ACA call center workers can barely afford their own health care coverage: report

Health plans for certain ACA employees come with a $4,500 deductible

Patient advocates who work at ACA call centers pay more for health care services and medical procedures than the national average, according to a new report. Consider what you can do to reduce your medical costs. (iStock)

Nov. 1 marks the beginning of the 2022 open enrollment period for the federal government's health insurance marketplace. During this time, many Americans will rely on federally employed call center workers to help them navigate the Affordable Care Act (ACA).

But these ACA call center workers are struggling to afford their own health care costs, according to a new report conducted by the union Communications Workers of America (CWA).

"It really hurts to know that I am providing insurance for other Americans and I can’t afford to go to the doctor."

Critics of the medical coverage say that "the very workers who the federal government trusts to help millions of Americans access affordable healthcare are struggling to afford their own," the report found.

Keep reading to learn more about the report's findings. If your finances are strained due to unpaid medical bills, consider borrowing a personal loan while interest rates are near record lows. You can visit Credible to see offers tailored to you without impacting your credit score.

SHOULD I TAKE OUT A LOAN TO PAY MEDICAL EXPENSES?

ACA employees pay more than the US average for health care

The CWA analyzed the high-deductible health care options offered by Maximus, a major federal contractor that employs thousands of workers at 11 Medicare and Medicaid call centers across the country. The report found that the out-of-pocket costs for accessing health care under the Maximus plan are nearly $3,000 higher than the national average.

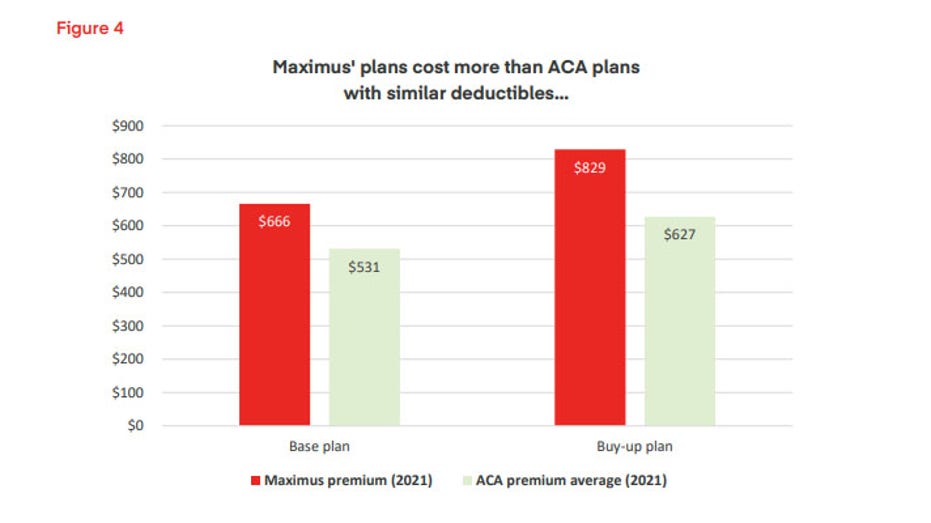

Additionally, the premiums for the base health care plan cost $995 more in 2021 than the U.S. average for similar plans and 26% more than ACA plans with similar deductibles.

REVOLVING CREDIT BALANCES REACH PRE-PANDEMIC LEVELS: HOW TO PAY OFF CREDIT CARD DEBT

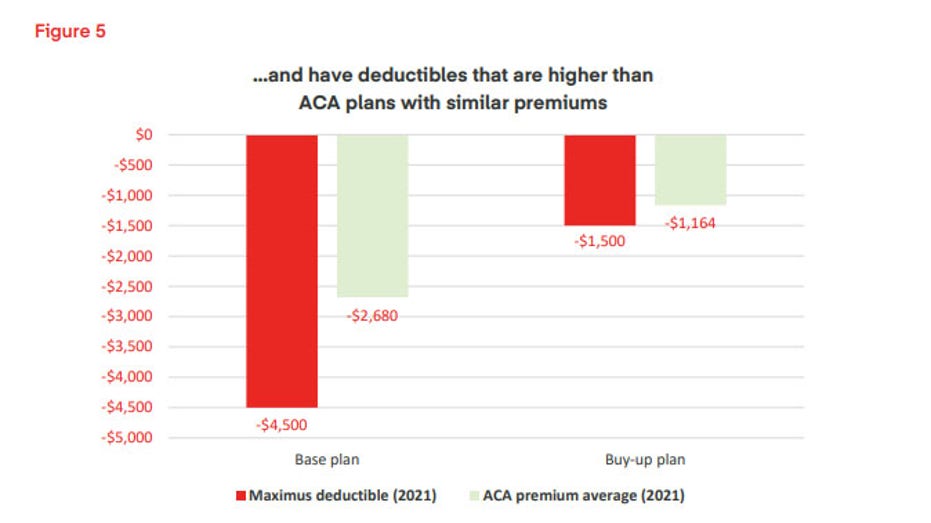

Federal contract employees, including the call center employees in the report, have certain wage and benefit protections under the McNamara-O’Hara Service Contract Act of 1965 (SCA). But the base health care plan offered by Maximus has a $4,500 deductible for health care and prescriptions.

Even when you have health insurance coverage, high deductibles can make it difficult to keep up with health care costs — especially for those with chronic illness.

DOES GETTING THE COVID-19 VACCINE AFFECT YOUR LIFE INSURANCE POLICY?

"I find it absolutely appalling that we answer questions about insurance all day, every day, and we have a $4,500 deductible," said Trinity Davis, an ACA call center worker based in Hattiesburg, Miss.

Maximus does offer a buy-up health insurance plan with a $1,500 deductible, which costs an additional $1,950 premium contribution from employees. The premium costs are on average 30% higher than ACA plans with a similar deductible, and the plan costs almost $3,000 (42%) more than the national average, the report found.

Keeping up with medical costs can be a financial burden, especially if you have overdue and unpaid medical bills. Consider using a personal loan to pay off medical costs at a low, fixed rate. See your estimated rate for free by filling out a single form on Credible.

CORONAVIRUS FINANCIAL HARDSHIP LOANS: WHAT ARE THEY AND SHOULD I GET ONE?

What to do if you're struggling with medical costs

The call center workers spotlighted in the CWA's report aren't the only consumers who struggle with medical debt. Nearly 1 in 5 Americans has unpaid medical bills, according to a recent survey. Plus, hospital bills are the leading cause of bankruptcy in this country.

If you're struggling to pay for medical care, consider the following options:

- Research your legal rights. Federal law requires nonprofit hospitals to offer financial assistance programs such as reduced-cost charity care and zero-interest payment plans to low-income and uninsured patients who meet certain eligibility requirements, according to the National Consumer Law Center (NCLC).

- Negotiate the cost of care. Medical billing discrepancies are common, so make sure you aren't being double-billed or charged for services you didn't receive by asking for an itemized Explanation of Benefits (EOB). Use a health care cost comparison tool like Healthcare Bluebook to make sure you weren't overcharged for a service.

- Borrow a personal loan. Personal loans are lump-sum loans with fixed interest rates and monthly payments. They can be used for virtually anything, including paying for hospital care or paying off medical debt.

If you decide to take out a personal loan, be sure to shop around for the lowest interest rate possible for your situation by comparing offers from multiple lenders on Credible.

CONSIDERING REFINANCING? HERE'S WHY YOU SHOULD LOCK IN YOUR MORTGAGE RATE BEFORE NOV. 2

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.