20-Year Fixed Refinance Rates

Refinancing a 30-year mortgage to a 20-year mortgage allows you to pay off your home faster, but you’ll have a higher monthly payment

If you have a longer mortgage loan term, you may want to take advantage of 20-year refinance rates. (Shutterstock)

Though 30-year fixed mortgages tend to be the most popular option, 20-year mortgage loans offer plenty of benefits. You’ll save money in interest over the life of your loan, plus you’ll be able to pay off your loan 10 years sooner.

In the second quarter of 2021, 30% of homeowners refinanced into a shorter term, according to research from Freddie Mac. Find out more about 20-year refinance rates and if refinancing into a shorter term is right for you.

Credible lets you compare mortgage refinance rates from different lenders, all in one place.

- Today’s 20-year mortgage refinance rate trends

- Historical mortgage rates

- How Credible mortgage refinance rates are calculated

- Pros of a 20-year mortgage refinance

- Cons of a 20-year mortgage refinance

- When is the right time to refinance into a 20-year fixed mortgage?

- How to get your lowest mortgage refinance rate

- What is the average cost of a refinance?

- What credit score do you need to get a good 20-year refinance rate?

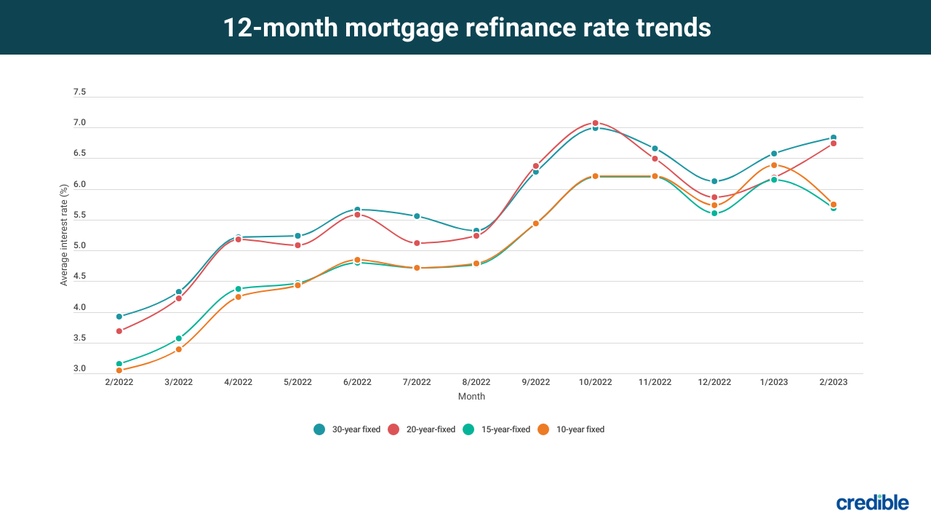

Today’s 20-year mortgage refinance rate trends

Here’s how mortgage refinance rates have been trending over the past 12 months.

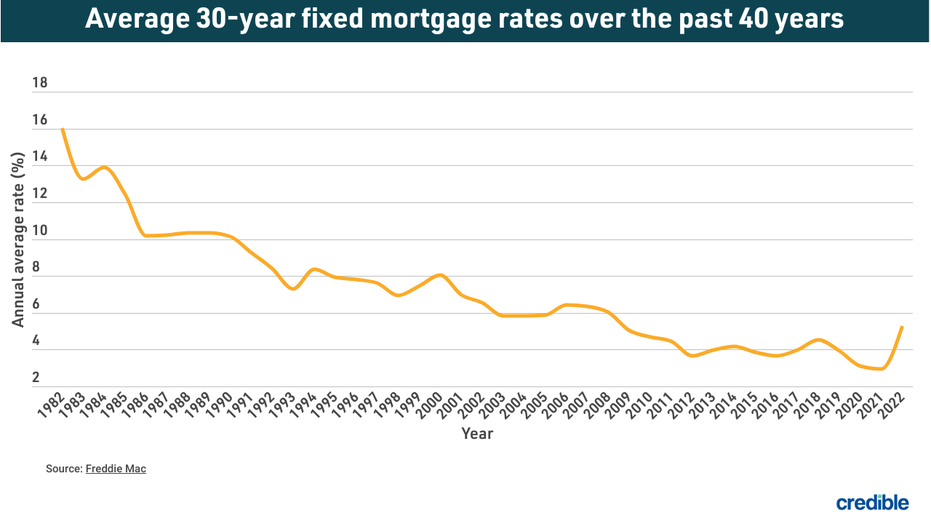

Historical mortgage rates

Here’s what the annual average mortgage interest rate has looked like over the past 39 years.

How Credible mortgage refinance rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Pros of a 20-year mortgage refinance

Refinancing into a 20-year mortgage offers significant benefits:

- You’ll pay less interest over time. You can save money when refinancing an existing 30-year mortgage into a 20-year refinance. Because you shave off 10 years of payments, you can save thousands of dollars in interest over the life of the loan. Plus, if you’re able to get a lower interest rate, you could save even more.

- You’ll pay off your home faster. If you refinance a 30-year mortgage into a 20-year mortgage, you’ll pay off your mortgage quicker while also gaining equity in your home faster. Your home’s equity is the difference between what you owe on your home and what it’s currently worth.

- You’ll have predictable monthly mortgage payments. When you refinance an adjustable-rate mortgage into a 20-year fixed-rate mortgage, your rate won’t change, and your payments will be much more predictable. This is why fixed-rate loans are the most popular option.

Cons of a 20-year mortgage refinance

A 20-year refinance also comes with a few drawbacks:

- You’ll pay upfront costs. When you refinance your mortgage, you must pay closing costs — as much as 2% to 5% of your loan amount. These costs vary depending on your lender, loan type and amount, your credit score, and more.

- You may have a higher monthly payment. If you refinance a 30-year mortgage into a 20-year mortgage, the repayment period shortens but your monthly payment increases. If you can afford a higher monthly payment, you can save a great deal of money in interest, and you’ll be rid of your mortgage payments sooner.

- Your mortgage loan may be reset. If you’re already 20 years into your 30-year mortgage, refinancing to a 20-year mortgage will tack on 10 more years to your loan. You may get a lower annual percentage rate, or APR, but end up paying much more than you’re saving.

When is the right time to refinance into a 20-year fixed mortgage?

If you’re paying a higher rate than current 20-year refinance rates, it may be a good time to refinance.

The Federal Reserve is expected to periodically increase interest rates for the remainder of 2022 to deal with growing inflation, according to Bank of America economists. But by refinancing to a 20-year mortgage now, you still have the opportunity to save on your monthly payment, shorten the length of your home loan, and qualify for a lower interest rate.

With Credible, you can compare mortgage refinance rates from multiple lenders without affecting your credit.

How to get your lowest mortgage refinance rate

Some factors that affect the refinance rate you’ll get are out of your control. But you can take several steps to ensure you secure the best refinance rate available to you. Here are some to consider:

Save for closing costs

In addition to saving for a down payment, it’s also a good idea to save up for closing costs, which can average $5,000, according to Freddie Mac.

Polish your credit

Just as when you bought your home, your credit score and history affect your refinance rate, so it’s a good idea to make sure your credit is in the best possible shape.

Check your credit report for errors, such as incorrect information or duplicated accounts. Pay off as much other debt as you can to improve your debt-to-income ratio, and pay down credit card balances to reduce your credit utilization.

Comparison shop

Just as you’d compare quotes from multiple vendors for an expensive home repair, you should look at loans and mortgage interest rates from multiple lenders. In fact, getting five rate quotes could save you $3,000 over the life of your mortgage, according to a Freddie Mac survey.

What is the average cost of a refinance?

Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Typical refinancing costs include:

- The cost of recording your new mortgage

- Appraisal fees

- Attorney fees

- Lender fees, such as origination or underwriting

- Title service fees

- Credit report fees

- Mortgage points

- Prepaid interest charges

Keep in mind there’s no such thing as a truly no-cost refinance. Lenders who market "no-cost loans" typically charge a higher interest rate and roll the costs into the loan — which means you’ll pay more interest over the life of the loan.

What credit score do you need to get a good 20-year refinance rate?

Before approving you for the best 20-year refinance rates, lenders look at several factors, including your debt-to-income ratio — the percentage of your gross monthly income that goes toward your debt. Lenders also consider the loan-to-value ratio, or the percentage of your home’s value you plan to finance, the type of mortgage, and your credit score.

FICO rates credit scores on a range:

- Exceptional — 800 or above

- Very good — 740 to 799

- Good — 670 to 739

- Fair — 580 to 669

- Poor — 579 or below

To qualify for the lowest interest rates when refinancing into a 20-year loan, lenders typically look for a credit score of at least 620 for conventional mortgage loans. The minimum credit score varies by lender.

It’s possible to qualify for FHA loans, like a rate-and-term or cash-out refinance, with a credit score of 500. You must make a down payment of at least 10% if your credit score is between 500 and 579. If your credit score is greater than 580, you may qualify with a down payment of only 3.5%.

You may be eligible for a VA loan with a credit score as low as 620, while most USDA loans require a minimum score of 640.

You can compare mortgage refinance rates from various lenders in minutes with Credible.