30-Year Fixed Refinance Rates

The benefits of refinancing your 30-year mortgage can be tempting. Just don’t lose sight of the drawbacks.

Refinancing into a 30-year mortgage could lower your monthly mortgage payment. (Shutterstock)

A 30-year mortgage refinance can help lower your monthly payments, thanks to the long repayment term, which can free up money to put toward other financial goals. It’s no wonder, then, that this refi option is so popular.

The first half of 2021 saw a 33% increase in refinance originations compared to the same time in 2020, according to research by Freddie Mac. And homeowners who refinanced their existing 30-year fixed-rate mortgage into a new 30-year fixed mortgage in the first half of 2021 saved more than $2,800 in mortgage payments annually.

If you’re considering a mortgage refinance, here’s what you need to know about 30-year refinance rates.

Credible lets you compare mortgage refinance rates from various lenders, all in one place.

- Today’s 30-year mortgage refinance rate trends

- Historical 30-year mortgage rates

- How Credible mortgage refinance rates are calculated

- Pros of a 30-year mortgage refinance

- Cons of a 30-year mortgage refinance

- When is the right time to refinance?

- How to get your lowest mortgage refinance rate

- What is the average cost of a refinance?

- What credit score do you need to get a good 30-year refinance rate?

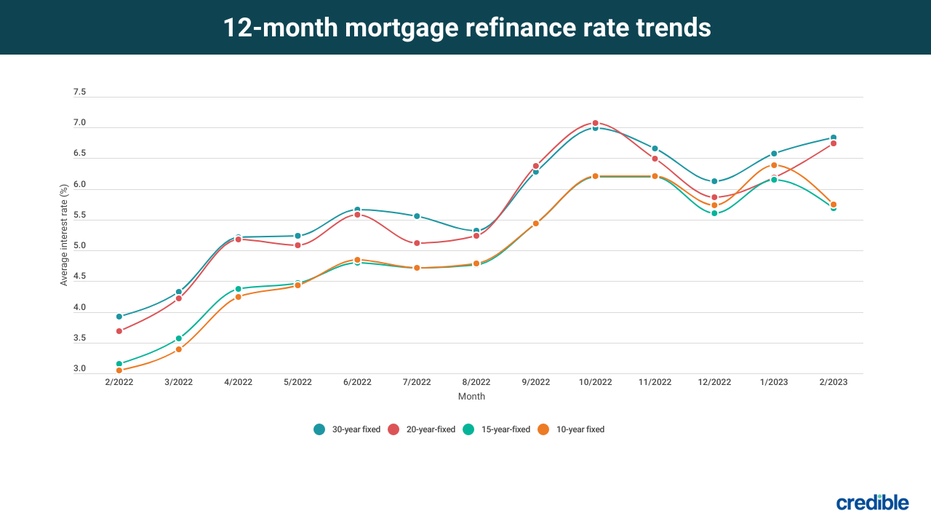

Today’s 30-year mortgage refinance rate trends

Here’s how mortgage refinance rates have been trending over the past 12 months.

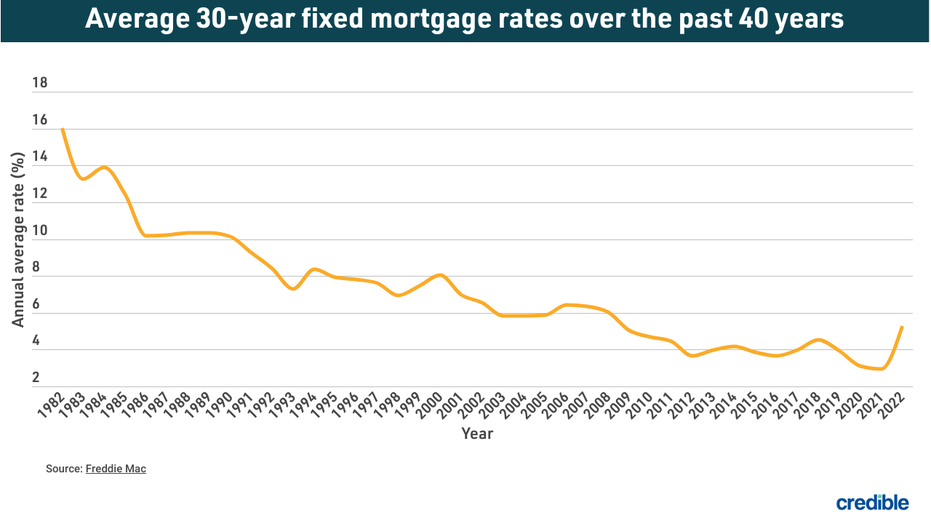

Historical 30-year mortgage rates

Here’s what the annual average mortgage interest rate has looked like for the past 39 years.

How Credible mortgage refinance rates are calculated

Changing economic conditions, central bank policy decisions, investor sentiment, and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no (or very low) discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Pros of a 30-year mortgage refinance

Refinancing into a 30-year mortgage offers significant benefits to homeowners:

- Possibility of a lower monthly payment — When you refinance your current 30-year mortgage to a new 30-year mortgage, you’re extending the time you have to pay off your new loan. That means your monthly mortgage payment will likely go down. If your new home loan has a lower interest rate, your payment may shrink even more.

- Frees up money for other uses — If you decide on a cash-out refinance or lower your monthly payment by refinancing, you can free up money to pay down high-interest credit card debt or student loans. Likewise, you can take the money you save and build an emergency fund or contribute more to retirement.

- Predictable monthly payments — When you have an adjustable-rate mortgage, your monthly payments can vary over the term of your loan because rates are based on the market. When you refinance an adjustable-rate mortgage to a 30-year fixed-rate mortgage, your rate will stay the same, and your payments will be much more predictable.

Cons of a 30-year mortgage refinance

In addition to the benefits of refinancing your 30-year mortgage, there are a few trade-offs to consider:

- Potential upfront costs — When you took out your first mortgage, you likely paid closing costs. Refinancing your 30-year mortgage is no different. Closing costs vary depending on your lender, loan type and amount, your credit score, and other factors. But you may end up paying a loan application fee, an origination fee, home appraisal costs, and lender fees when you refinance.

- Increase in total interest costs — Refinancing a shorter-term mortgage into a 30-year loan, or refinancing when you have less than 30 years left to pay on your existing loan, can increase the total interest you’ll pay over the life of your mortgage.

- You may pay a prepayment penalty — Some lenders charge a prepayment penalty for paying off your original loan early. That fee can eat into any savings you see from refinancing. If there’s a prepayment penalty, your closing disclosure or loan estimate will state any charges.

When is the right time to refinance?

The best time to refinance is generally when interest rates are lower than your current mortgage rate.

The Federal Reserve is expected to hike interest rates at every meeting for the remainder of 2022 as central bank policymakers try to take on the highest jump in inflation in almost four decades, according to Bank of America economists. This may equal rising mortgage interest rates in the near future. But by refinancing now, you might have the opportunity to save on your monthly payment or even eliminate your private mortgage insurance payments — that is, if your home’s value has gone up significantly since you bought it and the home’s loan-to-value ratio is under 80%.

With Credible, you can compare mortgage refinance rates from multiple lenders without affecting your credit.

How to get your lowest mortgage refinance rate

Some factors that affect the refinance rate you’ll get are out of your control. But you can take several steps to ensure you secure the best refinance rate available to you. Here are some to consider:

Save for closing costs

In addition to saving for a down payment, it’s also a good idea to save up for closing costs, which can average $5,000, according to Freddie Mac.

Polish your credit

Just as when you bought your home, your credit score and history affect your refinance rate, so it’s a good idea to make sure your credit is in the best possible shape.

Check your credit report for any errors, such as incorrect information or duplicated accounts. Pay off as much other debt as you can to improve your debt-to-income ratio, and pay down credit card balances to reduce your credit utilization.

Comparison shop

Just as you’d compare quotes from multiple vendors for an expensive home repair, you should look at loan terms and mortgage interest rates from multiple lenders. In fact, getting five rate quotes could save you $3,000 over the life of your mortgage, according to a Freddie Mac survey.

What is the average cost of a refinance?

Your exact refinancing costs will depend on multiple factors, including the size of your loan and where you live. Typical refinancing costs include:

- The cost of recording your new mortgage

- Appraisal fees

- Attorney fees

- Lender fees, such as origination or underwriting

- Title service fees

- Credit report fees

- Mortgage points

- Prepaid interest charges

Keep in mind there’s no such thing as a truly no-cost refinance. Lenders who market "no-cost loans" typically charge a higher interest rate and roll the costs into the loan — which means you’ll pay more interest over the life of the loan.

What credit score do you need to get a good 30-year refinance rate?

The credit score you need to get a good 30-year refinance rate can vary. FICO rates credit scores this way:

- Exceptional — 800 or above

- Very good — 740 to 799

- Good — 670 to 739

- Fair — 580 to 669

- Poor — 579 or below

To get the lowest interest rate on your 30-year refinance, you’ll typically need a minimum credit score of 620 for most conventional mortgage loans, but this requirement varies by lender.

You may qualify for an FHA rate-and-term or cash-out refinance with a credit score as low as 500. If your credit score is between 500 and 579, you must make a down payment of at least 10%. But if your credit score is 580 or higher, you may qualify with a down payment of only 3.5%.

Meanwhile, VA loans, FHA Streamline Refinance loans, and USDA loans don’t have minimum credit score requirements.

Your eligibility for a refinance depends on several factors, including your debt-to-income ratio — the percentage of your gross monthly income that goes toward paying your debt. Your lender also considers your loan-to-value ratio, or the percentage of your home’s value you plan to finance, as well as the type of mortgage program.

You can compare mortgage refinance rates from various lenders in minutes with Credible.