Most Americans optimistic about their finances in 2022 despite inflation, survey says

Here's how you can offset rising prices and achieve your financial goals this year

A new survey from Ally Bank found that consumers are optimistic about meeting their long-term financial goals despite the effects of inflation. (iStock)

2022 poses a number of financial challenges for American consumers. Inflation is rising at the fastest pace in decades, which means consumers are paying more for rent, utilities and groceries than ever before. Plus, federal student loan payments restart this year, potentially impacting the financial stability of millions of borrowers.

However, a new survey from Ally Bank shows that most Americans are optimistic about their finances in 2022, despite rising prices. More than half (53%) of respondents said they're confident about their personal financial standing, and 59% believe they will be better off financially a year from now. Nearly two-thirds (65%) said they will likely achieve their financial goals for 2022, even with record-high inflation.

But inflation won't just hit consumers at the cash register — it will also bring higher interest rates. The Federal Reserve is expected to implement multiple rate hikes this year to address inflation, which will cause interest rates to rise on key borrowing products like mortgages and credit cards.

Although they're feeling optimistic, consumers will need to prepare for several financial challenges in 2022:

- Rising consumer prices are outpacing wage growth

- Inflation is likely to drive interest rates higher

- Key student loan changes will impact financial well-being

Learn more in each section below, and visit Credible's online financial marketplace to compare a wide variety of financial products, from mortgages to debt consolidation loans.

AS GAS PRICES SURGE, HERE ARE 3 WAYS TO MAKE ROOM IN YOUR BUDGET

Rising consumer prices are outpacing wage growth

The cost of living is greatly outpacing higher wages, which means that Americans may be spending more money than they're earning. While average hourly earnings have increased 5.7% in the past year, consumer prices have risen 7.5%, according to the Labor Department's consumer price index (CPI).

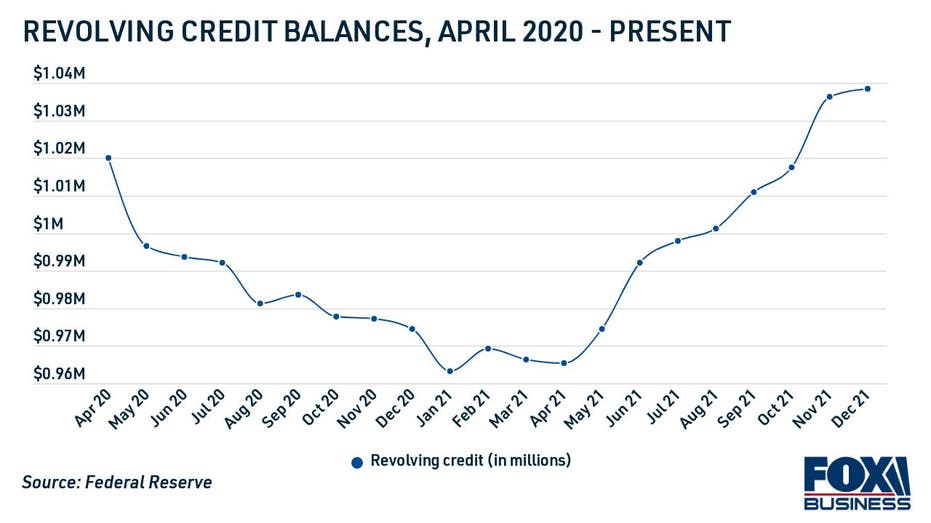

What's more, rising prices caused by supply chain disruptions may be causing some consumers to borrow money to pay bills. Revolving credit balances in the United States have skyrocketed in the past several months, signaling that Americans are becoming increasingly reliant on high-interest credit card debt.

Carrying a balance on your credit cards every month is a costly way to cover essential expenses. Due to high credit card rates, you could end up paying hundreds or thousands in interest charges as you repay your debt by making the minimum payments on your credit cards.

If you're struggling to pay off credit card debt you've accrued due to rising consumer prices, you could consider utilizing a debt consolidation loan. Visit Credible to see your estimated debt consolidation loan offers for free without impacting your credit score.

SHOULD I PUT MONEY IN A HIGH-YIELD SAVINGS ACCOUNT OVER A CD?

Inflation is likely to drive interest rates higher

Inflation doesn't just take a toll on consumers. Increased prices can also have a negative impact on the economy as a whole, which is why federal officials at the central bank are looking for ways to control inflation. The Fed has already begun revising its monetary policy, slowing down its bond-buying program and planning several interest rate hikes in 2022.

Although the Fed's financial decision may help to slow down rising inflation levels, it's still likely to cause interest rates to rise. Mortgage rates have already started to increase in 2022, and interest rates on other financial products like credit cards are likely to follow.

Rising mortgage rates may be alarming for current homeowners and prospective homebuyers, but higher rates don't necessarily need to be a cause for concern. Current mortgage rates are slightly lower than they were in 2018, when they reached nearly 5%, according to Freddie Mac.

The window of sub-3% mortgage interest rates may have passed, but many homeowners may still have the opportunity to refinance to a lower mortgage rate than they're currently paying on their home loans. The Mortgage Bankers Association (MBA) predicts that 30-year mortgage rates will average 4.0% in 2022, giving consumers some time to lock in a reasonable rate on a home purchase or refinancing loan.

You can compare rates across multiple mortgage lenders at once on Credible, which can help you find the best possible offer for your financial situation.

THIS DEGREE LEAVES GRADUATES WITH NEARLY $200K IN STUDENT LOAN DEBT ON $40K SALARY

Key student loan changes could impact financial well-being

Payments and interest on federal student loans have been paused since March 2020 when former President Donald Trump signed the CARES Act into law. The Biden administration has extended forbearance several times since taking office, but the payment pause will expire on May 1.

While 37% of student loan borrowers surveyed by Ally Bank said they'll be able to resume payments this year, 40% were not confident they will be able to. Most respondents (62%) said the end of the student loan payment pause will keep them from saving for emergencies.

If you're not ready to make payments on your federal student loans in a few short months, you could consider refinancing to a lower interest rate to reduce your monthly payments. A recent Credible analysis found that well-qualified borrowers who refinanced to a longer term were able to reduce their monthly student loan payments by more than $250 on average.

It's important to note that refinancing your federal student debt into a private loan would make you ineligible for certain government benefits, like income-driven repayment plans (IDR) and federal student loan forgiveness programs. But if you don't plan on utilizing these protections, then it may be worthwhile to lock in better terms on your student loans while refinancing rates are near all-time lows.

You can see your estimated student loan refinancing rate on Credible for free without impacting your credit score. Then, use a student loan refinance calculator to determine if this debt repayment strategy can improve your financial situation in 2022.

BUILD BACK BETTER WILL CUT COST OF INSTALLING ROOFTOP SOLAR PANELS, WHITE HOUSE ESTIMATES

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.