5-year personal loan rates plummet to new record low

Interest rates for 3-year personal loans hover near all-time low

More favorable repayment terms lead to lower personal loan payments and cheaper overall borrowing costs. Here's what to know about current personal loan rates. (iStock)

If you plan on borrowing a personal loan to consolidate credit card debt, finance a home improvement project or cover an unexpected expense, now is the time to lock in a low rate.

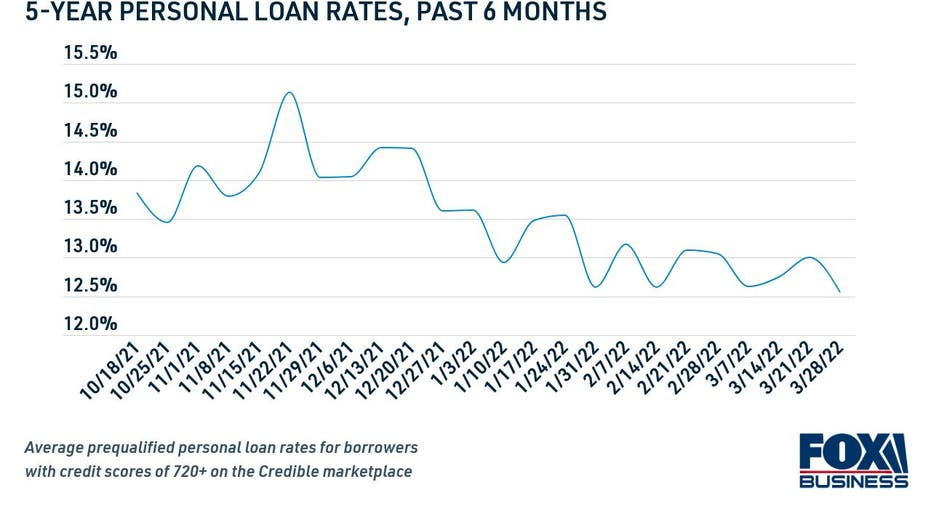

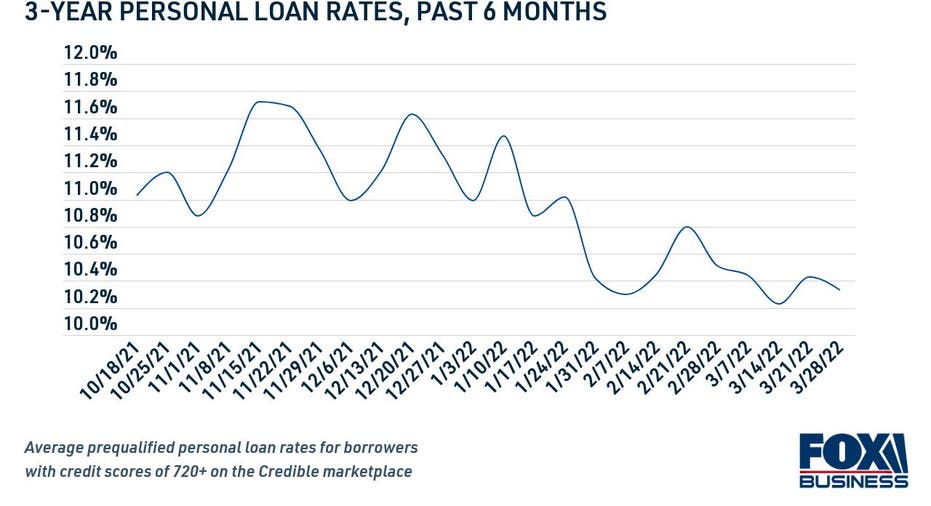

Personal loan interest rates have been trending down so far in 2022, with interest rates for the five-year loan term setting a new record low of 12.55% during the week of March 28, according to data from Credible. Three-year personal loan rates averaged 10.33%, which is just slightly higher than the previous record set during the week of March 15.

10 BEST PERSONAL LOANS FOR FAIR CREDIT

Keep reading to learn more about the current personal loan rate trends, as well as how you can lock in favorable terms when borrowing a personal loan. One strategy is to shop around with multiple online lenders to find the lowest possible rate for your financial situation. You can visit Credible to compare personal loan interest rates for free without impacting your credit score.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Personal loan rates are low for 3-year and 5-year terms

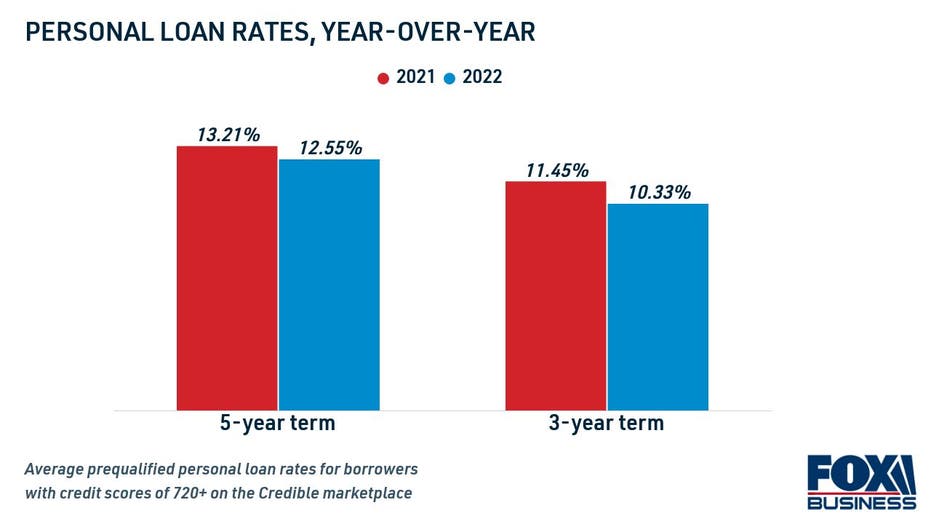

Historically, personal loan rates are now trending much lower than the same time last year. In late March 2021, the average prequalified rate for good credit borrowers was 11.45% for the three-year loan term and 13.21% for the five-year loan term.

HOW TO PAY FOR IMPROVEMENT PROJECTS WITHOUT USING YOUR HOME EQUITY

The current average rate for the five-year personal loan term (12.55%) has plunged from 15.41% since Credible began collecting this data in June 2020. Interest rates peaked for this loan term in August 2021, when they reached 16.51%. That's a significant advantage for applicants who borrow a loan in today's rate environment.

If you're considering borrowing a personal loan, it's important to compare rates from multiple lenders to find the lowest rate possible for your unique circumstances. You can shop for personal loan offers on Credible's financial product marketplace, and you might receive your funding as soon as the next business day after approval.

ANNUAL PERCENTAGE RATE (APR) VS. INTEREST RATE: WHAT'S THE DIFFERENCE?

How to lock in a low personal loan rate

Although personal loan rates are currently at or near historic lows, that doesn't guarantee that all applicants will qualify for a low interest rate. Since personal loans are typically unsecured, lenders determine your loan terms based on the loan length and loan amount, as well as your creditworthiness and debt-to-income ratio (DTI). Here are a few tips for getting a good rate on a personal loan:

- Work on building your credit score. Applicants with a good credit score of 720 or higher saw a lower range of rates than those with fair or bad credit, according to Credible. Those with excellent credit of 780 or above saw the best personal loan interest rates available. You can start improving your FICO score by enrolling in free credit monitoring through Experian.

- Choose a shorter loan term. Interest rates tend to be lower for the three-year loan term than they are for the five-year loan term. If you can afford the higher loan payments, a short-term personal loan can pay off in the long run with fewer interest charges. You can use a personal loan calculator to estimate your monthly payments and total interest savings.

- Compare rates across online lenders. Most personal loan lenders let you get prequalified to see your estimated interest rate without impacting your credit score. This allows you to shop around for the lowest rate possible for your financial situation. You can prequalify through multiple lenders at once on Credible's online personal loan marketplace.

You can browse current personal loan rates in the table below, and visit Credible to learn more about borrowing a personal loan.

5 THINGS TO KNOW ABOUT PERSONAL LOAN FEES AND PREPAYMENT PENALTIES

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.