Average personal loan interest rate is 9.58%, Fed reports, but you may qualify for a lower rate

Personal loans are often used to pay off high-interest credit card debt or finance an unexpected expense. To get the lowest rates for your situation, it's important to shop around and compare loan terms across online lenders. (iStock)

Personal loans are commonly used to consolidate debt, finance home improvements and make large purchases, since they tend to have lower rates than credit cards. But personal loan interest rates vary widely depending on a number of factors, including the loan length and loan amount, as well as the borrower's credit score and debt-to-income ratio (DTI).

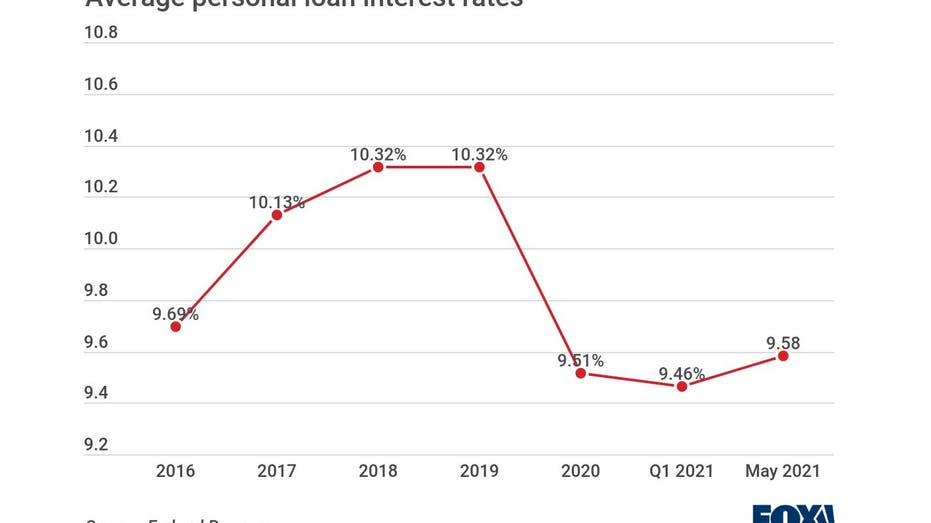

The average interest rate on a two-year personal loan was 9.58% in May 2021, according to the Federal Reserve. That's up slightly from 9.46% in Q1 2021, but still trending down year-over-year.

If you're in the market for a personal loan, it's important to shop around across multiple lenders so you can get the lowest interest rate possible for your financial situation. You can compare personal loan interest rates on Credible without affecting your credit score.

16 OF THE BEST PERSONAL LOAN LENDERS IN 2021

How to get low-interest personal loans

Personal loans are lump-sum loans repaid in month-to-month installments over a set time period. They have fixed interest rates, which means you'll have a clear picture of your payoff plan. Since interest rates vary widely, it's important to do your research when taking out a personal loan. Here's how you can get a low-interest personal loan:

- Check your credit score. The personal loan interest rates you're offered will greatly depend on your credit history, and the best rates will be reserved for borrowers with high credit scores. A different lender may have a specific minimum credit score requirement.

- Build your credit, if necessary. If your FICO score is below 670, it's considered fair or poor. You should consider building a higher credit score before you apply to get a competitive rate.

- Get prequalified through multiple lenders. Personal loan prequalification lets you check eligibility and estimated interest rates without affecting your credit.

- Compare your offers. Typically, you'll want to choose the personal loan with the lowest annual percentage rate (APR), which includes the interest rate as well as any fees.

- Formally apply for the loan. The lender will conduct a hard credit check to confirm your financial and personal information, and may ask for pay stubs and other forms to verify your identity.

These steps may seem like a lot of heavy lifting, but the process is simple when you utilize Credible's online loan marketplace to shop around for a good interest rate. You can fill out a single form to get prequalified through multiple lenders without affecting your credit score, so you can compare the lowest rates with no strings attached. Check out some popular personal loan lenders and their typical APRs in the rate table below.

WHAT IS A LOW INTEREST RATE ON A PERSONAL LOAN?

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Why it's critical to get a good rate on a personal loan

Personal loan rates affect the total cost of taking out a loan, as well as your monthly payment. Put simply, a lower interest rate means a cheaper loan and even smaller monthly loan payments. See how the repayment terms of a two-year, $10,000 loan are affected by different interest rates in the analysis below:

- 12% interest rate: $471 monthly payment and $1,298 total interest

- 10% interest rate: $461 monthly payment and $1,075 total interest

- 8% interest rate: $452 monthly payment and $855 total interest

The interest rates used in the example above are hypothetical, and you may be able to qualify for a personal loan interest rate as low as 2.49% APR on Credible if you have an excellent credit score. Check your potential rates on Credible, and use a personal loan calculator to estimate your monthly payment and interest paid. You can compare personal loan offers in just two minutes, all without impacting your credit score.

4 CREDIT UNIONS TO CONSIDER WHEN REFINANCING STUDENT LOANS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.