65% of pre-retirees worry they won't manage to pay for this major expense

It's too soon to tell whether the COVID-19 crisis will drive up the cost of long-term care

Retirement can be a daunting prospect, namely because of the vast expense it can entail. And while many Americans work hard and save diligently to avoid financial concerns later in life, sometimes, even the best savers worry about falling short in certain areas -- like long-term care.

A good 65% of pre-retirees are worried about that specific expense, according to a recent survey published by the Society of Actuaries. And when we look at the numbers involved, it's easy to see why.

CORONAVIRUS PUTS FULL SOCIAL SECURITY BENEFITS AT RISK YEARS EARLIER THAN EXPECTED, RESEARCHERS SAY

What does long-term care look like today?

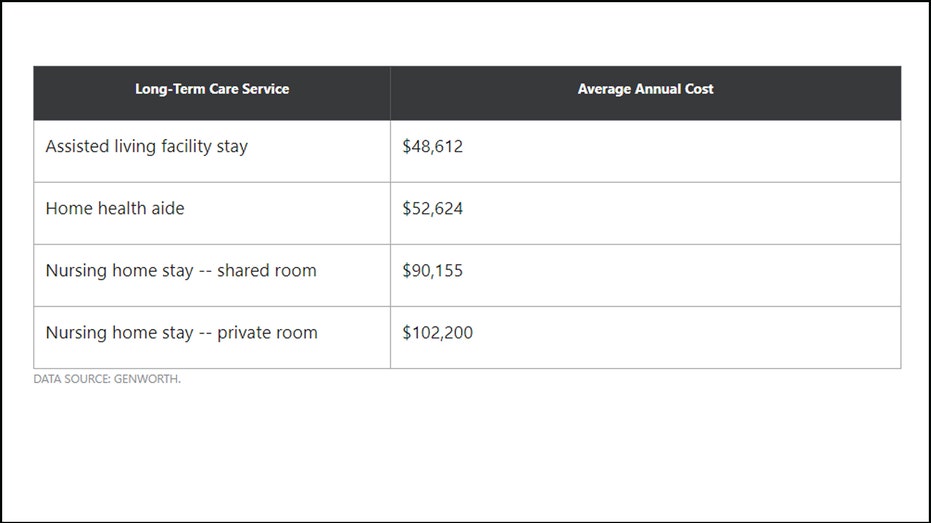

Long-term care can be an exorbitant expense -- one that many people don't plan for properly. Here's what the costs involved look like today:

(Credit: Motley Fool)

But keep in mind that these are just averages, and in some parts of the country, you'll pay a lot more. Worse yet, Medicare generally won't pick up the tab for any type of care that's custodial in nature, not medical. And long-term care usually falls into that bucket.

CORONAVIRUS DRIVES RETIREES TO SPEND ‘MUCH MORE’ ON THIS EXPENSE THAN ANTICIPATED

Furthermore, it's too soon to tell whether the COVID-19 crisis will drive up the cost of long-term care, but the pandemic has certainly exposed vulnerabilities in nursing homes that will likely cost money to remediate. The potential result? An uptick in cost for seniors, and quite possibly a drastic one at that.

It's for these reasons that securing long-term care coverage is crucial. If you're slowly but surely inching toward retirement and you don't have a policy in place, now may be the time to get moving.

CORONAVIRUS FORCING EARLY RETIREMENT? HERE ARE YOUR OPTIONS

When to apply for long-term care

Generally speaking, your mid-50s are a good time to apply for long-term care coverage. That way, you're young enough to snag a decent rate on your premiums, but you're also not signing up to pay those premiums for too long.

Of course, you'll get varying levels of coverage depending on the policy -- and premium -- you choose, so make sure you understand exactly what you're signing up for when you apply for long-term care coverage. Specifically, you'll want to understand your policy's:

- Maximum daily benefit

- Maximum length of benefits

- Waiting or elimination period before benefits kick in

Also, don't make the mistake of buying too much long-term care insurance. If you have a very healthy level of retirement savings, you may not need as large a policy as someone who doesn't.

CORONAVIRUS DRIVES RETIREES TO SPEND ‘MUCH MORE’ ON THIS EXPENSE THAN ANTICIPATED

Another thing you should know is that you can use a health savings account to pay for long-term care insurance premiums. If you're too young to apply for a policy but are eligible for a health savings account, now's the time to try maxing out your contributions.

The fact that most pre-retirees are worried about long-term care isn't shocking given the costs involved. The best way to protect yourself in that regard is to secure long-term care insurance. The right policy won't just pick up the tab for an assisted living facility or nursing home stay; it could buy you some much needed peace of mind as retirement gets closer.

CLICK HERE TO READ MORE ON FOX BUSINESS