This is the single biggest retirement savings mistake you can make

A few sacrifices now will pay huge dividends later in life

Saving enough to retire can seem difficult, especially during these financially turbulent times. Unfortunately, many people make it harder than it needs to be with a costly mistake: waiting to start saving.

CORONAVIRUS PUTS FULL SOCIAL SECURITY BENEFITS AT RISK YEARS EARLIER THAN EXPECTED, RESEARCHERS SAY

Delaying could be the biggest mistake you'll ever make

To save enough for your future, you need to start investing as soon as possible. This may seem hard if you're barely getting by. But the longer you wait, the more you need to save.

If you start saving sooner rather than later, compound interest enables your money to work for you, instead of you having to work for all of your money. As your investments grow, the profits are reinvested and you earn interest on interest. This enables your account balance to grow exponentially.

CORONAVIRUS DRIVES RETIREES TO SPEND ‘MUCH MORE’ ON THIS EXPENSE THAN ANTICIPATED

The magic of compound interest is like a snowball rolling down a hill: It allows you to build wealth by investing small sums consistently over a long time.

Unfortunately, even a small delay in getting started makes a huge impact: That snowball isn't rolling as much as it would be if you'd given it a push earlier on, so you wind up shoveling a lot more snow later in life.

How much will waiting cost you?

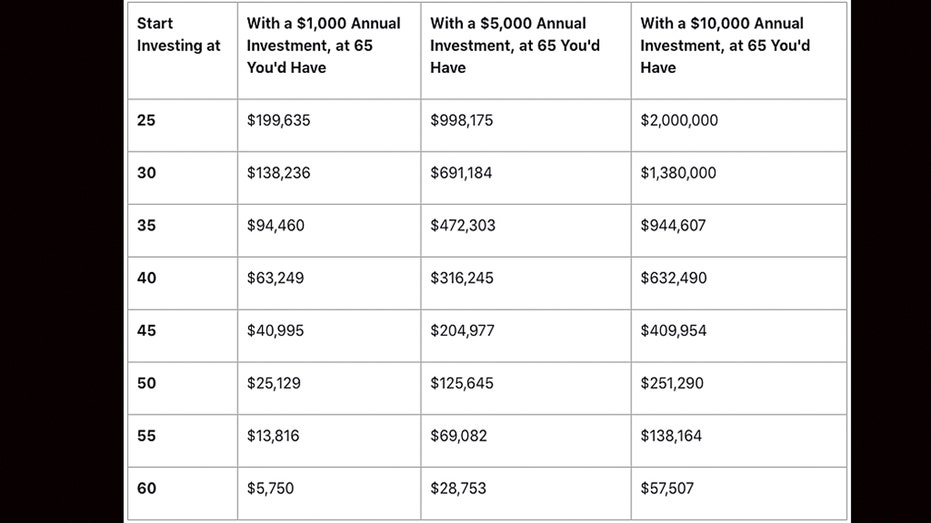

The table below shows how much you'd have by 65, depending on when you start and the amount you invest (assuming a 7% average annual return).

(Credit: Motley Fool)

HOW TO GET A PERSONAL LOAN WITH GOOD CREDIT

As you can see, even a decade of delay makes a huge impact. If you started saving just $1,000 a year at 25, you'd have more than $100,000 extra in the bank than if you'd started at 35. That extra $10,000 you invested over those 10 years would've snowballed more than 10 times over by age 65.

Find the money to start investing ASAP

This may not seem like an ideal time to start investing when the stock market is volatile during the coronavirus crisis. But finding just a few dollars a month to invest now could keep you from having to invest thousands more later to end up in the same place.

65% OF PRE-RETIREES WORRY THEY WON'T MANAGE TO PAY FOR THIS MAJOR EXPENSE

Once you have an emergency fund and your daily bills are paid, try to find just a little bit to put into a 401(k) or IRA for retirement. You can start your snowball rolling, and the sacrifice you make now will pay huge dividends later in life.