guaranteed lifetime income stream through an annuity.

By doing any one of these things, they’d be better off. By doing all three, they are guaranteed to live comfortably in retirement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Retirement plans – no brainers

The first – participating in a retirement plan – allows individuals to take advantage of tax benefits, which reduces the actual cost of prioritizing savings, along with putting money away for retirement. In addition, plans with employer contributions provide additional money to participants’ savings at no extra cost to the employee.

That is money you earned. Not taking it is like giving your employer a part of your paycheck every time you get paid.

Permanent life insurance

After you have secured your retirement plan, step two is to purchase permanent life insurance. While permanent life insurance at its core is a protection product that ensures families and businesses will be financially stable after the death of a bread winner, it is also a powerful savings tool.

Permanent life insurance accrues value annually, and those savings can be drawn on when needed. In addition, the cash value in permanent life insurance policies is stable and can be incredibly valuable, especially in contrast to market volatility.

Annuities

Finally, you should consider purchasing an annuity to ensure a guaranteed lifetime income. Annuities are a tool to provide people with a stable and steady income stream. There are many different kinds of annuities, but the most important feature is that they offer guarantees and cannot be outlived.

Even the most disciplined savers need a plan for converting their accumulated savings into “retirement income” to cover their expenses in those golden years.

Building a strong relationship with a trusted financial adviser can help you design a plan. Advisers can help you through each of these steps and review your plan regularly. Just as you should see your doctor for an annual physical, you should also review your financial security plan annually.

Most Americans who have access to a retirement plan participate in one, and the good news is Congress is working on opening up access to more Americans.

The House has already passed a bill called the SECURE Act, which would make it easier for more Americans to save for retirement. The bill passed 417-3, an impressive bipartisan achievement, showing that even in this polarized environment, saving for retirement is an imperative priority.

The Senate should pass it this year, and President Trump should sign it, unlocking retirement tools for hundreds of thousands.

So as we get our fall routines under way, let’s take the steps to better prepare for retirement and do what’s necessary today to live comfortably tomorrow.

Marc R. Cadin is president and CEO of AALU.